Maximizing rewards on every dollar you spend allows you to earn valuable cash back, miles, and points. One of the biggest monthly expenses for most households is paying for rent or a mortgage. Yet, it has been virtually impossible to earn rewards on paying for rent with a credit card, unless you were willing to pay a fee that (generally) was more than the rewards earned. Enter the Bilt Mastercard, which is the first credit card to offer fee-free rental payments, no matter who your landlord is. In this Bilt Rewards credit card review, we explain what Bilt Rewards is, the pros & cons of its credit card, and if the card is worth it for renters and homeowners.

In This Post

What are Bilt Rewards?

Bilt Rewards is a loyalty program that earns points when paying rent, using its credit card, and performing other eligible activities. The Bilt Rewards Alliance is a collection of more than two million rental homes across the U.S. that lets you earn rewards by paying rent at participating properties. And, when you have the Bilt Rewards credit card, you can earn points by paying rent to ANY landlord without paying any fees… even if they don’t accept credit cards.

Points earned through Bilt Rewards can be redeemed in multiple ways, including booking travel through the Bilt Rewards Travel Portal or transferring to airline and hotel partners. Members can even use their points to pay their monthly rent or save up for a home down payment.

Benefits of the Bilt Rewards Credit Card

When you have the Bilt Rewards credit card (referral link), you’ll enjoy the following benefits to save money, earn rewards, and more.

Earn rewards when paying rent

Housing costs are usually one of the major household budget categories that don’t earn rewards. The Bilt Rewards credit card earns 1x points per dollar, up to 50,000 points per year. When paying through the Bilt portal, you can pay rent to your landlord electronically or through a paper check.

Pay rent without a transaction fee

Even when landlords accept credit cards, they’ll tack on a 3% (or higher) convenience fee. While nobody likes this, it makes sense because the landlord has to pay fees to accept credit cards.

When you pay your rent with the Bilt Rewards credit card, there are no transaction fees. This way, both you and your landlord are happy. You’re not charged extra, and they get the full rent payment.

Points transfer to partners

Bilt Rewards offer tremendous value when transferred to its nine airline and two hotel partners. Points transfer on a 1:1 basis with no fees. Depending on how you redeem them, your points could be worth thousands of dollars.

Trip cancellation & interruption

If your trip is canceled or interrupted, the Bilt credit card has your back. You’re covered up to $5,000 per person when your reservations are made using the card. This benefit covers paid-in-full reservations that are non-cancellable.

Trip delay reimbursement

Delays are happening more and more when you travel. Having trip delay coverage minimizes the pain and helps to cover your expenses. When your trip is delayed by six hours or more, you’ll receive up to $200 per day per traveler (max of $1,800 per trip).

Auto rental collision damage waiver

Avoid paying for costly insurance when renting a car. When you use your Bilt Mastercard to pay for your rental, you’ll receive primary insurance against damage or theft to the rental car for free.

No foreign transaction fees

When making purchases internationally, many credit cards charge foreign transaction fees of up to 3%. This hidden tax makes all of your purchases more expensive. The Bilt credit card has no foreign transaction fees so you can use your card without worry.

Monthly Lyft credits

Every calendar month that you pay for three Lyft rides, you’ll receive a $5 Lyft credit from your Bilt Mastercard.

No annual fee

With no annual fee, all of the rewards and benefits of the Bilt credit card are free for you. Many travel credit cards that offer similar benefits charge annual fees of $95 or more. And it’s one of the few credit cards with transferable points with no annual fee.

The downsides of the Bilt Rewards Credit Card

There are plenty of positives for the Bilt Mastercard, but no card is perfect. These are the downsides that could keep you from applying for this card:

- No welcome bonus. New cardholders do not receive a welcome bonus when they are approved for the Bilt credit card. However, there is no annual fee, and the card offers benefits only available through credit cards that charge yearly fees.

- No cash back option. Although you can’t redeem directly for cash back, you can use your points to pay (all or some of) your monthly rent.

- Travel bonus purchases are limited. To earn the 2x bonus points on purchases, you must book directly with airlines, hotels, and car rental agencies or the Bilt Travel Portal. Other online travel agencies, like Expedia, Hotwire, or Priceline do not qualify.

- No rental benefit for homeowners. People who own their homes may question the value of this card since they can’t earn points when paying rent.

- Higher minimum point transfer amount. Other flexible point currencies have minimum transfer increments of 1,000 points. While this is a problem if you have a small balance, most travelers transfer points in larger amounts to book award travel. Basic members transfer points in 2,000 increments until reaching elite status by earning 25,000 points in a year. Then, points are transferred in 1,000 increments like other flexible point programs.

Depending on how you spend and which bonus categories are most important to you, the Bilt Rewards credit card may or may not be a good fit. As always, our advice is to seek out rewards credit cards that offer a combination of generous welcome bonuses, high earning power, attractive benefits, and low (net) fees.

How to earn Bilt Rewards points

Members can earn Bilt Rewards points in five different ways:

- Paying rent through the Bilt Rewards Alliance. There are over two million properties where you can earn rewards by paying rent without any add-on fees.

- Bilt Rewards Alliance promotions. Some properties offer bonus points for signing or renewing leases, referring tenants, and other activities.

- Paying rent with the Bilt Rewards credit card. Even if your rental property isn’t part of the Bilt Rewards Alliance, when you have the Bilt credit card, you can pay ANY landlord rent through the Bilt mobile app. If they don’t accept electronic payments, Bilt mails them a paper check.

- Using the Bilt Rewards Mastercard. Use the Bilt Rewards credit card for your daily purchases to earn up to 3x points on every purchase. Bonus categories include 2x points on travel and 3x points on dining.

- Booking through the Bilt Rewards Travel Portal. When you book flights, hotels, and more through the Bilt Rewards Travel Portal, you’ll earn up to 2x points on your reservations. You’ll even earn points on the cash portion of any points & miles trips that you book.

What are Bilt Rewards points worth?

The value of Bilt Rewards points varies based on how they are redeemed.

- Transfers to partners. Values depend on how they are redeemed upon transfer. But, members can expect to receive 1.5 to 2 cents per point or higher when used strategically.

- Book through the Bilt Travel Portal. Points are worth 1.25 cents each for booking flights, hotels, rental cars, and more.

- Pay monthly rent. Varies based on which building you are renting and who manages the property. The property manager sets values.

- Save for a house down payment. Up to 1.5 cents each.

- Gym classes. About 1 cent per point.

- Unique art. Depends on the piece of art. In many cases, the artwork itself can be difficult to value.

You’ll find the best values when you redeem points through the Bilt Travel Portal, save up for a house down payment, or by transferring them to airline and hotel partners.

How to redeem Bilt Rewards points for max value

Redeeming Bilt Rewards points is simple through its website or mobile app. Members have many options described above, but I want to focus on three of my favorites – hotel and airline transfer partners, real-time award searches, and booking through the Bilt Rewards Travel Portal.

Hotel and airline transfer partners

Bilt Rewards transfer to 11 airline and hotel transfer partners on a 1:1 basis. You’ll get the most value when transferring to the airlines because their miles and generally worth more than 1.5 to 2 cents each. Generally, I wouldn’t transfer to its hotel partners except to top off your account to book a reservation because most hotel points are worth 1 cent or less.

Transfer partners include:

- American Airlines AAdvantage

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Cathay Pacific Asia Miles

- Emirates Skywards

- Hawaiian Airlines HawaiianMiles

- IHG One Rewards

- Turkish Miles&Smiles

- United MileagePlus

- World of Hyatt

- Virgin Atlantic Flying Club

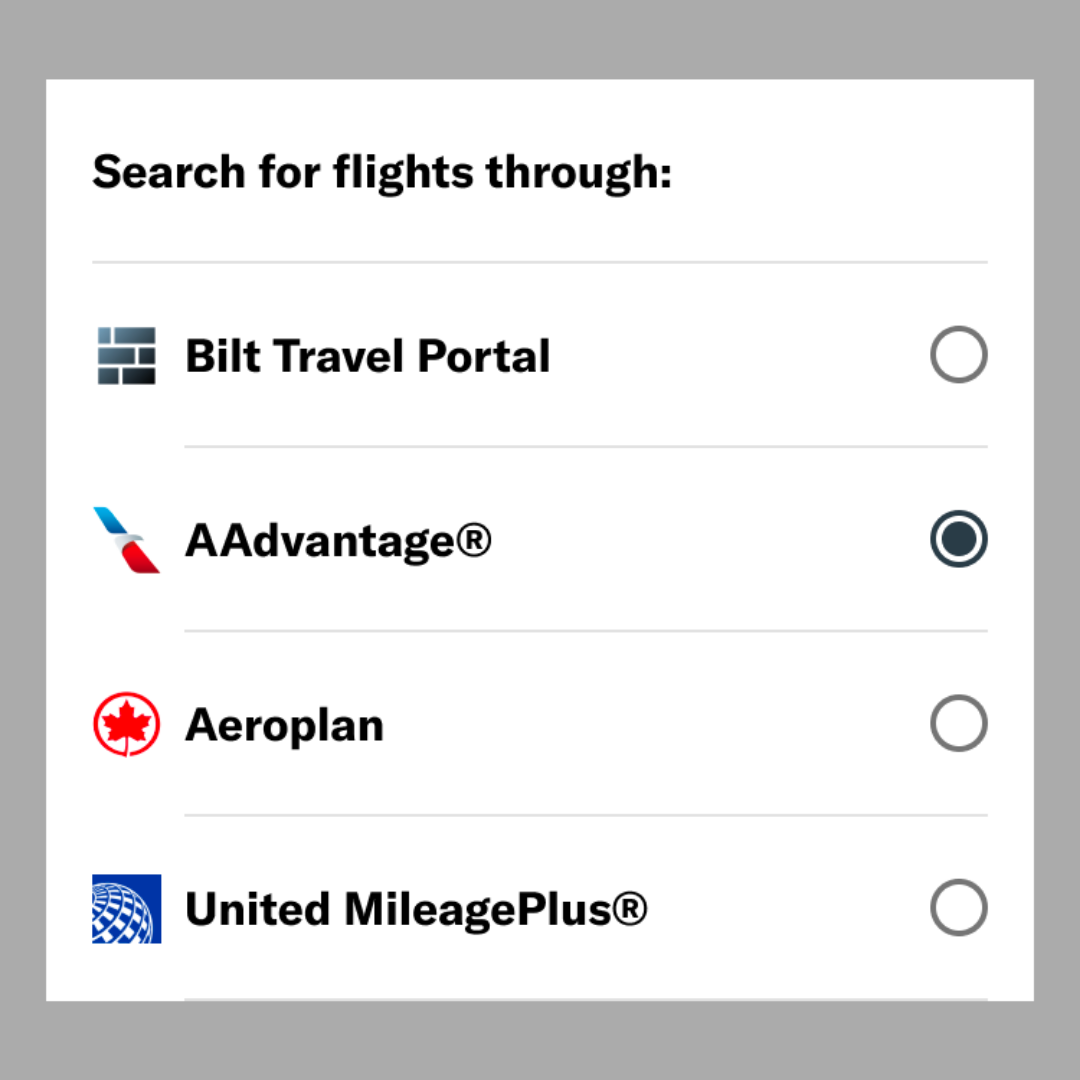

Search for real-time award availability

While many flexible point programs allow you to transfer points to their airline and hotel partners, none offer the ability to search for award space to book flights or rooms. Bilt Rewards changes the game with real-time award availability searches with American Airlines, Air Canada Aeroplan, and United Airlines.

Few things are more frustrating than transferring points to an airline, then finding out that the flight you wanted to book isn’t available or the price changed. With Bilt Rewards, you can search for real-time award availability to transfer and book your award flight with confidence. How cool is that?!?

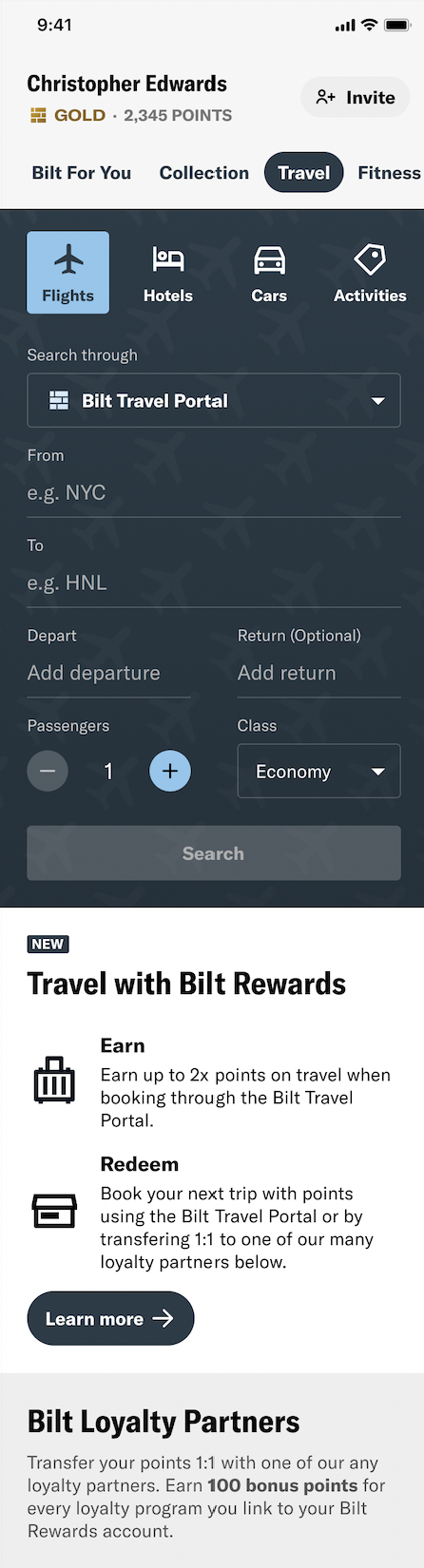

Book travel through the Bilt Rewards Travel Portal

You’ll get 1.25 cents per point in value when booking flights, hotels, rental cars, and more through the Bilt Rewards Travel Portal. The screenshot below shows what the mobile app interface looks like when booking travel using your cash, points, or a combination of the two.

Should I get the Bilt Rewards credit card?

The decision of whether or not to apply for the Bilt Rewards credit card varies based on whether you rent or own your home. Here are factors to consider:

People who rent

If you’re a renter, getting the Bilt Rewards credit card is a no-brainer. It is the easiest option to earn rewards when paying your monthly rent without any fees. The card includes a variety of benefits that save money, and you’ll find good value when using your points to pay for rent, save for a down payment, book travel, or transfer to partners.

Homeowners

While homeowners can’t earn rewards when paying their mortgage, the Bilt Mastercard offers enough benefits and rewards to make it worthwhile. First off, there is no annual fee for having the card, which makes it a long-term keeper. You’ll earn up to 3x points on travel and dining purchases. Plus, redeeming points through the Bilt Rewards Travel Portal or its airline and hotel transfer partners offers tremendous value. And Bilt is the only flexible points program that transfers to both United Airlines and American Airlines.

The Bald Thoughts

The Bilt Rewards credit card is targeted at renters who want to earn rewards by paying rent, but it offers enough unique benefits where I think the card offers value for anyone. There is no annual fee, which makes it a long-term keeper, and you can earn up to 3x points on its bonus categories. Bilt Rewards offer higher value when booking travel or transferring to its 11 airline and hotel partners. And the biggest benefit is seeing real-time award availability with American, United, and Air Canada, which no other card offers.

What are your thoughts about the Bilt Rewards credit card? Is the card worth it, or is there a different card that makes more sense for the way you spend and redeem rewards?