Many of us use credit cards for every transaction because we love all of the miles and points that we earn. But not everyone is comfortable using a credit card because of the potential to go into debt. It is a very reasonable concern, especially for people just starting into the miles and points game.

What is Debitize?

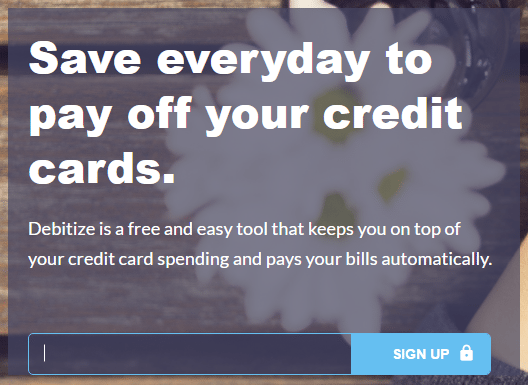

Debitize is a company that seeks to eliminate those concerns by making your credit card act like a debit card! By doing this, you get the best of both worlds… all the miles and points from your credit cards, but your checking account gets debited every time a transaction clears!!!

Debitize is free and easy to use. It is compatible with almost any checking account and credit card, and it works automatically after every purchase – no need for users to do anything once they sign up.

Why use Debitize?

When you use Debitize, you can pay with your credit card instead of your debit card, which allows you to:

- Earn credit card rewards

- Build credit

- Get better security and fraud protection than debit

- No overdraft fees if your checking account is temporarily short funds

I obviously LOVE earning miles and points, but the biggest reason I NEVER use a debit card is security. I used to work in a bank branch, and I can’t tell you how many times a client would come into the branch with fraudulent transactions hitting their checking account due to debit card fraud.

You’ll eventually get your money back after the bank concludes its research, but you’re worried about checks and electronic payments bouncing in the meantime… and you’re the one who has to explain to your mortgage company, car lender, and credit card companies that it is not your fault that the payments are being returned for Non-Sufficient Funds… all the while, begging them to waive the bounced payment and late payment fees on your account.

What a mess! Now you can see why security is the number one reason why I recommend to never use a debit card.

Debitize automatically sets aside funds to cover every purchase so users also get the benefits of debit:

- Stay on top of their spending (your checking account reflects how much you’ve spend so far)

- No bills to pay

- No worrying about interest or late fees

- Stay out of credit card debt

Sounds pretty cool, huh?

How does it work?

1 – First, sign up at Debitize with our referral link and enter your email address, and we’ll BOTH get $10 when you sign up!

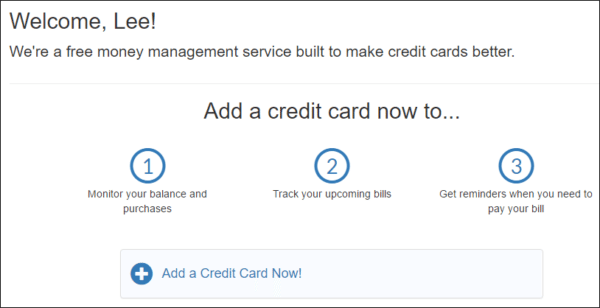

2 – Enter your name and create a password

3 – Accept terms of service

4 – Then start adding your credit cards.

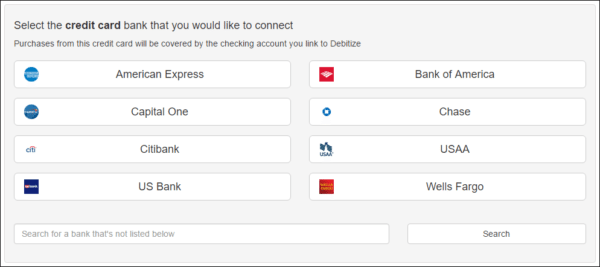

When you log into your bank, you can choose which of your credit cards you want to participate in Debitize. If you need a better card, check out the current list of the best credit cards.

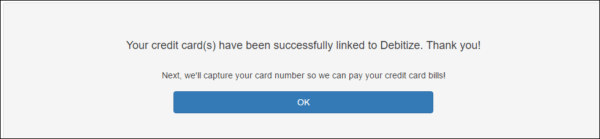

It is not an all-or-nothing approach. You can pick one card, all of them, or somewhere in between. After you pick your cards, you’ll receive a confirmation.

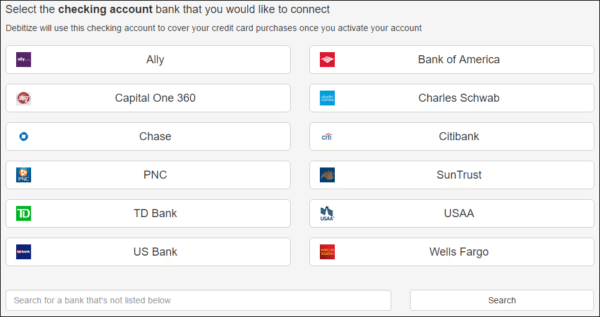

5 – For the Debitize service to work properly, you’ll also need to add your checking account information so that Debitize can debit your account daily whenever a credit card transaction posts to your chosen credit cards.

Rest assured, your bank credentials are never stored on Debitize’s servers and the information is deleted after the link is established. Bank-level 256-Bit encryption is used at all times and their computer servers are verified and monitored by Symantec.

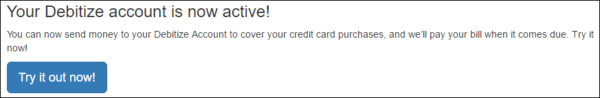

6 – Debitize now active and you’re ready to rock and roll.

Advanced Features of Debitize

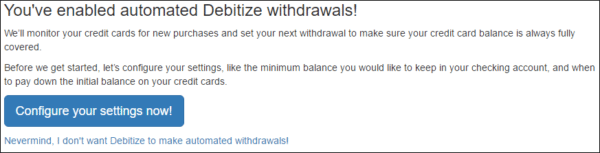

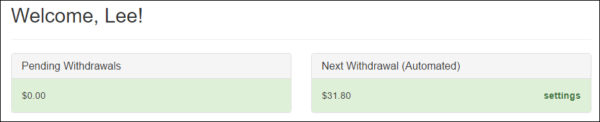

Now that your Debitize account is active, you will want to enable automated withdrawals to ensure that all of your charges are deducted from your checking account, just like a debit card would.

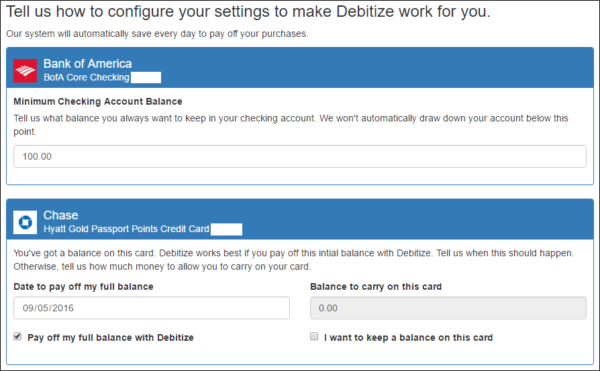

And just in case you get a little crazy with your credit card one month, you can customize Debitize to ensure you keep a minimum amount in your checking account to cover normal bills and cash needs. You can also select the date in which to pay your credit card and a balance to carry so that Debitize doesn’t pay too much off at once.

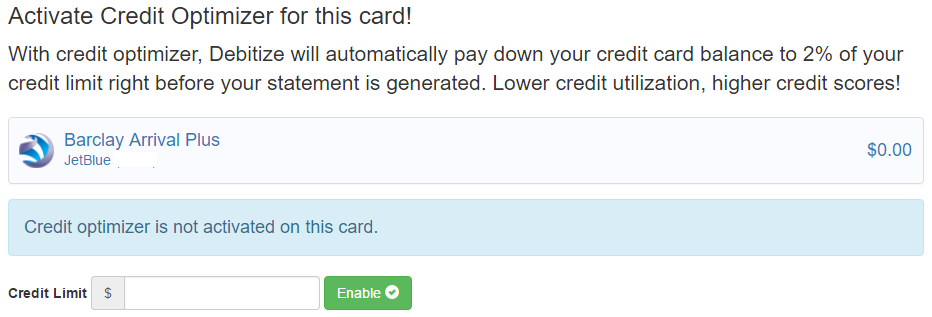

And Debitize recently launched their Credit Optimizer functionality. With this process, Debitize seeks to pay down your credit card each month before the statement closes to a target of 2% utilization.

How does Debitize pay your credit cards?

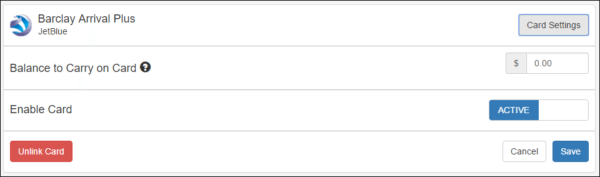

As I mentioned above, you can choose to carry a balance on your card (say that you’re working to pay it off, but want every charge above a certain amount to be paid each month).

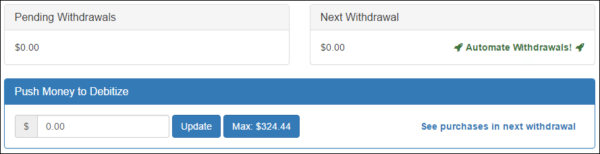

Debitize will collect money for your charges each month and store them in the Debitize account until it is time to pay the bill. And you can always push extra money to Debitize to ensure you don’t spend it.

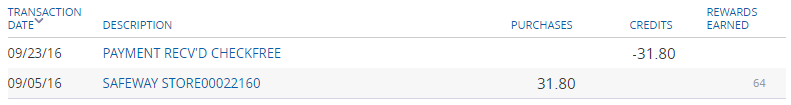

When you log in, you’ll be notified of pending withdrawals. I did a test transaction on my Barclay JetBlue card at the grocery store.

When Debitize saw the transaction post to my credit card, they initiated a withdrawal from my checking account.

And about a week before my credit card’s due date, Debitize made the payment to my card to ensure that I didn’t carry a balance and incur any fees or interest charges.

The Bottom Line

With Debitize, you no longer have to be afraid of using credit cards because this platform allows your credit cards to act like a debit card. You get the best of both worlds… rewards and protection of a credit card, while using a pay-as-you-go system like you would when using a debit card.

Sign up for the free Debitize service and earn $10 for using our referral link!

now only if they can do pin enable debit so it can be used to buy MO and pay other services for lower fees

I hear you Choi! Always looking for the next great option for MS. Unfortunately, this one doesn’t work for that.

This sounds like a great idea but do you know if it works in the UK?

I’m not sure if it works for international-based credit cards. I’d recommend trying it out since the service is free and you get $10 for joining with my link.