** If you click on the links in this post, I may receive a commission which will not affect the price you receive or the offer you get. We appreciate your support of our site!

When I started the $1,000 Challenge on October 1st, I wanted to include my existing investment with Lending Club to compare its results vs. what I will receive from Prosper. I’ve been investing with Lending Club for over 1 year and have had great results, while adding some diversification to my portfolio.

The $1,000 Investment Challenge

- An Introduction – Where to invest $1000 – my investment challenge

- Investing with Prosper peer-to-peer lending

- Investing with Lending Club peer-to-peer lending

- Investing with Betterment

- Investing with Sharebuilder

What is Lending Club?

Lending Club is a peer-to-peer lending platform that allows you to be a lender to borrowers or you can borrow money from people who are looking for an alternative to bonds. You have full control over your investment criteria and can set up automated investing in notes that meet the criteria that you have selected.

This platform helps borrowers consolidate debt or borrow to make home improvements or start a business. Banks are really picky with who they will lend money to. With Lending Club, you have the ability to help people improve their financial situation at an interest rate that is reasonable for both the borrower and investor based on the borrower’s profile.

What is peer-to-peer lending?

Peer-to-peer lending is a way for average people like you and me to borrow money without going to a bank. Rather than a bank offering a solution to their borrowing needs, investors invest in their loans at any amount.

Peer-to-peer loans can be for any purpose, whether it be to consolidate debt, start a business, fund home improvements, or any number of other goals. Borrowers get fixed-rate personal loans that are smarter alternatives to high-interest rate credit card debt that could take years to pay off. With easy monthly payments of principal and interest to investors like you, borrowers get what they want without getting deeper into debt. These are real people with real stories, wants and needs.

My results with Lending Club

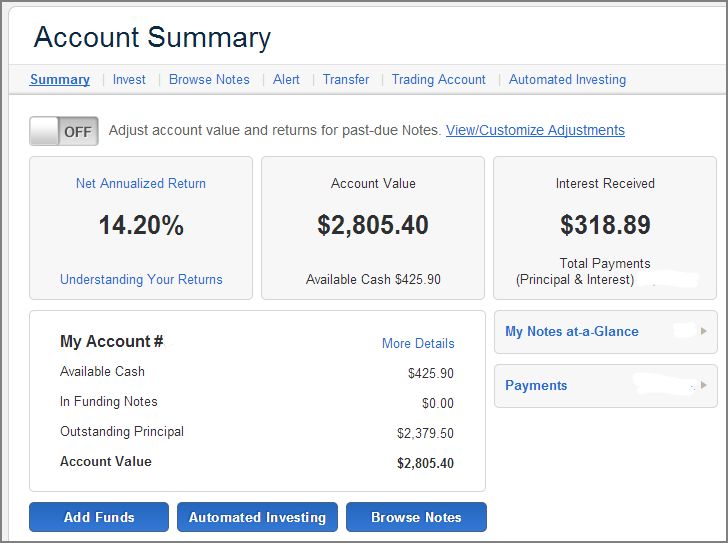

I opened my account with Lending Club in early 2013, so it has been awhile. I got really busy with life and actually didn’t invest in my first notes until June 2013. Inertia and complacency can be a problem for all of us. I started with the $2,500 minimum needed to open an account and my account has grown to $2,800 in a little over a year, which is a net annualized return of 14.20%.

I’m going to subtract the October 1, 2014 balance of $1805.40 plus estimated monthly returns so that this investment is on par with the other 3 options. There will be some static in the numbers compared with my Prosper investment since my Lending Club account will be primarily invested immediately, while the Prosper account will take time to fund the loans I have invested in.

I’m going to subtract the October 1, 2014 balance of $1805.40 plus estimated monthly returns so that this investment is on par with the other 3 options. There will be some static in the numbers compared with my Prosper investment since my Lending Club account will be primarily invested immediately, while the Prosper account will take time to fund the loans I have invested in.

What is the minimum needed to open an investing account with Lending Club?

When establishing an account with Lending Club, your account needs to reach $2,500 by the 1st anniversary of opening your account. With the $1,000 Challenge, within 1 year the contributed amount would reach $2,100 by the anniversary date ($1,000 initially + 11 $100 monthly contributions)… so investment gains and additional contributions would need to exceed $400. Something to think about if you’re looking to open an account.

How to open an account with Lending Club

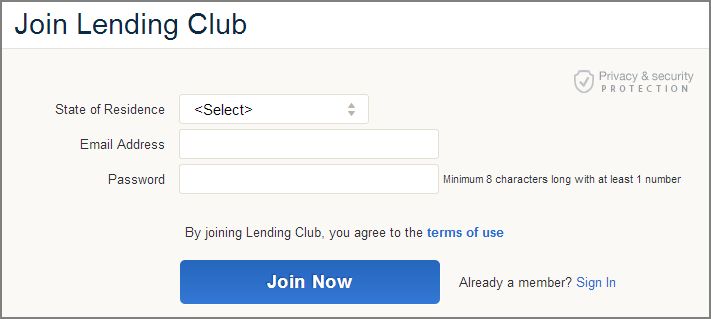

1. Go to Lending Club‘s website and select Investing and Invest Now before they ask you to select your state, tell them whether it is a regular investment account or a retirement account, enter your email address, and choose a password.

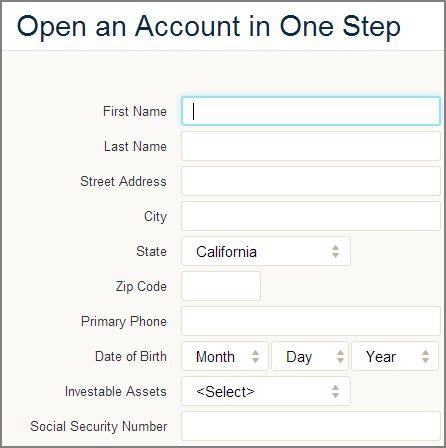

2. Enter your personal information to open your account in one step!

Set your investment criteria with Lending Club

Once your account with Lending Club is set up, you can select your investment criteria. There are many choices you can make to customize your criteria. For example, here are some of the criteria that I customize:

- Home ownership

- Delinquencies

- Inquiries

- Max debt-to-income ratio

- Credit score

- Months since last delinquency

- Loan term – 36 or 60 months

- Loan purpose

These same criteria can be used whether you are investing manually or automatically through reinvestment of payments or through auto-deduct from your checking account.

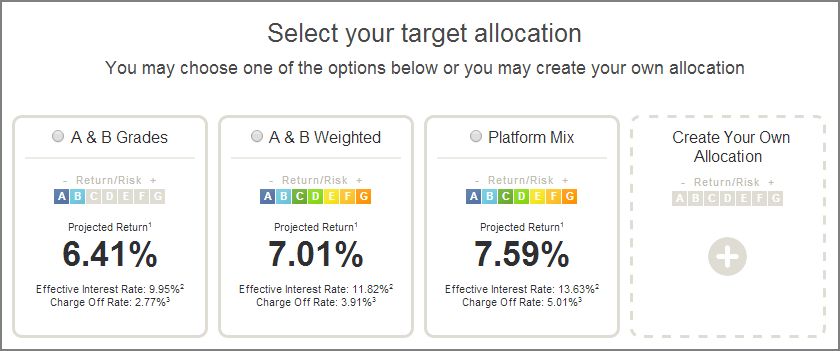

Alternatively, you can select from 3 pre-defined portfolios created by Lending Club.

Investing automatically with Lending Club

When you enroll in automated investing, Lending Club asks you to choose from pre-defined options…

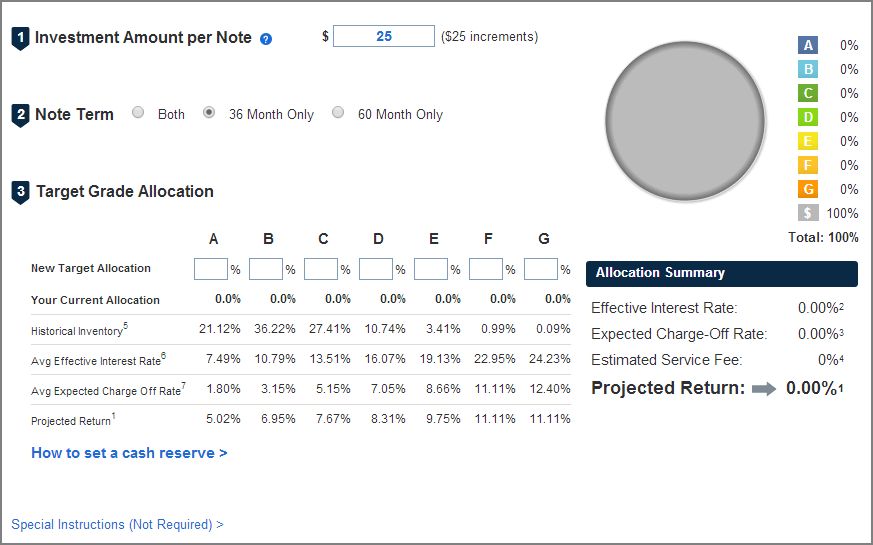

or you can define your own criteria for ongoing contributions based on the grade of the borrower.

You can then enter the Special Instructions section to apply a filter based on your specific criteria that we discussed above.

If you’d like to borrow from Lending Club

If you need to borrow money, Lending Club is a great option to explore and compare versus what a bank will offer you. Interest rates start as low as 6.78% APR! You can input some basic information to see what your rate would be through Lending Club… and it won’t affect your credit score. Click on the banner below.

Conclusion

I have been investing with Lending Club for over 1 year, and I am happy with the results. I’ve invested in a wide variety of notes and (knocking on wood) it has produced quality results that exceeded my expectations. I experienced my first charge-off in July 2014 from one of the first notes I invested in… no more 60 month notes for me! Even after the charge-off, I’ve seen returns of approximately 13-14%. I see this as a great alternative to the bonds I might normally include in my portfolio… with the added benefit of directly helping people improve their financial position through consolidating debt, making home improvements, and starting small businesses.

Join Our Newsletter

Join the BaldFinance.com newsletter to stay up-to-date with the latest news, specials, promo codes, and interesting stories about personal finance.

good job with lending club. I am a long time investor in Prosper and consistently scoring 7% + return. I recently joined lending club and had my first $5,000 there. Let’s see if it can beat Prosper. I only choose A rated borrowers.

That’s great that you’ve seen consistent returns with Prosper. I’m hoping for something similar. I’ve balanced my Lending Club portfolio with some riskier loans to boost my returns to the 13-14% range. <> I’ve only had one charge-off so far. I figure the higher interest rate should offset some of the potential for loss by going outside the A rated borrowers.

This is pretty cool! It’s definitely good to have real hands-on experience you can point to in your investing, 12 months from now you will have a lot of history you can review to see if it’s worth it to continue investing here or to move on to something else. My main goal at the moment is to max my 401k before investing in anything else.

Thanks for the encouragement Sally. I’m hoping that all 4 options will be worthwhile to continue beyond the next 12 months. The bad thing about the peer-to-peer lending options of Lending Club and Prosper is that, until I receive repayment, I have to ride out the loans for the duration of the term. I believe that Prosper offers a secondary marketplace in which you can sell notes, but I haven’t explored that function yet. Good luck with maxing out the 401(k)!

Any updates on how you are doing with Lending Club? Your criteria are pretty good, although research that I have conducted shows 36 month loans outperform 60 months. Also, credit score is not really correlated with loan default if you apply it based on grade, as this is what the loan underwriters do.

Thanks for the tip. I haven’t invested with either LendingClub or Prosper in years. I stopped reinvesting repayments, and I’ve been slowly withdrawing as the loans get repaid.

As for my criteria, I quickly learned to focus on the 36-month loans instead of the 60-month loans to reduce my duration risk. The extra 2 years worth of duration was not worth any initial premium in interest rate due to the concerns over default.