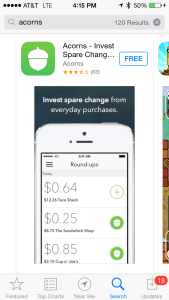

I keep my eyes open for easy ways to invest at a low fee. While listening to the Stacking Benjamins podcast, they were interviewing Colton Dillion of Acorns. They described a iPhone application that rounds up your credit card and bank transactions to the next dollar, then invests that amount into a basket of low-cost ETF and index funds.

What is Acorns?

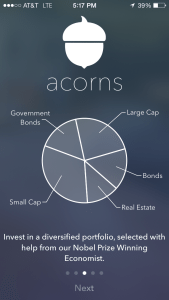

Acorns is an app on your iPhone (coming soon with an Android and website version) that constructs and optimizes portfolios with help from the father of “Modern Portfolio Theory,” Dr Harry Markowitz.

How does the Acorns app work?

You can connect any credit or debit card to the app, which will then enable you to automatically or manually round-up purchases and invest your spare change.

You can also invest any amount at any time if you want to supercharge your investment balances!

You will invest in a diversified portfolio of low-cost ETFs and mutual funds. Your portfolio mix is based upon answers to questions about your age, investment timeframe, tolerance for risk, income, and assets.

There are no minimums in the accounts, and there are no commissions on trades… whether you are buying or selling. You can add money at any time… and withdraw any amount at any time without a penalty. The money will be deposited directly into your bank account.

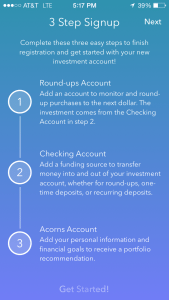

How do you set up your Acorns account?

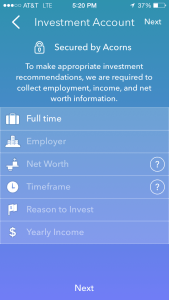

You can easily set up your account by downloading and installing the app on your iPhone, then following the 3 step set-up… add your round-ups account (or multiple accounts), connect your checking account, and add your personal information to allow Acorns to construct a personalized account just for you.

Your personal information required is pretty basic — work, net worth, timeframe for investing, reason to invest, and yearly income.

What about the investments?

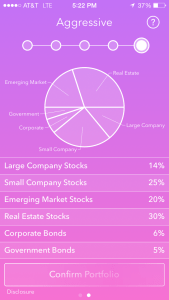

Based upon my answers, Acorns recommended an Aggressive Portfolio mix. Even though this was the recommendation, I could make changes to the mix of investments, if I chose to do so.

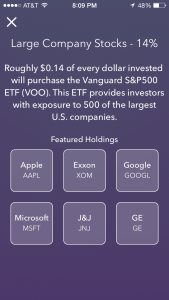

And you can click on any of the portfolio types to get a better understanding of the types of investments within each category. For example, by clicking on Large Company Stocks, you can see that this portion of the portfolio invests in the Vanguard S&P 500 ETF (ticket VOO), which contains companies such as Apple, Exxon, Google, Microsoft, Johnson & Johnson, and GE.

Which banks does Acorns work with?

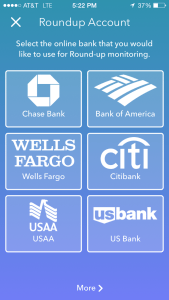

Acorns works with the biggest banks in the US, such as Chase, Bank of America, Wells Fargo, Citibank, USAA, and US Bank.

After entering in your log-in information, you can choose which of your accounts to have Acorns access for round-ups. At least in the beginning, I’m setting all of them for automatic round-ups until I see if the amount contributed per month is at a comfortable level for me or not.

Conclusion

I’m in favor of easy to implement apps that will help people save more for their future. Unfortunately, there is no option yet for retirement contributions, but I can imagine that will be available once users get comfortable with the technology. It is simple, easy, and effective at helping people save, which I love! To find out more, go to the Acorns website or search for it in iTune.

Newsletter

Join the BaldFinance.com newsletter to stay up-to-date with the latest news, specials, promo codes, and interesting stories about personal finance.

Haha, my brother was just telling me about this at dinner last night. He called it “something for that blog you write.” It definitely looks interesting. I may have to download it and see how it goes for a few months.

I agree Mel. It is a novel concept, similar to something BofA started offering a few years ago, but theirs just went into a savings account offering nothing for interest. I like the ability to invest in the market automatically for minimal fees. I use my credit cards a lot, so it will be interesting to see how much these “round-ups” equal over the course of a month. Have a great weekend!