We work hard to build up our miles and points so that we can go on awesome vacations. However, life gets in the way and sometimes you can’t use all of your miles right away. Unfortunately, airlines have policies that cause your miles and points to expire if there is no activity on your account after awhile. Here is one of the easiest options to earn frequent flyer miles without setting a foot in the airport that will keep your miles and points from expiring.

Some related posts about earning miles and points without flying:

- 7 ways to earn miles and points without getting a new credit card

- 3 simple ways to keep reward miles from expiring without flying

- 11 immediate steps to take when you get a new credit card

Rapid Rewards Dining

I used to fly frequently with Southwest Airlines a couple years ago but since my job changed, I started to fly with Delta Airlines. As a result, my Rapid Rewards account started to countdown until my miles would expire. Luckily, the kind people at Southwest recently emailed me saying my miles will soon expire.

I don’t have too many miles with Southwest but hey, 6,000 Rapid Reward miles is better than nothing, right? Especially, when I can redeem my miles for a free roundtrip from Los Angeles to San Jose,CA for only 6,000 miles.

One of the biggest misconceptions people have is that, to keep their miles from expiring, they have to fly. While this is true, it is not your only option. Nowadays airlines, such as Southwest, give their customers more options to earn miles without even flying!

How Does it Work?

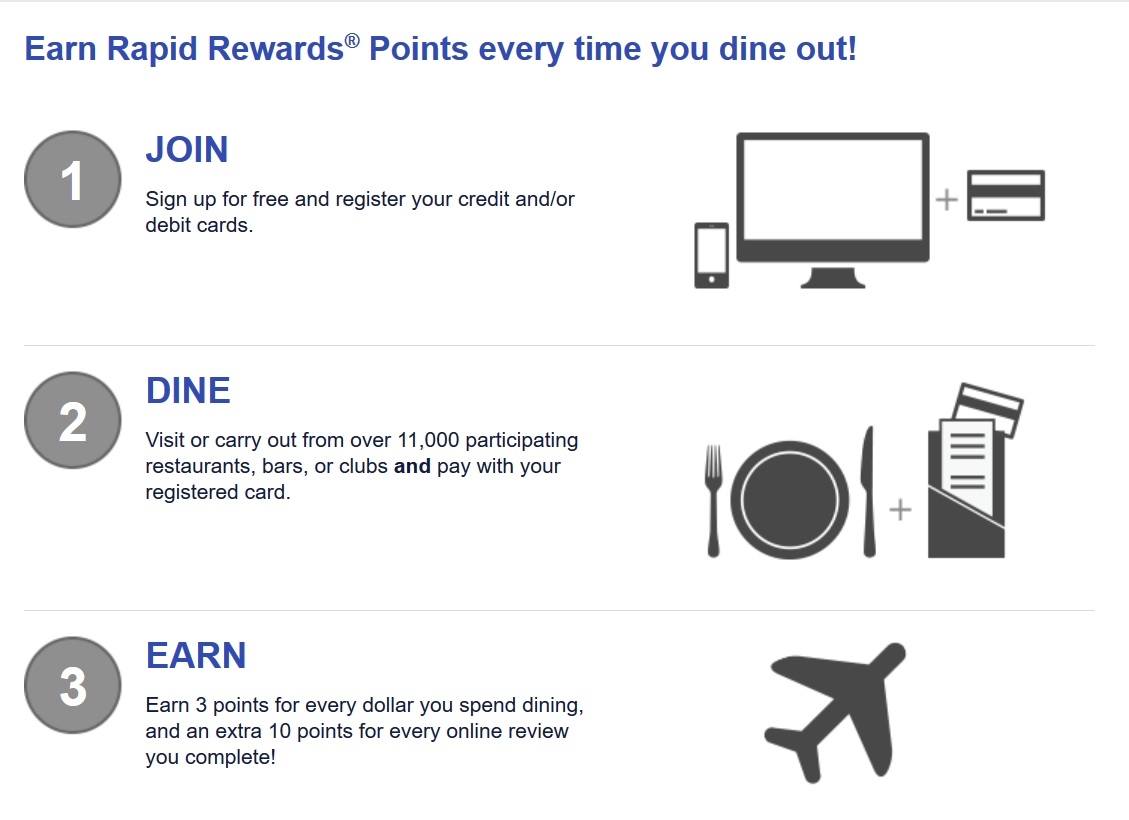

To get started, you must first be a Rapid Rewards member. If you already have a Rapid Rewards number, log into the Rapid Rewards Dining portal to activate your account with an active debit or credit card. The best thing about the Rapid Rewards dining is that it offers many different styles of restaurants to choose from. Some examples include fast food, family style and top dining. To find participating restaurants, you will need input your address or zip code to locate nearby restaurants.

Warning: Although, a restaurant may be listed as a participating restaurant, each restaurant has specific guidelines for their participation in the program. For example, some restaurants limit the opportunity to earn miles to certain days. Always check each restaurant’s reward schedule. Also, some restaurants may not accept American Express at their establishment. It is always good to register all of your cards, and preferably a mix of Visa and Mastercard credit or debit cards.

If you’re looking for a new credit card, please use our referral link to see the current list of the best cards available or submit a request for a free 30-minute phone consultation where we’ll help you pick out the best card that will help you reach your goals.

Pro Tip: After you complete your qualifying dine, you’ll receive an email asking you to complete a short survey (takes 1-2 minutes), where you’ll earn additional points.

Sign-up Bonus

If you’re a first time user on the Rapid Rewards dining portal, Southwest extends an introductory offer of earning 1,000 points when you spend $25 in the first 30 days. I recently got the new Chase Sapphire Reserve card and decided to add it to this account. With the 3 points per $1 spent on dining and travel worldwide, I can easily double dip on points.

Final Thoughts

Airlines are making it easier for people to earn miles without flying. You can learn more ways to avoid your miles from expiring and keep your account active. It’s a good rule of thumb to pair your Rapid Rewards dining account with a card that gives your the best point value per dollar spent. For example, the Chase Sapphire Reserve credit card or to earn more additional Rapid Rewards miles, the Southwest Airlines Rapid Rewards Premier Card is an excellent choice.

If Southwest isn’t your airline of choice, don’t worry. Most major airlines participate in a dining rewards program. Here are the links for American, Delta, and United.

Rewards Credit Cards

- Earn rewards with your everyday spend, and get a little closer to your next vacation.

- Use rewards to book hotels, air travel, gift cards, or to cover travel expenses like Uber.

- Loyalty pays off — earn double rewards when you use your card to book a trip with your favorite hotel or airline.

- Enjoy additional travel perks like travel insurance, waived foreign transaction fees, and airport lounge access.

- Terms vary by partner offer. Please see each bank’s application for terms and conditions.