When you apply for any type of credit, your score will initially decline because of additional inquiries. The general rule is 2 to 5 points per credit application. However, when applying for auto loans or a mortgage, multiple inquiries within a short time only affect your score as 1 inquiry to allow for shopping for the best rate.

In This Post

What To Do Before You Do An App Party?

In the miles and points world, it is common to time your applications for multiple cards on one card to lessen the impact. This is also done to reduce the possibility that the other credit card companies will see the multiple inquiries and ask a bunch of questions.

To get an idea of your credit score, go to CreditKarma, CreditSesame, and Quizzle and get it for free.

Additionally, the US Government mandated that the 3 credit bureaus (Experian, Equifax, and Transunion) provide you with a copy of your credit report once per year for free. You can get these reports to check for inaccuracies that may be affecting your score at AnnualCreditReport.com.

Doesn’t An App Party Kill Your Credit Score?

Kill is an overstatement. Depending upon the number of applications you do per app party, your credit score will go down by a little or a lot… temporarily.

Credit inquiries make up only 10% of your score, while 65% is based upon payment history and amounts owed. Control those two factors, and not much else matters. When you do open new accounts, your length of credit history is impacted due to the new accounts, so that a drop in that category, which is 15% of your score, will also bring your score down.

Generally, credit inquiries only affect your credit score for 6 – 12 months, although they stay on your credit report for 2 years. The decrease in average age of open accounts will happen right away, but every month your cards are open, that average age will continue to increase.

On the plus side, whenever you are approved for more credit, your overall credit utilization will decrease! Say you have 2 cards with a combined $20,000 limit on them. If your outstanding balance is $4,000, then your utilization will be 20% ($4,000 divided by $20,000). If you get approved for 2 more cards with a total limit of $20,000, then your new total credit limit will be $40,000. Now, your credit utilization is now only 10% ($4,000 divided by $40,000).

The increase in credit available will stay with you for as long as you have the card open.

In other words, your score is hurt on one side temporarily and helped on the other side long-term.

In my personal experience, the credit score drop will happen for a couple of months until your new cards start reporting activity, then your score will recover to where it was before the applications.

My Personal Experience

I have applied for a lot of credit the last several years. I bought my house in 2010 and have refinanced it twice since then (including January 2013, when I lowered it to 3.25% 30-year fixed). I refinanced my rental properties in January 2012 into 15 year rates in the 3% range. And, I have applied for 27 cards since January 2012, getting approved for 24 of them!!!

You can find the results of my App Parties here, including what I applied for, why, and what I hope to do with the points!

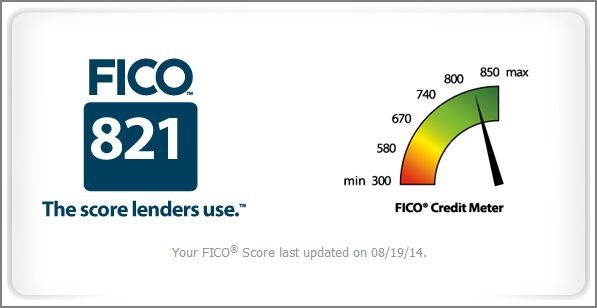

Yet, my scores remain in the mid-700s. In fact, I’m getting a Home Equity line of credit now and my score was 739 on the letter they sent me.

So, applying for a bunch of credit hasn’t affected me in a negative way, or kept me from doing things I want to do outside the “credit card world of miles and points.”

Conclusion

Applying for numerous cards will reduce your score temporarily, but it will recover within a couple of months. Just in time for your next round of cards. Ideally, you should space out your applications 3-6 months from your last app party. Only apply for cards that you can meet the minimum spend in the time allowed. And DO NOT get involved if you carry a balance… go to BankRate.com for other cards that have lower APRs and are better suited for people who carry a balance.