Planning for retirement can seem like such a daunting task for something that seems so far away. Because of this, most people put it off until they can’t ignore it any longer.

What if I told you there was one small change you can do immediately that will have a profoundly positive impact on your retirement?

The answer… log into your retirement account and increase your contribution rate by 1%. Boom. Simple. Major impact accomplished!

Let’s walk through the reasons why you need to do this now.

In This Post

Why Now?

The reason I bring this up now is that the company I work for gives our annual raises effective March 1st. When you get your raise is the perfect time to increase contributions, because you haven’t experienced a paycheck with a raise included, so you won’t miss the money!

After we bought our house and had a baby, we’re no longer maxing our retirement accounts, but we’re working back up to it. So, we’re increasing our contributions effective with the next pay period.

Retirement Contributions

According to a CNN Money article from November 2013, a study of 12.6 million accounts at Fidelity Investments found that the average 401(k) balance reached $84,300 during the 3rd Quarter of 2013. This is an 11% increase over the same period a year ago.

The study also found that people contributed roughly the same percentage of salary, but contributions increased because salaries were higher.

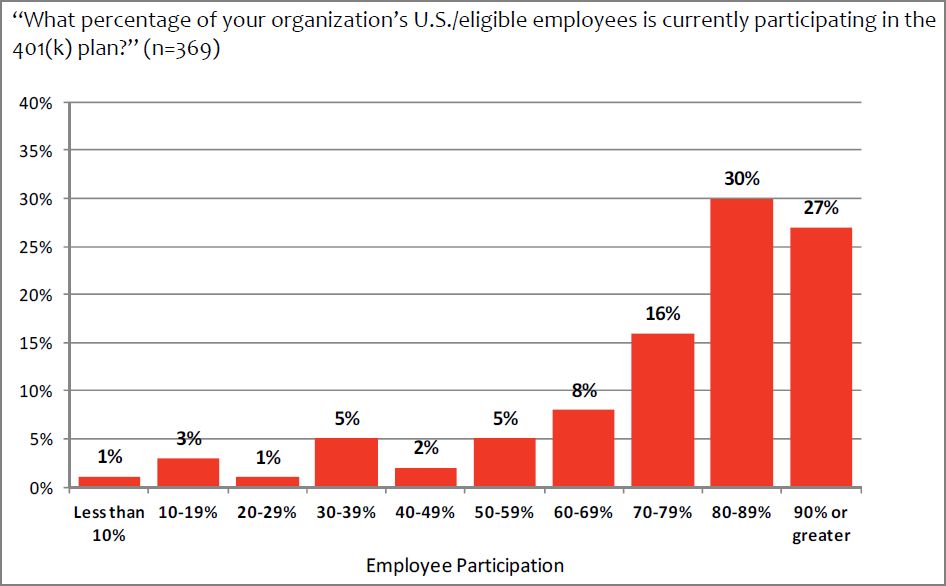

An American Benefits Council study reported that more than 70% of eligible employees contribute to their employers’ retirement plan.

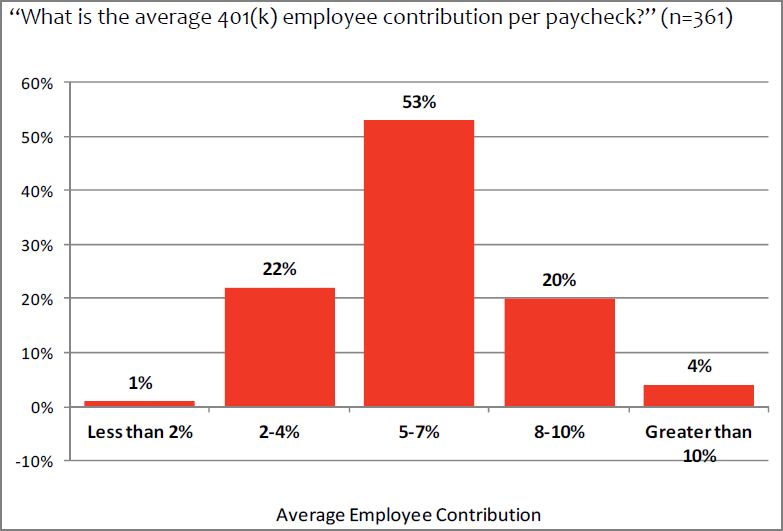

The most common level of employee contribution was between 5% and 7% of salary per paycheck… and 77% of companies reported that the average employee contribution was greater than 5% of salary per paycheck.

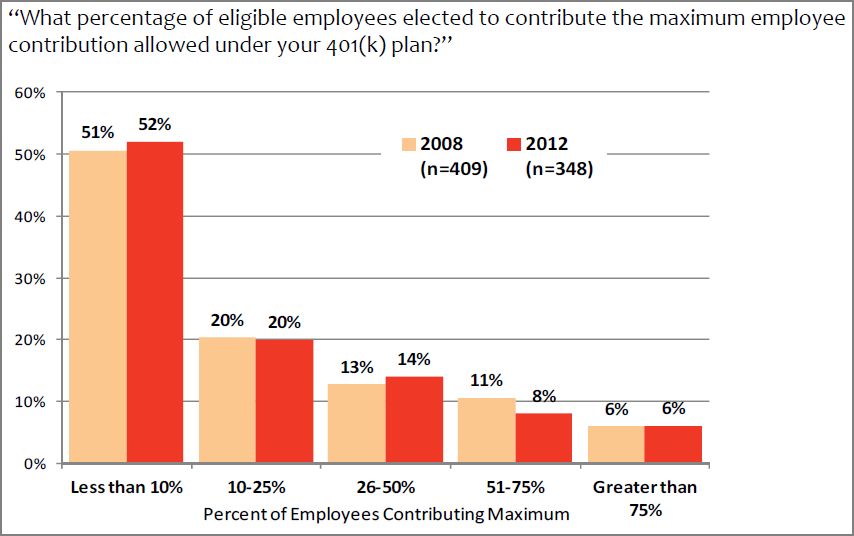

This study also found that fewer than 10% of employees elect to contribute the maximum to their retirement plan.

For 2014, the maximum 401(k) contribution is $17,500. If you are 50 years or older, you can contribute an extra $5,500 (for a total of $23,000) to your 401(k) under what is known as the “catch-up” provision.

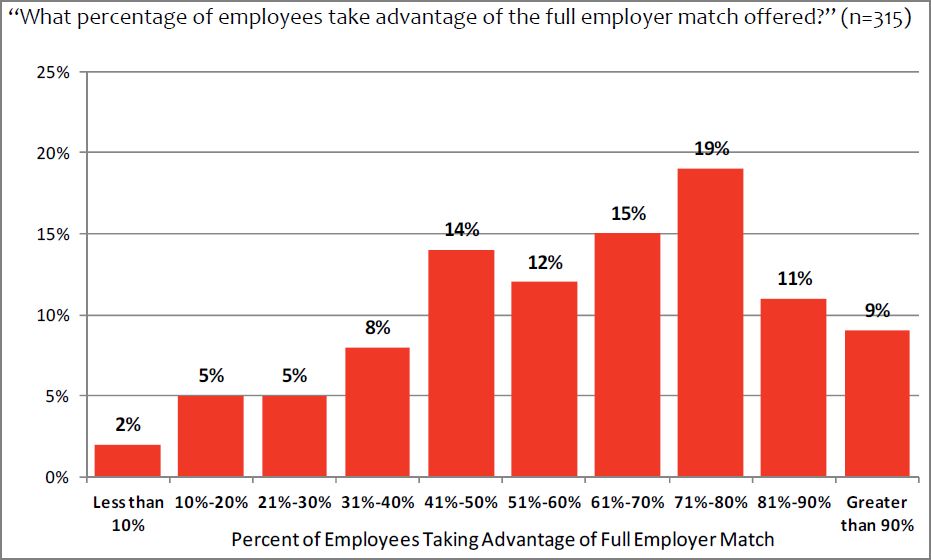

Of the companies surveyed, 34% believe that more than half of their employees are NOT taking full advantage of the employers’ matching retirement contributions!!! That is crazy… so many people are leaving FREE MONEY on the table!

My company matches 50% of the first 6% that I contribute to my 401(k). So, if I put in 6%, they will contribute an additional 3%, for a total of 9%.

If you don’t know your company’s retirement plan matching policy, contact your HR or Employee Benefits department and ask.

How much will increasing my contribution 1% impact me?

The median US household income was $51,017 in 2012, so contributing an additional 1% to the average family’s 401(k) would be $510.17 per year, or $42.51 per month, or $21.26 per semi-monthly paycheck.

However, because your contributions are made before taxes, the impact to your take home paycheck would be much less!

For the 2013 tax year, federal income tax brackets were 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%, depending upon your level of income. Depending upon which state you’re in, state income taxes could add to this amount.

For simplicity, we’ll assume that you’re in the 25% federal tax bracket and you pay no state taxes…

Since you are not paying taxes on the amount you contribute to your 401(k) today, the net decrease to your paycheck would only be $15.94 [$21.26 * (1 – 25%) or contribution amount x (1 – tax bracket)].

Between your employer offering a match and the government providing a tax incentive for you to contribute, it’s almost like they are begging you to save in your 401(k).

What will 1% do for me?

If an additional contribution of 1% takes only $15.94 after taxes ($21.26 before taxes) out of your paycheck, you’re probably asking yourself “why even bother?”, right?

This is where the magic of compounding interest kicks in.

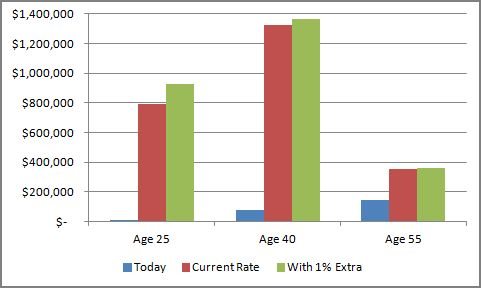

At Age 25

If you are 25 years old, with no 401(k) and just starting out with a 6% contribution to your 401(k) earning 8% on average, you will have $793k at age 65.

If you increase your savings rate from 6% to 7%, at age 65 you will have $925k, an extra $132k, even though you only contributed an extra $20k!!!

At Age 40

If you are 40 years old, with the average 401(k) balance of $80,600 while contributing 6% and earning 8% on average, you will have $1.33 million at age 65.

If you increase your savings rate from 6% to 7%, at age 65 you will have $1.365 million, an increase of $37k, even though you only contributed an extra $13k!!!

At Age 55

If you are 55 years old, with the average 401(k) balance of $143,300 while contributing 6% and earning 8% on average, you will have $354k at age 65.

If you increase your savings rate from 6% to 7%, at age 65 you will have $361k, an increase of $7400, even though you only contributed an extra $5100!!!

Conclusion

Making a small adjustment to your 401(k) contribution today makes a HUGE impact on your retirement in the future. As you can see from the examples, the sooner you start, the bigger payoff you will receive. So, Monday morning, please log in and increase your retirement contributions by at least 1%! You will thank me later… and you probably won’t even notice the change in your paycheck.

Great point! Personally, I don’t have the option of a 401(k), and my husband is on disability. So we’re not able to contribute as much as we’d like. That said, each year we’re increasing the IRA contribution when I’m notified of my raise. And hey, $500 a month is still something.

Congrats on making the best of a tough situation. Even though your employer doesn’t offer the option of a 401(k), I commend you for taking personal responsibility for your retirement future by contributing to your IRA and increasing your contribution each year. $500 a month is a huge step forward… $6,000 a year for 20 years at 8% is roughly $275k. If you’re saving in a traditional IRA, you’re getting a tax deduction today… and if you’re saving in a Roth IRA, the money will be tax free for you in retirement. Personally, because I have a kid and all the bill that go along with it, I favor saving in a Traditional IRA for the tax break today. Beyond that, something inside me believes I should follow the “bird in hand vs. 2 birds in the bush” when deciding whether or not the government will keep their hands off the investment returns inside a Roth. Good luck, and I wish you both future success!