The stock market has seen major ups and downs, while interest rates have been hovering near historic lows for the past decade. In many ways, it doesn’t pay to be a saver in this economy. Yet, you need a safe place to keep your short-term savings. Whether you’re saving for a rainy day or for a large purchase, there has to be a better way. There is with the new savings account from Bask Bank. In this article, I’m going to show you how to earn miles instead of interest on your Bask Savings Account.

I’m partnering with Bask Bank to share the details of their Bask Savings Account with my readers. I opened an account with my own money to earn miles instead of interest.

In This Post

Why should you earn miles instead of interest?

The average savings account earns a paltry 0.27% each year. For many people, it’s not even worth saving money when the interest rate is so low.

You can try to earn a higher rate of interest through an online savings account. However, when you do earn something worthwhile, you’ll pay a big portion of that amount in taxes.

A new savings account from Bask Bank does things differently. The Bask savings account is the only savings account that earns American Airlines AAdvantage® miles, instead of interest.

When you earn airline miles instead of interest, you determine how much value you’ll get out of those rewards. You can redeem them for a domestic economy ticket, an international First Class experience, or something in between.

I’ve been able to use American Airlines AAdvantage® miles for economy flights to the Caribbean, business class flights to Italy, and so much more. My family has literally saved thousands of dollars using our airline miles.

Who is Bask Bank?

Bask Bank is a new online-only bank that offers a unique twist on savings accounts. It is a division of Texas Capital Bank, N.A., which was founded in 1988 and has over $33 billion in assets.

Click here to read a detailed Bask savings account review I published a couple of weeks ago.

How many American Airlines AAdvantage miles can I earn?

If you maximize all three of the available bonus offers, you can earn an additional 46,000 American Airlines AAdvantage® miles. Even if you don’t have a lot of money available, you can easily earn 6,000 miles in the next 60 days. Here’s how to earn miles instead of interest on your bank account with Bask Bank.

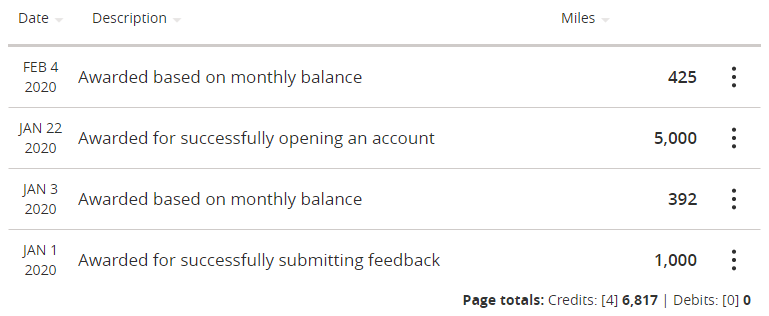

I opened my account in late December 2019, and I’ve already earned 6,817 American Airlines AAdvantage® miles. It’s not enough for a free flight (yet) but I’m getting closer!

Unlimited AAdvantage miles on your savings account balances

You’ll earn one American Airlines AAdvantage® mile annually based on your average balance. Miles are deposited into your account each month. There are no caps on the number of miles that you can earn on your savings account balances.

New account bonus of 5,000 miles

Open a Bask Savings Account by February 29, 2020, to qualify for 5,000 American Airlines AAdvantage® bonus miles. The miles are earned when you maintain a minimum balance of $1,000 or more for 30 consecutive days at some point during the first 60 days the account is open.

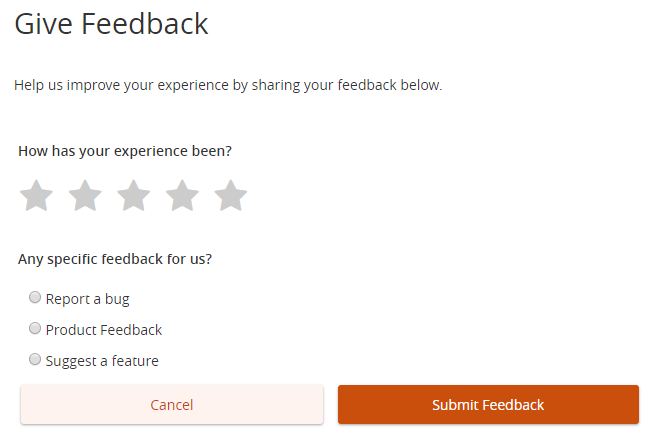

Feedback survey bonus of 1,000 miles

Bask Bank encourages feedback on its accounts. You’ll receive 1,000 bonus miles just for reporting a bug, providing feedback on the product, or suggesting a new feature. Sharing your opinion can be very rewarding and takes only a couple of minutes.

Submit your feedback within 60 days of account opening to receive your 1,000 bonus miles.

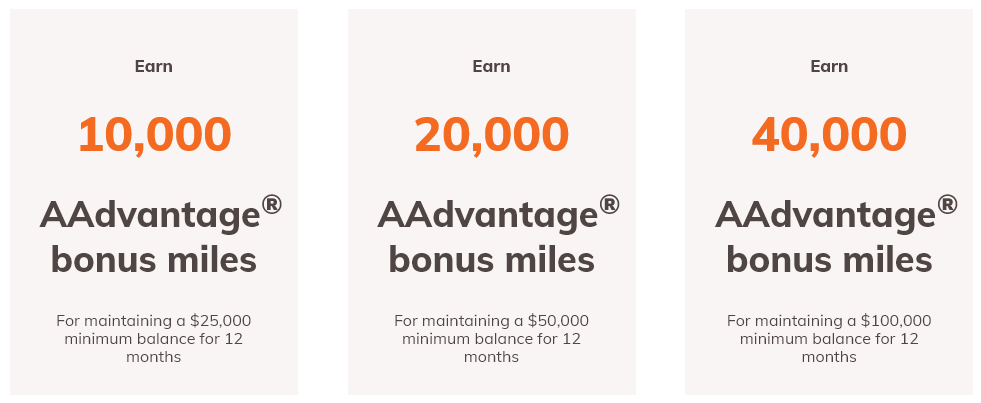

Balance bonuses of up to 40,000 miles

Customers have three opportunities to earn bonus miles based on their account balances. These bonuses are not cumulative. You will earn the highest number of bonus miles that your balances qualify for.

The three bonuses available are:

- 10,000 bonus miles for $25,000 balance

- 20,000 bonus miles for $50,000 balance

- 40,000 bonus miles for $100,000 balance

These bonuses are split into equal parts. The first half is earned for maintaining a minimum balance for six consecutive months. And the second half is earned for maintaining a minimum balance for 12 consecutive months. You have 14 months from the date your account was opened to earn one or both bonus amounts.

For example, the 10,000-mile bonus is actually two 5,000-mile bonuses. The first 5,000 miles are earned when you maintain a balance of $25,000 or more in your Bask Savings Account for six consecutive months. The remaining 5,000 miles (for a total of 10,000 miles) is earned after keeping $25,000 or more in the account for 12 consecutive months.

Balance Bonus Offers valid through April 30, 2020

AAdvantage® bonus miles are awarded within 10 business days upon meeting offer qualifications and may take 6-8 weeks to post to your AAdvantage® account.

The value of the bonus offers will be reported to the IRS and the recipient is responsible for any federal, state or local taxes on the offers

Frequently Asked Questions about the Bask Savings Account

Although I wrote a detailed Bask Savings Account review, some readers still had questions. Here are some of the most common questions I received from readers like you.

Are there any monthly service charges?

No. The Bask Savings Account does not charge a monthly fee.

Is there a minimum balance required?

No. Keep as much or as little as you want in your account. The higher your balance, the more miles you will earn. If your balances are high enough during the promotional period, you may earn bonus miles when you meet those qualifications.

Is my savings account covered by FDIC insurance?

Yes, your account is insured up to $250,000. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held. Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC.

How many miles can I earn the first year?

If you meet all of the qualifications, you can earn more than 146,000 American Airlines AAdvantage® miles during the first year of your account. This includes a new account bonus of 5,000 miles, a survey bonus of 1,000 miles, and a balance bonus of 40,000 miles, plus the normal 100,000+ miles you earn from keeping a minimum balance of $100,000 or more in your account during the first 12 months.

What if my balance dips below the required amount to earn a bonus?

The promotional bonuses require you to keep your daily balance above certain requirements. If your balance falls below, even for one day, you miss out on that bonus.

Bask Bank understands that customers need to withdraw from their savings from time to time. That’s why the balance bonuses are split into two hurdles. Even if you can’t maintain the minimum balance for a full 12 months in a row, you’ll still earn half of the miles for maintaining the minimum balance for six consecutive months.

Will I lose my miles if I close my account?

All miles that have transferred to American Airlines are yours to keep. You will lose any accrued miles that have not yet transferred to the American Airlines AAdvantage® loyalty program. If you close your account before the bonus posts to your account so those miles could transfer to American Airlines, those miles will be lost as well.

Will I receive a 1099 tax form for the miles I earn?

Yes, you will receive a 1099 tax form for the miles that you earn.

What is the taxable value of the miles I earn?

Bask Bank has placed a value of 0.4 cents per mile on the miles that you earn. For example, if you earn 100,000 American Airlines AAdvantage® miles, your taxable income is $400.

If you’re in the 25% tax bracket, that means that you paid $100 for those 100,000 miles. Compare that to the value of the flights you can redeem for 100,000 miles. In my opinion, paying $100 in taxes on $400 of taxable interest is an incredible bargain.

The Bald Thoughts

Instead of earning a barely-there interest rate on your current savings account, open a Bask Savings Account. It is the only account that earns American Airlines AAdvantage® miles, instead of interest. Not only will you earn miles based on your average balance, but you can earn up to 46,000 bonus miles in the first year.

Remember, you need to open your account by February 29, 2020, to qualify for the 5,000 bonus points offer. To earn the bonus, you need to keep a minimum balance of $1,000 for 30 consecutive days within the first 60 days your account is open.

Now that you know how to earn miles instead of interest on your bank account, what are you waiting for? Open your Bask savings account today.

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held.

![]()

“The average savings account earns a paltry 0.27% each year. For many people, it’s not even worth saving money when the interest rate is so low.”

I get it… you’re getting paid, so…

I’m sure you’ll understand why every financial advisor in the world disagrees with you. Saving money even at 0% interest valuable… Saving money is important.

And if you’re referring to the more well off people; none of them are making 0.27% on their savings or money, and none of them are going to use Bask Bank to earn taxable AA miles.

I agree that saving money for your future is worth it, even if the rate was 0%. Like many people in this community, I’m a natural saver and planner. However, I know many people who said “it isn’t worth saving” if the rates are low or if they can only afford to set aside a small amount (say $25) each month. I worked in financial planning in the past and met hundreds of people who felt that way.

In my review of the Bask Savings Account, I did a comparison between higher interest online savings accounts and Bask Bank. I listed a couple of online savings accounts that pay almost 2%. Where you put your money depends on your approach. From a simple return, those accounts pay better given the average value of an AAdvantage mile (approx 1.4 cents). But, if you can redeem your miles for greater than 2 cents each, you’re better off earning miles with Bask Bank. And this is before factoring in taxes (0.4 cents per mile).

Personally, I have some money with Bask Bank, money invested in mutual funds, and other money in online savings accounts. Like most people, I have multiple goals, so my money is set aside in accounts to help me reach those specific goals.

Thanks for telling us how to earn miles instead of interest on bank account. Great work and guidance. Really good list, you did great! Some awesome stuff and I highly recommend ALL of it… Keep sharing such amazing blog posts with us.