On October 1, 2014, I opened 4 accounts to evaluate investment options for myself and my readers. There are two options that are stock-focused and two that a peer-to-peer lending that are an alternative to bond investing.

In This Post

The $1,000 Investment Challenge

- An Introduction – Where to invest $1000 – my investment challenge

- Investing with Prosper peer-to-peer lending

- Investing with Lending Club peer-to-peer lending

- Investing with Betterment

- Investing with Sharebuilder

What is Sharebuilder?

Sharebuilder is a part of a Capital One. Both Sharebuilder and ING Orange Savings accounts were sold to Capital One a couple of years ago. Sharebuilder offers an easy-to-use online trading platform, with online equity trades for $6.95.

Why Sharebuilder?

I’ve been using the CapitalOne360 Online Savings accounts for close to 20 years (when it was ING Orange), so it is a brand that I know and trust. Sharebuilder is an extension of that brand that seeks to reduce fees and keep more money in your pocket.

When researching where to put your money, there are many investment options that have no fees. Additionally, you can set up automatic investing, which is what I’ve done with $100 a month being invested in my accounts. The big difference between Sharebuilder and most brokerage accounts is that you can own fractional shares.

Opening an account with Sharebuilder

When I opened my account, there was a promo code “50TRADE” that gave you a bonus of $50 once you made your first trade. Take a look here for the latest promotions and see which one works best for you.

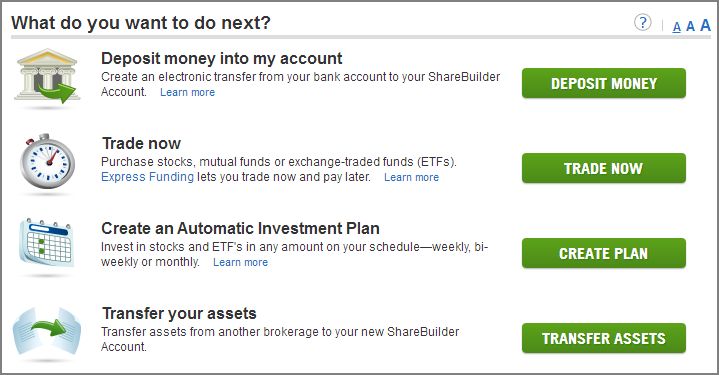

Since I already had an account with CapitalOne360 Online Savings, opening a Sharebuilder account was really simple. If you don’t already have one, I suggest that you open an online savings account with them. The money is always available, since there are no monthly fees or minimum balance requirements. I open accounts for all of my large bills (like property insurance, auto insurance, life insurance, property taxes, etc.) so that I can make smaller monthly deposits into the accounts, rather than struggle to come up with a large payment when the bill comes due… and most of them come due at the same time near the end of the year!!!

Once you have a CapitalOne360 Online Savings account set up, you just need to confirm your information. Very simple.

Once the account is set up, you can transfer money from your bank account or CapitalOne360 Online Savings. When the money hits your account, you can trade immediately.

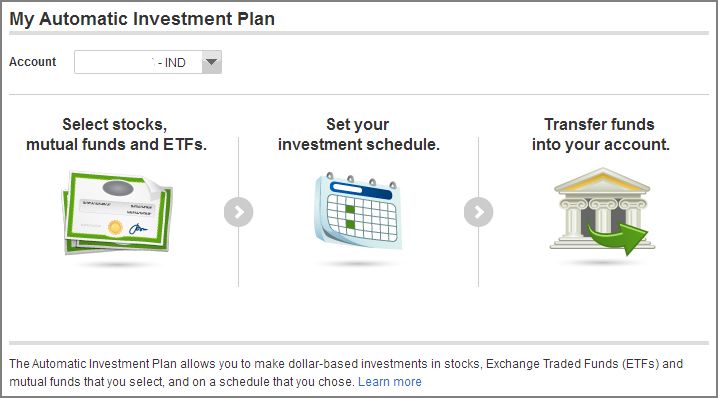

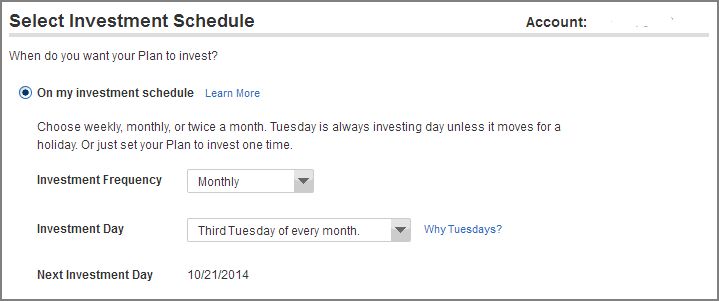

I established an Automatic Investment Plan into a no-fee mutual fund.

It will happen on the 3rd Tuesday of each month into the mutual fund that I selected.

Choosing an investment option with Sharebuilder

Choosing an investment option with Sharebuilder

With my Investment Challenge, I chose to invest $1,000 into the four investment options. With Sharebuilder, that proved to be a little difficult because I wanted an option that had no fees. There were many options that had no fees, but almost all had a $3,000 minimum investment.

First thing, I searched for a few of the household names in low-cost index fund investing, such as Dodge & Cox Balanced ($2,500 minimum, $150 monthly), Vanguard Star ($1,000 minimum, $100 monthly), and Fidelity Balanced ($2,500, $100 monthly)… but each one was subject to a $19.95 commission. Some had higher than $1,000 minimum investments, while others required greater than $100 per month to automatically invest. For some companies, they truly don’t cater to the small investor who is just starting out.

After further research, I picked the USAA First Start Growth fund (UFSGX). This fund is a balanced fund that primarily invests in stocks, with the ability to invest between 20% and 80% in bonds and cash to reduce overall volatility, based on the advisor’s view of the overall market.

Can you open an IRA with Sharebuilder?

Yes, you can open a Traditional or Roth IRA with Sharebuilder. There is no annual maintenance fees with a Sharebuilder IRA, and they offer bonuses to fund your account with higher balances, including rolling over from another IRA or a previous employer’s 401(k) or 403(b). Additionally, they offer tools so that you can open up a Small Business 401(k).

Conclusion

Sharebuilder is a simple way to invest, but you need to be careful in selecting your investments. Many mutual fund investment options have $2,500 or $3,000 minimum requirements to open accounts… and some options charge you up to $19.95 per transaction. After searching, I was able to find an option that met my criteria — no fees, $1,000 minimum investment, and $100 minimum investment per month. Sharebuilder is a good option if you are patient and willing to search through the many options to find one that fits what you are looking for.

Join Our Newsletter

Join the BaldFinance.com newsletter to stay up-to-date with the latest news, specials, promo codes, and interesting stories about personal finance.