I’ve had the Marriott Rewards credit card for several years. Although many of my travel friends have churned through the card many times, I’ve stuck with it. I’m happy to pay the annual fee just to receive the annual free night certificate. Over the last six months, Chase has sent several messages to me offering to upgrade the credit card. In the craziness of life, those emails end up buried in my inbox and long forgotten. Yesterday, another email caught my eye and this time I decided to act on it. Here is why I upgraded my Marriott credit card.

Benefits of the Marriot Rewards Premier Plus Card

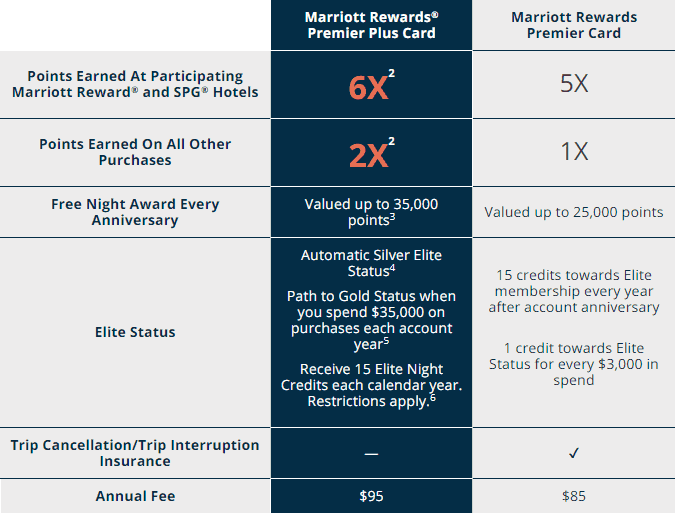

The benefits of the new Marriott Rewards Premier Plus Card are superior to the Marriott Rewards Premier Card in almost every way.

- Cardholders receive an extra point on all Marriott purchases (for a total of 6x) and everywhere else (doubled to 2x).

- The annual free night is worth more. Instead of being capped at 25,000 points (standard Category 4), the free night can now be redeemed for properties up to 35,000 points (standard Category 5).

- Automatic Silver status. Gold status is earned after spending $35,000 within a calendar year. I’m lifetime Gold, so this benefit doesn’t mean anything to me.

- 15 Elite Night credits each year. Unfortunately, these night credits don’t stack with other Marriott cards.

With the $10 per year upgrade, I’m losing out on trip cancellation insurance (which I’ve never used) and the ability to earn one Elite Status credit for every $3,000 spend. The earning potential of the Marriott Rewards Premier Card wasn’t that great, so I never spent on it. No loss there on the one night per $3,000 benefit.

Chase Marriott upgrade offer

Aside from getting additional benefits every year with my new Marriott Rewards Premier Plus credit card, Chase provided additional incentive. If I upgraded my credit card and spend $3,000 by March 31, 2019, then I’ll receive a $200 statement credit.

It’s not as good as a normal signup bonus, but I’ll gladly take the $200 in exchange for a little bit of spend on the card.

The upgrade process is easy

To upgrade your card, go to this Chase website and enter in basic information. First name, last name, last four digits of your credit card, and zip code. Providing your email address is optional. I recommend using this page to check all of your Chase credit cards to see if there are any upgrade offers available.

Once you provide your information, as long as your credit hasn’t changed for the worse recently, you’ll be approved for the upgrade. The new benefits will take effect within a few business days and the new credit card will arrive shortly thereafter.

Marriott Rewards is now Marriott Bonvoy

In the midst of this upgrade, Marriott is also rebranding its hotel loyalty program and credit cards to Marriott Bonvoy. This is not just a name change. Other changes are happening as well that aren’t so rewarding.

Category 8 Hotels Added

In 2019, around 300 properties will be changing category. And with this change is the introduction of Category 8 award redemptions. Here are eight Marriott Bonvoy Category 8 hotels that can cost up to 100,000 points per night!

- Scrub Island Resort, Spa & Marina, Autograph Collection

- The London EDITION

- Pine Cliffs Residence, a Luxury Collection Resort, Algarve

- Las Alcobas, a Luxury Collection Hotel, Napa Valley

- The Ritz-Carlton, Dubai

- The Ritz-Carlton Ras Al Khaimah, Al Hamra Beach

- W Hong Kong

- The Westin Europa & Regina, Venice

Introduction of Peak Pricing

Peak and off-peak pricing is starting on March 5, 2019. This means that hotel prices are no longer fixed based upon their category. Instead, there will now be normal pricing, off-peak, and peak based on the schedule below. For some of the most popular resorts, you can imagine that there will be very few days at the off-peak pricing.

| Category | Standard | Off-Peak | Peak |

|---|---|---|---|

| 1 | 7,500 | 5,000 | 10,000 |

| 2 | 12,500 | 10,000 | 15,000 |

| 3 | 17,500 | 15,000 | 20,000 |

| 4 | 25,000 | 20,000 | 30,000 |

| 5 | 35,000 | 30,000 | 40,000 |

| 6 | 50,000 | 40,000 | 60,000 |

| 7 | 60,000 | 50,000 | 70,000 |

| 8 | 85,000 | 70,000 | 100,000 |

All credit cards are being rebranded

Last summer, Chase and American Express shuffled the cards around to determine who would issue what Marriott credit cards going forward. Chase is keeping the personal credit cards, while American Express is focusing on the business and luxury cards.

If you have an existing Marriott credit card from Chase or American Express, you’ve already received an email with an animated graphic like the one below. It shows what your existing credit card looks like compared to the new Marriott Bovoy version.

What do you think of the new credit card designs? I think they’re pretty meh. Not horrible, but nothing that blows your mind.

The Bald Thoughts

I’m glad that I upgraded my Chase Marriott Premier card to the Chase Marriott Premier Plus. It will soon be replaced by the Chase Bonvoy Boundless card design. The additional perks and upgraded annual free night are worth the increase of $10 to the annual fee. And I like that I’ll receive a $200 statement credit once I spend $3,000 within the next 6 weeks.

Have you upgraded your Chase Marriott credit card? If so, what offer did you receive? Let us know in the comment section below.

Thinking of getting a new credit card?

To see the best credit card offers available, go to our credit card marketplace to find your next card.