It’s pretty annoying when you rent a car on vacation and you have to repeatedly say no to the clerk when they offer you an array of car insurance options on your rental. I generally decline all the coverages, but there are times when it makes sense. For example, if the weather is going to be bad or if I’m heading someplace where there is snow, I lean towards being cautious.

In This Post

What do car rental companies charge for insurance?

Car rental companies try to play on your emotions and concerns by telling you that, with their insurance, you can avoid using your own insurance in the event of an accident. Most of us drive thousands of miles per year… and how often do you get into an accident?

They want to charge you a separate fee for Loss Damage Waiver, Personal Accident Insurance, Personal Effects Protection, and Additional Liability Insurance. Not to mention the extra charges for Roadside Assistance, GPS machines, child safety seats, toll roads, etc.

When looking at each one of these individually, the amounts don’t seem so high. But, when you add them together, you’re looking at $37.80 per day, not including roadside assistance or any of the other add-ons like GPS. Quite often, that is higher than the amount I pay per day for the actual car!!!

Now, multiply that $37.80 per day times a normal rental period of 3 to 7 days. Combined you’re looking at $113.40 to $264.60 in fees that you didn’t need to spend.

What are the alternatives?

Again, I never accept the insurance coverage offered by the car rental company.

Credit Card Primary Insurance Coverage

Many credit cards offer primary insurance coverage, provided that you use the card to pay for the car rental AND you decline the coverage offered by the rental company.

Primary rental car insurance with a credit card only pays for damage to your rental car or theft of your property from the car. If you cause damage to another car or property, or you injury someone, you would still need to rely on your normal auto insurance policy.

However, when you rent cars outside the United States, all insurance is primary if you don’t have car insurance in that country (which most people do not).

Here are some cards that offer primary insurance coverage on rental cars when you use the card to pay for the reservation:

- Chase Sapphire Preferred

- Chase Fairmont

- Chase Ink Plus and Bold

- Chase Marriott Rewards Premier Business

- Chase Ritz Carlton

- Chase Southwest Business

- Chase United Mileage Plus Explorer

- Citibank AAdvantage World MasterCard

- Diners Club

- JP Morgan Select

With the business cards on this list, you must be traveling for business for the coverage to be in effect.

The list of credit cards that offer primary insurance coverage on car rentals changes all the time. Before your next vacation or car rental, check with your credit cards to see what coverage is available as a benefit.

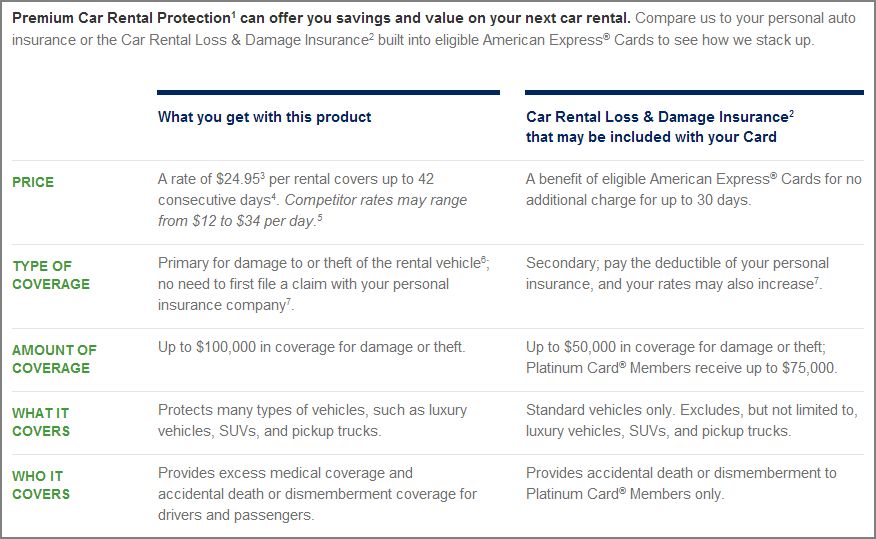

American Express Premium Car Rental Protection

If you have an American Express credit card, I would recommend signing up for the American Express Premium Car Rental Protection service. Whenever you use the registered card, the coverage will automatically be in effect… so don’t reserve the rental with that card unless you are intending to purchase the insurance!

There is no cost to enroll and there is no deductible in the event of a claim.

American Express charges a flat rate of $24.95 on reservations up to 42 days…. so whether your reservation is 1 day or 42 days, you pay the same $24.95. If you are a California resident, your charge is only $17.95. If you are a Washington state resident, your coverage is only good up to 30 days.

You will be covered up to $100,000 in primary theft and damage insurance. Liability insurance is not provided… which means that other property or people are not covered in the event of an accident or damage, only the rental car that you are driving.

What coverage is included with the American Express Premium Car Rental Protection?

- Up to $100,000 of primary coverage for damage or theft of a Rental Car.

- Up to $100,000 of Accidental Death or Dismemberment coverage ($250,000 for California Residents).

- Up to $15,000 for excess medical expenses per person.

- Up to $5,000 for excess personal property coverage ($15,000 for Florida Residents).

- Note: Liability is not included.

If you want to sign up for coverage on your American Express, click here to start the enrollment.

Conclusion

I signed up for the American Express Premium Car Rental Protection years ago. So far, I’ve only used it when we’re going someplace that is snowing or where we’ll be going into the mountains for snowboarding. We’ve never had to make a claim… and hope to keep it that way! However, if there were ever a need, I feel safe knowing that the coverage is with American Express.

Join our Newsletter

Join the BaldThoughts.com newsletter to stay up-to-date with the latest news, specials, promo codes, and interesting stories about travling the world using airline miles, hotel points, and timeshares.

Lee:

I usually opt out of the insurance at the rental car counter and rely on my credit card or personal car insurance provider. However, (and I might be wrong on this) an acquaintance of mine who is an insurance agent, said that you need to realize that while credit card companies will pay for the damages, most companies will not pay for the downtime (number of days that it takes to repair the vehicle while it is in the shop) so you will be stuck paying that. Check with your provider.

Cynthia, that’s a very valid concern. Coverages do vary, so you should verify what is and is not covered. If downtime isn’t covered, who knows what rate the rental car company will charge you!