The Citi Strata Elite Card is the new kid on the block when it comes to premium credit cards. Although it has a $595 annual fee, the cost is at the lower end of premium travel credit cards, after so many cards have recently increased their annual fees. Introduced in the summer, I find the Strata Elite to be a solid premium card: great value without annoyance.

I haven’t had a premium credit card in several years. But when the Strata Elite was released, I knew it was a good opportunity to get back in. With a 100,000-point sign-up bonus and a curated list of easy-to-track benefits, I think this card delivers well on its value proposition. In fact, since getting the card in late July, I’ve been able to extract over $2,300 in value from the card. And there’s even more to come when the calendar flips to 2026.

Here’s how I’ve been able to maximize the Citi Strata Elite Card’s value even after paying its hefty annual fee.

The Value I’ve Earned From The Citi Strata Elite Card

Premium credit cards have turned into pseudo-coupon booklets (I’m looking at you, Amex Platinum). For many, tracking the laundry list of spending benefits becomes a part-time job. And many of us either lose out on those perks or find ourselves making purchases we normally wouldn’t make in order to redeem them.

The Citi Strata Elite strips away those headaches. It gives cardholders a small handful of benefits that are easily usable.

Here’s how I’ve used them, and the value I earned back.

Earning Citi ThankYou Points

I’ve been able to earn a significant amount of Citi ThankYou Points by using this card as my everyday card. The card earns:

- 12x per dollar spent on hotels, car rentals, and attractions when booked through the Citi Travel portal

- 6x per dollar spent on airfare when booked through the Citi Travel portal

- 6x per dollar spent during Citi Nights: dining out on Friday and Saturday night from 6 pm to 6 am EST

- 3x per dollar on all other restaurant spending outside Citi Nights

- 1.5x per dollar on all other purchases

Combining points earned from spending and the 100,000 points from the welcome bonus, I’ve earned roughly 150,000 Citi ThankYou points in just a few months. Many people value Citi ThankYou Points at 1.9 cents per point. Even when intentionally undervaluing Citi ThankYou points at 1 cent per point, I’ve earned at least $1,500 in value.

With 150,000 points in my wallet, that’s enough points for me to redeem for an outstanding business class redemption on Turkish Airlines in April 2026. Taking advantage of the recent 50% transfer bonus from Citi to Turkish Airlines gave me enough points to book my flight and cover the taxes.

$300 Hotel Credit

The Citi Strata Elite Card comes with a $300 hotel credit when you stay two or more nights on rooms booked through CitiTravel.com. I used this credit to book a weekend stay in the Bahamas at the Hyatt Baha Mar.

Even though I saved $300 on the stay, I still earned 12x points per dollar on my bill. It’s an amazing property, and I can’t wait to book another visit.

$200 Splurge Credit

I found the splurge credit to be one of the most unique benefits of the Citi Strata Elite Card. After opening your account, you get a $200 Splurge credit each year to spend at one of four brands: American Airlines, Best Buy, Future Personal Training, and Live Nation.

Originally, I planned on booking a flight on American Airlines since I live close to Miami International Airport.

But then I remembered that Best Buy sells retail gift cards for numerous restaurants and other household names, including Amazon. Instead of booking a cash flight, I’ll use AAdvantage miles for my next trip. This allowed me to visit my local Best Buy to buy a $200 Amazon gift card. I sold it to my Mom for a small discount since she regularly shops there. Win-win for both of us. She gets a good deal, and I get cash that I can use anywhere for anything.

American Airlines AAdmirals Club Passes and Priority Pass Lounge Access

The card comes with four single-use American Airlines lounge passes. These cost $79 if you buy them at the lounge. For the sake of this article, I’m valuing them near retail, but I wouldn’t ever pay $79 to visit a lounge.

The Strata Elite Card also includes Priority Pass lounge access, which gives me free entry into more than 1,300 lounges globally.

I’m going to use two of the AAdmirals Club lounge passes on my next trip from Miami to Phoenix. For round numbers, I’ll value these lounge perks at $150.

Security Enrollment Credit

Many premium credit cards come with an application credit for either Global Entry® or TSA PreCheck®, and this one is no different. My Global Entry membership doesn’t expire until 2028, so I typically give my credits away to friends and family.

This time, I gave it away as a wedding present to a friend. Since I’m not personally using this benefit and I have other cards that also offer reimbursement, I’m assigning a $0 value to this perk.

Blacklane

I had never heard of Blacklane until applying for the Citi Strata Elite card. It’s a premium chauffeur service that’s basically a fancy Uber ride. The card gives you a $200 annual credit, which is divided into two credits – $100 in January-June, and $100 in July-December.

I played around with the app to get an idea of how much rides cost on the platform. I live roughly 9 miles from Fort Lauderdale International Airport, and a ride there on their lowest car service was $120. After accounting for the $100 credit, I paid $20 out of pocket for my ride. The $20 I paid is about the normal cost I spend on an Uber or Lyft, so it was a nice treat to have an upscale experience without costing anything extra.

This one is tricky to value because I wouldn’t normally use this service. But for this article, I’m giving it a $100 value since that’s what I’ve spent so far.

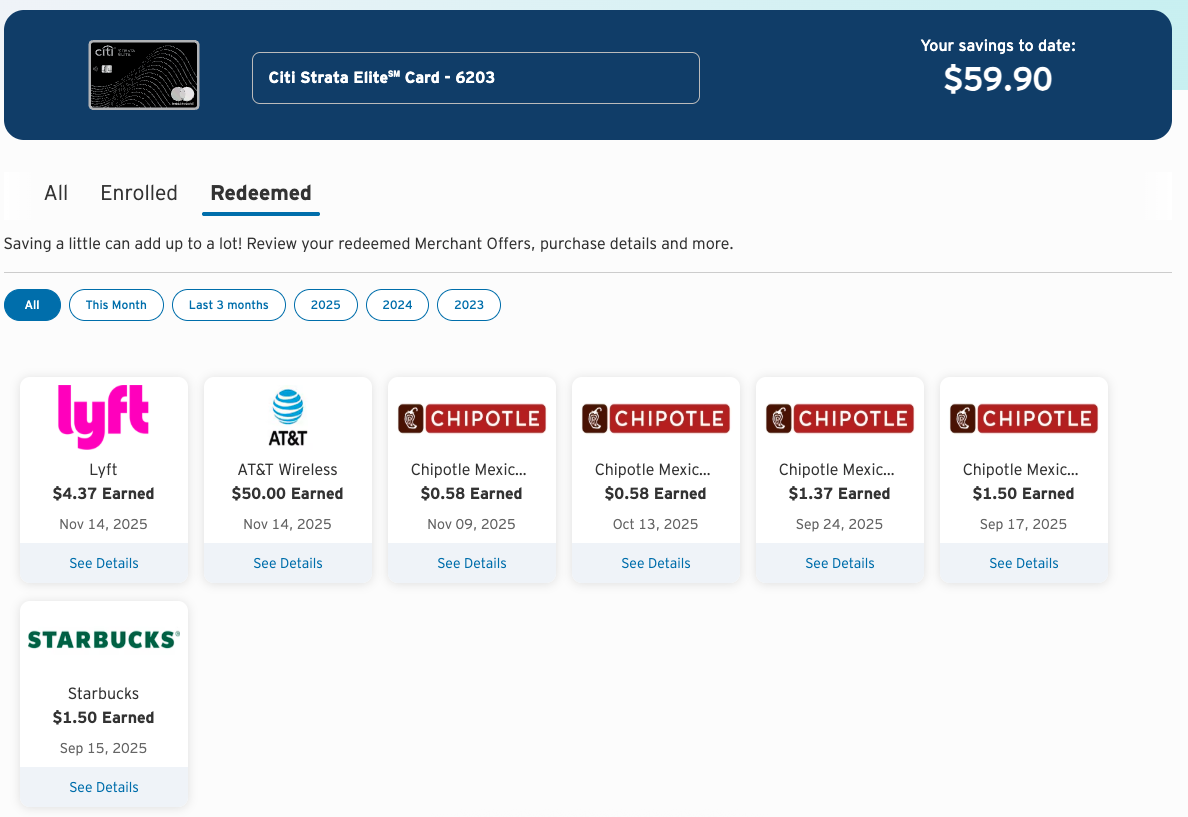

Citi Merchant Offers

Citi Merchant Offers are an easy way to earn rebates on purchases you ordinarily make. The big one recently was a $50 off a $65 purchase with ATT. I have ATT Fiber Internet at home and prepaid my account with $65. The purchase triggered the $50 credit and it appeared on my statement soon after.

My internet bill is about $50 per month, so this offer essentially gave me one free month of internet. I’ve earned $60 so far using various Citi Merchant Offers, so I’ll value it at that.

The Bald Thoughts About This Citi Strata Elite Review

I figure I’ve earned about $2,310 in value from the card in four months. After deducting the $595 annual fee, that puts me at $1,715 in net value. The value I’ll receive in the first year will be much higher since many of the most valuable credits reset in January. Since these perks are based on the calendar year, I’ll get another $300 hotel credit, $200 Splurge credit, and the other half of the Blacklane credit to provide even more value. With this additional $600 in value, that should cover my annual fee to justify keeping the card another year when the annual fee hits.

Have you applied for the Citi Strata Elite Card? If so, have you found it easy or hard to use the card’s annual credits and other benefits? Let us know in the comments.

I’ve never heard of blacklane until this card had the credits. My wife got the card and I loved the credit as I booked a ride for myself back from a trip that landed at LAX. In order to get a Lyft or Uber you have to take the stupid LAXit bus which usually tacks on another 30 minutes after you get curb side. On top of that rides are often $80 due to demand. So after credit my ride home was only $50 which included tip! The biggest plus is the driver shows up at baggage claim and will help push your luggage to the parking lot across from the terminal and drive you home. It saves so much time! I rode home in a nice EQS never been in one before so it was nice. I would totally do it again!

That’s awesome. I hate how airports make rideshare passengers feel like third-rate customers by sending us to far-off corners of the parking lot to catch a ride. Paying a little extra for superior service is worth it in my book.