Earlier this month, I set up accounts at four online investment options so that I can track the performance of them against each other. Each account was funded with an initial $1,000 investment plus $100 a month going forward. Let’s discuss the first investment option, Prosper, a peer-to-peer lending company.

In This Post

The $1,000 Investment Challenge

- An Introduction – Where to invest $1000 – my investment challenge

- Investing with Prosper peer-to-peer lending

- Investing with Lending Club peer-to-peer lending

- Investing with Betterment

- Investing with Sharebuilder

What is Prosper?

Prosper is a peer-to-peer lending company that offers an online platform where you can participate in two ways. You can submit a request for a loan and have people invest in your loan, or you can be an investor where you select individual loans to invest in or select specific investment criteria and have their software automatically invest for you.

What is unique with Prosper vs. Lending Club is that notes are traded on the secondary market as well.

The loans are either 3 or 5 years, so as a borrower and an investor, you can choose the duration of the loan.

When you invest, you can either invest in a taxable account (pay taxes each year on earnings) or in a retirement account (Traditional or Roth IRA).

What is peer-to-peer lending?

Peer-to-peer lending is a way for average people like you and me to borrow money without going to a bank. Rather than a bank offering a solution to their borrowing needs, investors invest in their loans at any amount.

Peer-to-peer loans can be for any purpose, whether it be to consolidate debt, start a business, fund home improvements, or any number of other goals. Borrowers get fixed-rate personal loans that are smarter alternatives to high-interest rate credit card debt that could take years to pay off. With easy monthly payments of principal and interest to investors like you, borrowers get what they want without getting deeper into debt. These are real people with real stories, wants and needs.

How do you open an account and invest with Prosper?

Opening an account with Prosper is fairly simple.

1. Click here to open an account with Prosper.

2. Now you’re ready to enter some personal information.

3. You provide the bank account information from which your investments will be deducted.

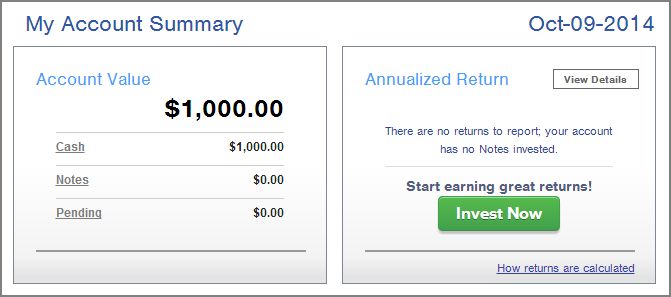

4. After almost a week, my initial deposit of $1,000 had cleared their account and was ready to invest.

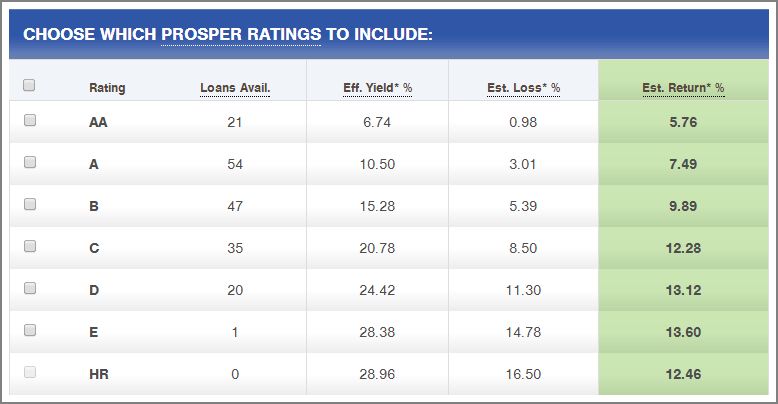

5. Choose which Prosper Ratings to include in your investment strategy.

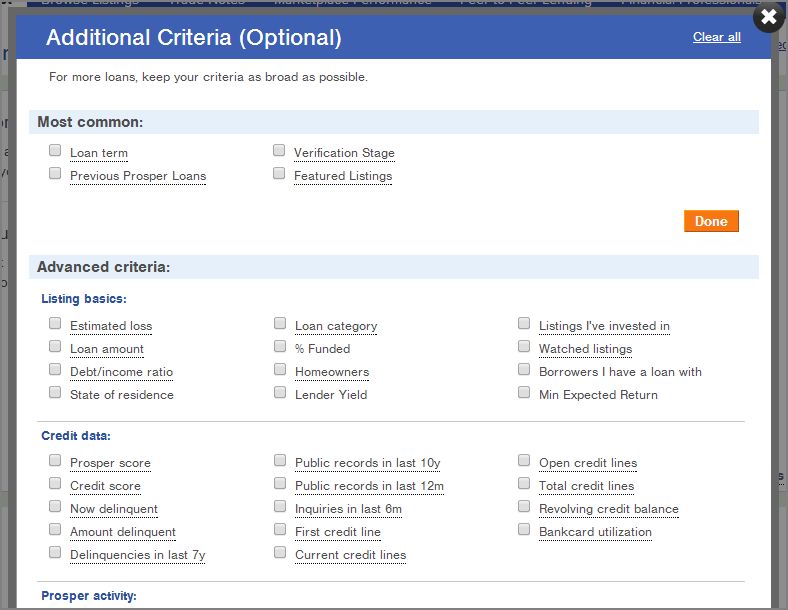

6. There are numerous additional criteria to choose from to further personalize your portfolio.

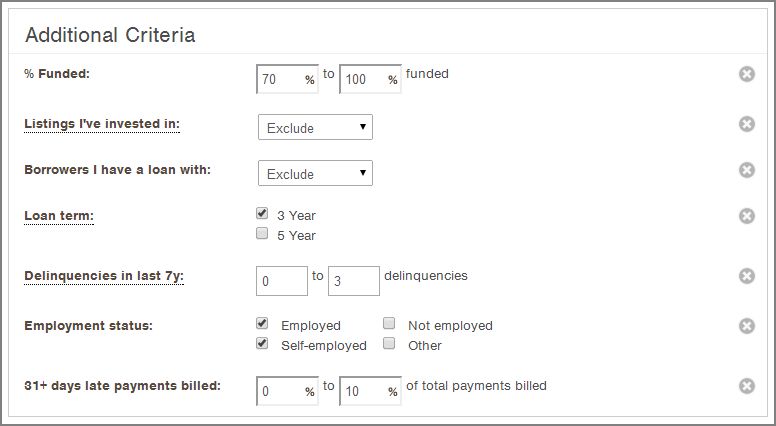

7. These are some of the selections I chose to personalize my portfolio… I subsequently changed a few criteria because the first pass didn’t find enough loans to fully invest the initial $1,000 investment.

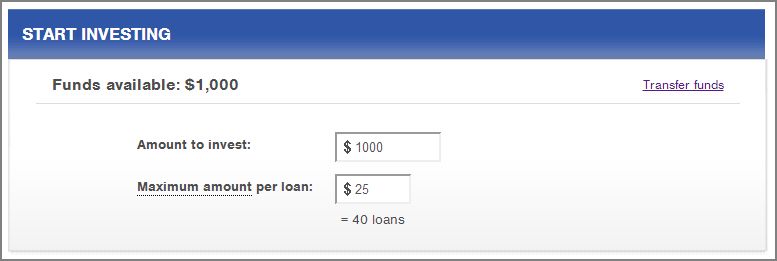

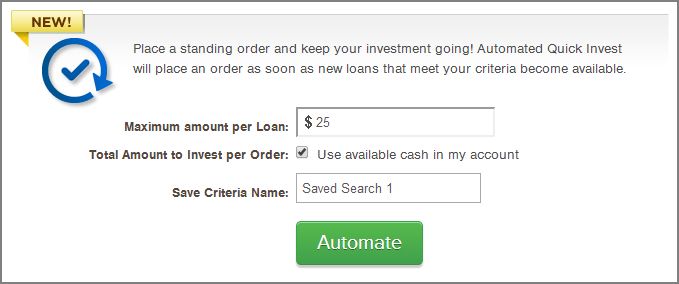

8. I picked a maximum amount to invest per loan of $25 in order to diversify my risk across a larger number of loans.

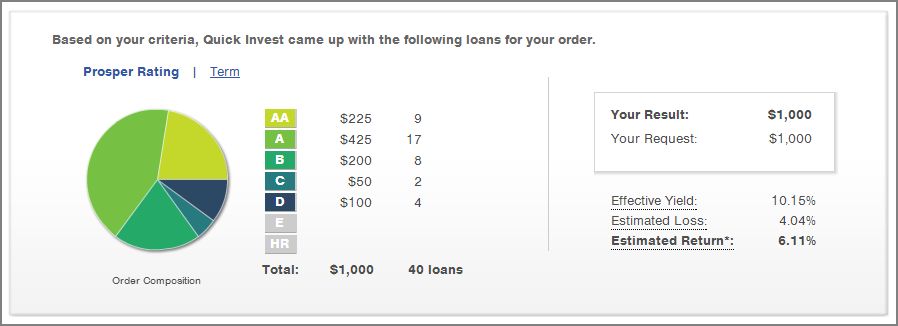

9. Based on the criteria I selected, here is the portfolio that was created for me.

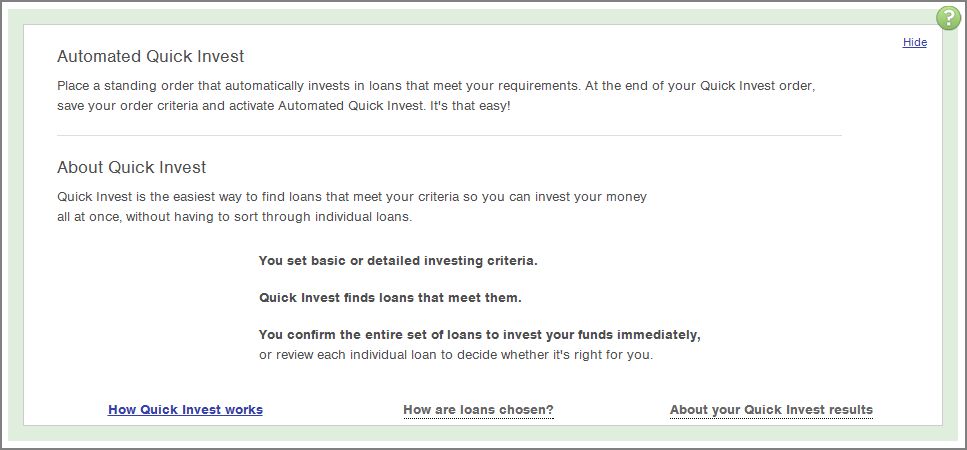

10. I picked the Automated Quick Invest so that repayments and future investments would automatically be invested according to the criteria that I’ve selected.

11. From now on, whenever there is cash available, Automated Quick Invest will place an order to invest in loans that meet my investment criteria automatically for me, up to a maximum of $25 per loan.

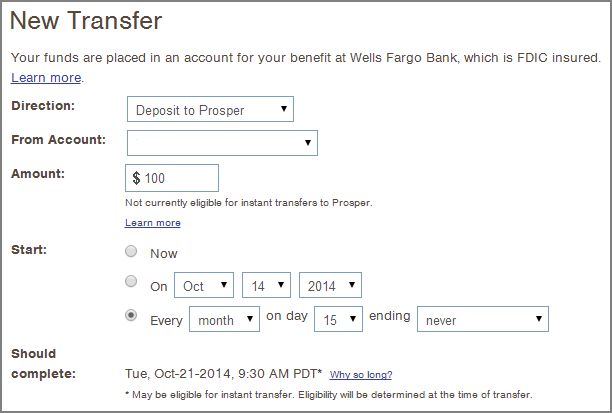

12. Finally, I set up an automated investment of $100 a month from my checking account into Prosper so that all 4 investment selections will have the same ongoing contribution.

The account is now all set up, invested, and on auto-pilot. All I have to do is to monitor my progress and compare how Prosper performs against Lending Club, Betterment, and Sharebuilder.

If you’d like to borrow from Prosper

Click on the banner below or open an account with Prosper here.

Conclusion

I’ve been investing in peer-to-peer lending with Lending Club for over a year, so I’m looking forward to being able to compare their services with Prosper. I like the idea of being able to help someone consolidate debt, make home improvements, or start a business. Prosper allows me to make a difference in someone’s community.

Newsletter

Join the BaldFinance.com newsletter to stay up-to-date with the latest news, specials, promo codes, and interesting stories about personal finance.

Great article! We are linking to this particularly great article on our site.

Keep up the great writing.