We usually talk about travel, credit card rewards, and other fun topics. However, it is hard to travel the world when you have student loans hanging over your head. Ironically, I found out about the First Republic Bank student loan refinance from an offer I received in the mail. And from my first interaction with the bank, the service I’ve received has been exceptional.

In this article, I’ll explain how the student loan refinance process works with First Republic Bank, the requirements, and the benefits of refinancing your student loans with First Republic. Read on to find an offer to earn a $300 bonus towards refinancing your student loans with First Republic Bank.

Who is First Republic Bank?

First Republic Bank, founded in 1985, is a publicly-traded bank that offers a variety of banking services such as private banking, business banking, investment, trust, and brokerage services. With the student debt crisis at over $1.6 trillion owed, First Republic Bank now offers student loan refinancing. And now, First Republic Bank student loan refinancing offers some of the lowest rates in the country.

First Republic Bank Student Loan Refinance review

First Republic Bank offers the student loan refinance product as a way to begin “relationship banking.” Their goal is to become lifelong partners in your financial journey, and paying off your student loans is one step in that journey. However, there are stipulations to qualifying for First Republic Bank student loan refinancing.

First Republic Bank only serves clients in the following states and areas:

- California (San Francisco, Palo Alto, Los Angeles, Santa Barbara, Newport Beach, San Diego)

- Oregon (Portland)

- Wyoming (Jackson Hole)

- Connecticut (Greenwich)

- Florida (Palm Beach)

- Massachusetts (Boston)

- New York (New York City)

First Republic only services those who live within “close proximity” of their offices. I was targeted by a mailer sent to my in-laws’ address in Glendale, CA, about 15 miles north of downtown Los Angeles.

You can find a list of First Republic Bank branches here.

Read: Refinancing student loans to reduce the interest rate by 55%

How it works

First and more important, their student loan refinance interest rates are incredibly low. This goes back to its “relationship banking” model, where First Republic strives to keep you as a client past your student loan payoff.

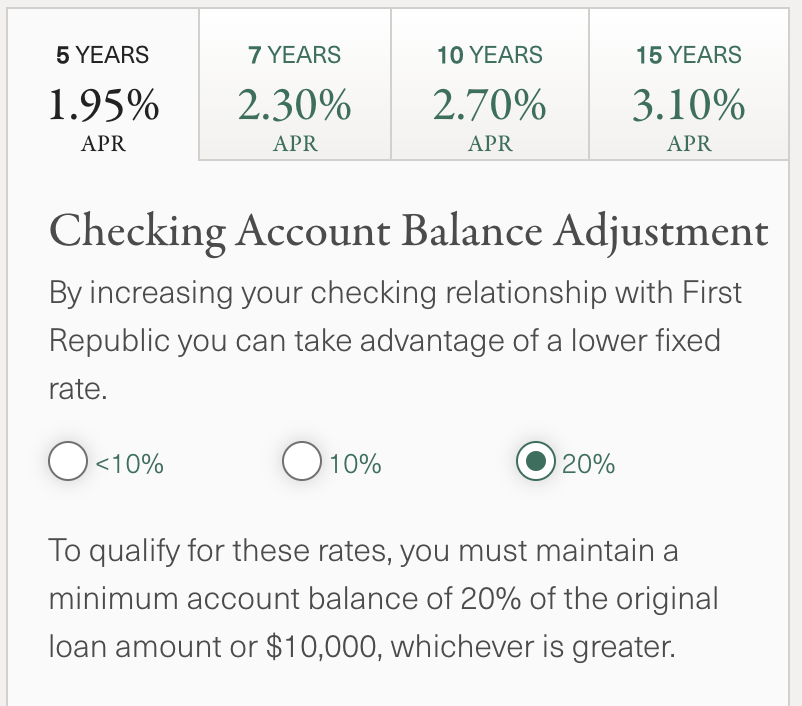

At the time of publishing, the most discounted interest rates are:

- 1.95% for a 5-year loan

- 2.30% for a 7-year loan

- 2.70% for a 10-year loan

- 3.10% for a 15-year loan

The rates above are indicative of meeting the three rules below:

- Rate discount of 0.50% for keeping at least 10% of the originated loan amount in your First Republic Bank checking account for at least 12 months.

- Additional rate discount of 0.25% for keeping at least 20% of the original loan amount in your checking account for at least 12 months.

- An additional rate discount of 2% for maintaining autopay and direct deposit with First Republic.

If you aren’t able to meet the above rules, your rate will increase slightly. To play around with the different options, there is an interactive tool on the First Republic Bank website to show different interest rate options.

The rates range anywhere from 1.95%-3.85%, which are still great rates to refinance your student loans.

Student Loan Refinance Program qualifications

On top of being near a branch location, there are a few more qualifiers for the First Republic Bank student loan refinance product.

- High credit score (750+).

- Low debt-to-income ratio. First Republic Bank will ask for your full financial picture (income, debt, assets, etc.) to consider your application. During my first application process, my debt-to-income ratio was too high and I wasn’t approved. The second time I applied, I was approved.

- Have a First Republic ATM Rebate Checking account with a minimum of $500 deposit. A $25 monthly fee applies if a $3,500 minimum average balance is not maintained.

- Loan limits based on your degree. You can only refinance $40,000 to $300,000 for a Bachelor’s degree. If you have a Master’s degree, the minimum is $25,000.

- How it is reported on your credit report. The loan isn’t considered a “student loan” on your credit report.

- You may not refinance it again. This loan cannot be refinanced again to a different lender.

These requirements may sound intimidating (I was intimidated). However, the goal of this product is to have consumers fully commit to First Republic Bank as their primary financial institution. And outside of the student loan refinance interest rates, the benefits of First Republic Bank are outstanding.

Benefits of refinancing your student loans

The student loan refinance process may seem scary, but the savings you have in interest is well worth it. Here are a few benefits of refinancing your student loans with First Republic Bank:

-

Interest rebate

If you are able to pay off your student loans in under four years, you will receive all of the interest back, up to 2% of the original loan balance. This is a great incentive to pay your loans down quicker.

-

No ATM fees

As part of the First Republic Bank student loan refinance program, you must open an ATM Rebate Checking account. The best part of this checking account is that all of your ATM fees are refunded to you. So regardless if you need some quick cash around town, or traveling abroad, you can access your funds without any pesky fees.

-

Hassle-free payments

Once your loan is completed, your loan automatically pays itself from the ATM Rebate Checking account each month. If you want to pay more or make additional payments, there are no fees or penalties to do so.

-

Intuitive app

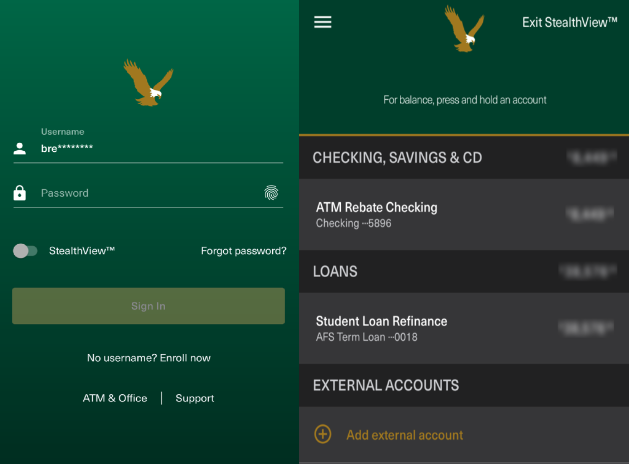

We’ve all heard stories about student loan servicers being extremely difficult to navigate. Nothing can be more frustrating than a clunky website, especially trying to pay bills. The First Republic app has a unique feature called StealthView.

StealthView allows you to view your balances in private by clicking on each balance to lift the blurry cover. This is helpful if you are in a public place like an airport lounge or grocery store.

-

Personalized service

This is my favorite part of banking with First Republic. With the majority of banks, you don’t have a specific point of contact for questions. You are one in millions of potential customers. With First Republic, I have multiple points of contact for any questions I have.

I have a Student Loan Refinance specialist, a specific banker, and my Relationship Manager Arpi who is an outstanding point of contact.

-

Excellent branch services

The need for in-person banking is diminishing as more consumers bank online. But if you prefer in-person banking, the First Republic branches are outstanding to visit.

Retail banking is an unenjoyable experience. It involves uninviting bullet-proof glass and waiting in lines that take forever. The First Republic Bank experience is met with fresh baked cookies every day (they are so good!), and a beautifully designed lobby where you can sit down with a banker to discuss your financial needs.

$300 bonus offer

If the First Republic Bank student loan refinance program interests you, you can qualify for an additional $300 bonus towards your student loans. Email my Relationship Manager Arpi Dagesyan, and tell her that BaldThoughts sent you.

You can reach Arpi at adagesyan@firstrepublic.com with the subject line “First Republic Bank student loan refinance.”

The Bald Thoughts

With interest rates so low, right now is the best time to refinance your student loan debt and get them paid off. Interest on student loan debt can be difficult to write off and the debt payments could keep you from being approved for a home loan or your next credit card. Once you have your student loans paid off, the money you save every month could be used for so many things. You could save up for a large purchase (e.g. home, college for your kids), accelerate the payoff of other debt, or fund some amazing vacations.

Do you still have student loan debt from college? What is your strategy to pay it off? Let us know in the comments below.

Why would anyone with federal loans refinance now – zero interest and no payments through september

You make a good point about keeping Federal loans for the short-term. However, when that no-interest period expires, then what? Your rate will most likely return to the higher rate.

The best option is to use the 0% and no payment option through September. Then, during September, start the refinance process to lock in these low rates through the end of your student loans.

Unfortunately, not all student loans qualify for the 0% rate and forbearance. This article provides some good guidance such as:

So which loans qualify?

— All direct loans — those taken out since 2010 — qualify. This includes direct Parent PLUS loans.

— Most Federal Family Education Loan Program or FFEL loans — those taken out before 2010 — do not qualify. There are some exceptions.

— Most Perkins loans — held by a college or university — do not qualify. There are some exceptions here too.

Those exceptions are for the 10 or so percent of FFEL loans — and the handful of Perkins loans — that the Department of Education bought back from other lenders during the recession. Those qualify.

And the link to the U.S. Department of Education page is here.

So does this mean if you already have a loan with them you cant refinance again with them or any other institution? this leave rest of us who got a higher rate few years ago cant really do anything.

If your loan qualifies, you should be able to refinance with First Republic. The terms indicate that you are not allowed to refinance it away from First Republic in the future. It is not clear what penalties may happen if you tried to refinance it to another bank.