If you’re like me, you’re always looking for new ways to earn extra airline miles and hotel points so you can travel more often. When I travel internationally, American Airlines is usually the airline that I turn to first. Because of that, I’m uber-focused on earning extra AAdvantage® miles wherever I can. That’s why I am so excited to learn about the Bask Savings Account that earns AAdvantage® miles instead of interest.

I’m partnering with Bask Bank to share the opportunity to earn more miles with travelers like you and me. Continue reading to learn how the Bask Savings Account works, how many miles you can earn, and how to set up your own account.

Click here to open your Bask Savings Account now. Or continue reading to learn about the bank, the opportunity to earn bonus miles, and how these miles are taxed.

What is Bask Bank?

Bask Bank is a new online bank that has an interesting opportunity for people who love to travel.

What products does Bask Bank offer?

The bank only offers the Bask Savings Account. It does not offer checking accounts or credit cards. You don’t need to switch from your current checking account or apply for a new credit card to earn these miles.

The Bask Savings Account is the only savings account that earns American Airlines AAdvantage® miles, instead of interest.

Who is Bask Bank?

Although Bask Bank may be a new name to you, the Bank’s parent company is over 30 years old. Bask Bank is a division of Texas Capital Bank, N.A., which has over $33 billion in assets. Texas Capital Bank was founded in 1988 and is publicly-traded (ticker symbol TCBI).

Are Bask Savings Account deposits insured?

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Member FDIC.

How do you earn American Airlines miles with Bask Bank?

Plain and simple, you’ll earn one American Airlines AAdvantage® mile for every dollar you save annually. There are no caps on the number of miles that you can earn.

When you open an account, there are a few limited-time-only opportunities to earn additional American Airlines AAdvantage miles with your Bask Savings Account.

New account bonus

Through February 29, 2020, when you deposit $1,000 or more in your Bask Savings Account, you’ll earn 5,000 bonus miles. Open your account before March 1, 2020, to qualify for this promotion.

At some point during the first 60 days, you must carry at least $1,000 in your account for 30 consecutive days to earn the bonus. Bonus miles are awarded within 10 business days upon meeting offer qualifications and may take 6 to 8 weeks to post to your AAdvantage® account.

Share your feedback

As I mentioned above, Bask Bank really wants your feedback to help perfect its program. When you complete the Bask Bank online feedback survey within 60 days of opening your account, you’ll receive 1,000 bonus miles.

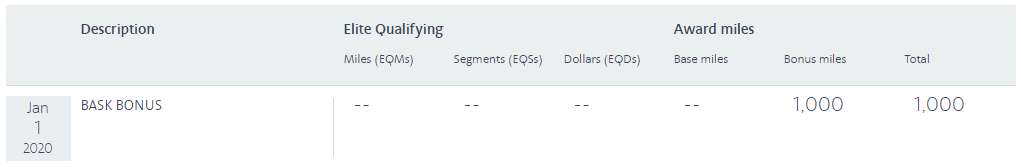

This offer is valid through June 20, 2020. Bonus miles are awarded within 10 business days upon meeting offer qualifications and may take 6 to 8 weeks to post to your AAdvantage® account. For example, I opened my account on December 19, 2019, and my 1,000 bonus miles posted to my AAdvantage account on January 1, 2020.

Balance bonus

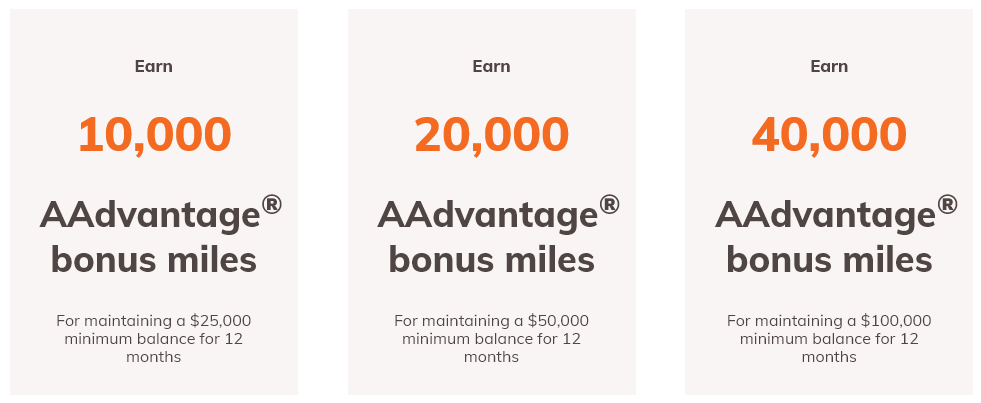

Bask Bank wants to reward savers with bonus miles. There are three opportunities to earn bonus miles when you are able to meet certain savings targets.

- 10,000 bonus miles for $25,000 balance

- 20,000 bonus miles for $50,000 balance

- 40,000 bonus miles for $100,000 balance

Take note that this is a minimum balance requirement, not an average. In other words, if your Bask Savings Account balance drops below these levels, even for one day, that month won’t count towards your goal.

You’ll receive the first half of the bonus after six consecutive months of maintaining these balances. Then, earn the second half of the bonus by maintaining these balances for 12 consecutive months. You have 14 months from the date you open your account to meet these hurdles.

Balance Bonus examples

I like that Bask Bank has divided the bonus into two pieces because “life happens.” It would be horrible if you saved for so long and lost the full bonus because of an emergency expense in month 11.

Note that the bonuses are not cumulative. It is a total bonus opportunity. For example, someone who maintains a $100,000 balance for 12 consecutive months will earn a total balance bonus of 40,000 miles, not 70,000.

These AAdvantage bonus miles may take 6 to 8 weeks to post to your account.

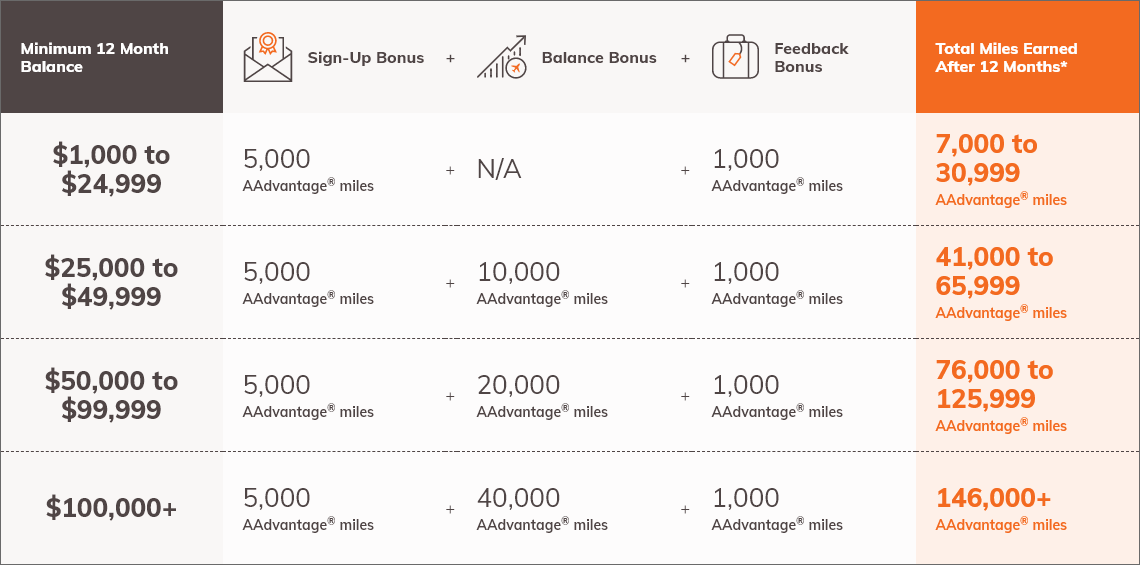

How many miles can you earn with the Bask Savings Account?

There is no limit to the number of miles you can earn with the Bask Savings Account. Your limit is how much money you have to save.

You can earn up to 46,000 bonus miles if you maximize all three limited-time-only bonus offers.

- Balance Bonus Offer. 40,000 bonus miles for maintaining a minimum account balance of $100,000 or more for 12 consecutive months during the first 14 months after account opening.

- Account Opening Bonus Offer. 5,000 bonus miles for maintaining a minimum account balance of $1,000 or more for 30 consecutive days during the first 60 days after opening your account.

- Feedback Bonus Offer. 1,000 bonus miles for completing the online feedback survey within 60 days of opening your account.

How does the Bask Savings Account compare against a traditional savings account?

According to the FDIC, the national average interest rate for a savings account is 0.09%. That translates to $9 per year in interest on a $10,000 average balance. Pitiful. Hopefully, you are doing better than that already.

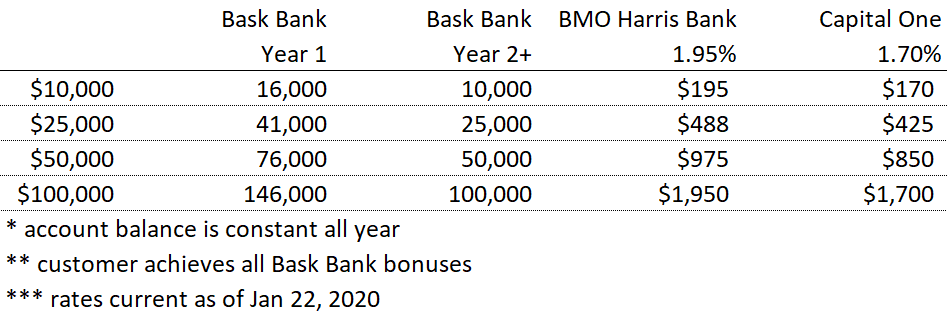

Most of us already have a savings account that provides an above-average interest rate. With that in mind, the rewards earned from the Bask Savings Account need to be compelling enough to make a switch. Here is a comparison of how much interest you’d earn with a couple of online savings accounts versus a Bask Savings Account.

In these scenarios, with $100,000 in savings, you would earn up to 146,000 American Airlines AAdvantage® miles from the Bask Savings Account. From a traditional savings account, you would earn up to $1,950.

Many people peg the average value of an American Airlines AAdvantage mile at 1.4 cents per mile. That means 100,000 miles is worth $1,400 on average. However, if you use your miles for the right flights, you can get significantly more value out of them.

Example redemption of American Airlines miles

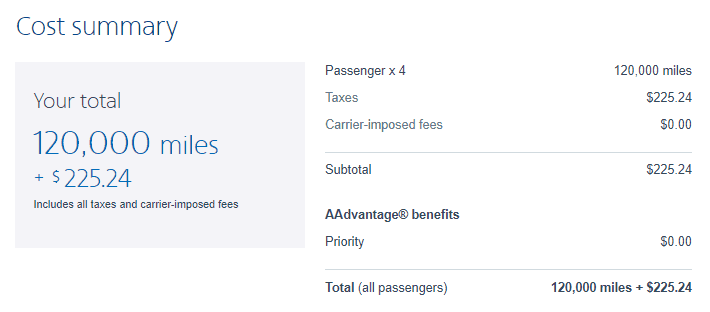

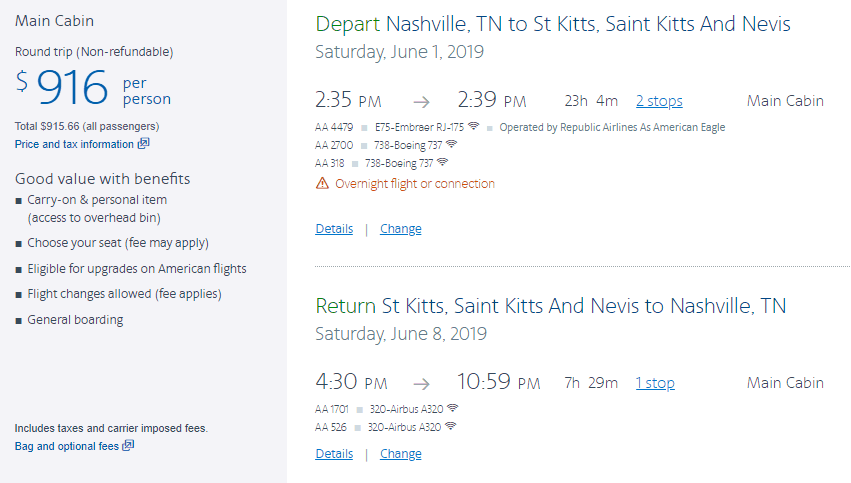

For example, I flew my family of four from Nashville to St Kitt’s in June 2019 for 30,000 miles per person.

The cash price of those flights was $916 per person, which means 120,000 American Airlines AAdvantage® miles saved us over $3,400 (after accounting for the $225 in taxes). This redemption had a value of almost 2.9 cents per mile, which is more than twice the average value of 1.4 cents!

Will I be taxed on the miles that I earn?

Yes, you are taxed on the number of miles that you earn. However, while some banks assign a value of 1 cent per mile (or higher), Bask Bank assigns a value of just 0.4 cents per mile.

For example, if you earned 50,000 American Airlines AAdvantage® miles from Bask Bank, you would receive a 1099-INT form for $200.

It is pretty standard to get taxed on the amount of interest that you earn on a bank account. With Bask Bank, your savings account doesn’t earn interest. Instead, it earns miles.

How do you open a Bask Savings Account?

Opening your Bask Savings Account is fairly quick. I did the whole thing in 10 minutes from my cell phone, so it’s also pretty easy.

The first step is to click this link to start your application. I opened my Bask Savings Account through the app on my phone.

Here is the step-by-step detailed process to open a Bask Savings Account.

Create an account

If you’re in the app, click “create an account here” to go to the Bask Bank website and start the account opening process.

Sign up now

Click “sign up now” to open your Bask Savings Account.

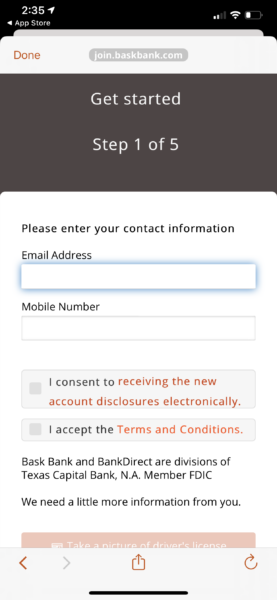

Enter contact information

Start by entering your email address and phone number. Read the disclosures and Terms and Conditions, then check the boxes.

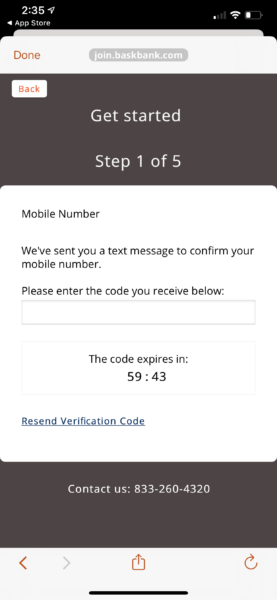

Confirm your mobile number

Bask Bank will send you a text message with a code to confirm your mobile number. Enter it here within 60 minutes of receiving it. Otherwise, you’ll need to have Bask Bank resend a new code.

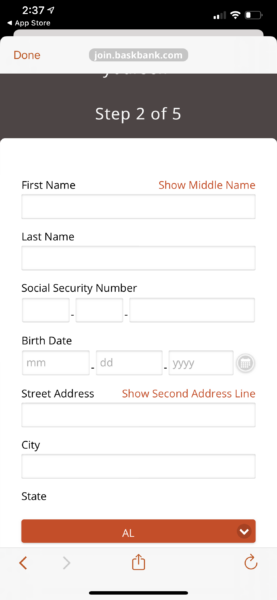

Enter your personal information

Type in your first and last name (exactly as it appears on your American Airlines AAdvantage® account), Social Security Number, date of birth, and address.

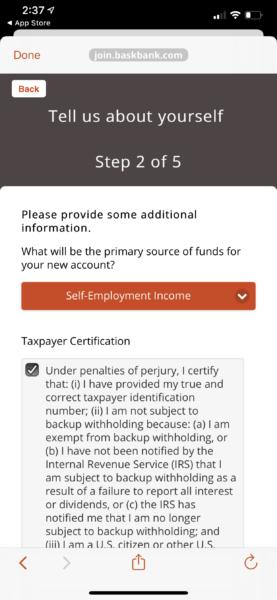

Primary source of funds for your new account

The bank wants to understand where the funds are coming from. Since I run my own business, I chose “self-employed.” Check the box to certify your taxpayer information.

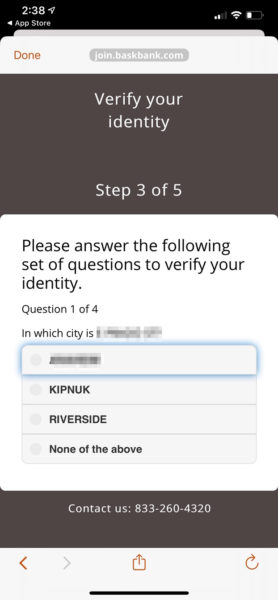

Public records verification question

Bask Bank will perform a search of public records and ask you a question to confirm your identity. For me, it asked which city a previous address of mine was located.

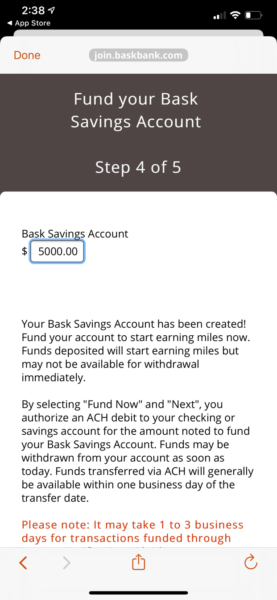

Fund your Bask Savings Account

Enter how much you want your initial deposit to be. It may take 1 to 3 business days for your Bask Savings Account deposits to fund via ACH.

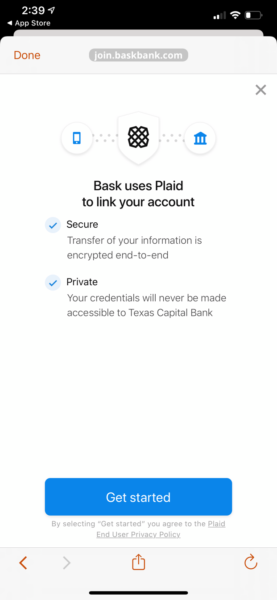

Link your funding account via Plaid

I chose to link my funding account via Plaid to speed up the funding process.

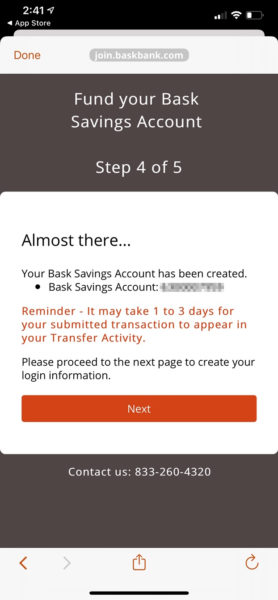

Your Bask Savings Account is now created

The savings account is now open and this is your account number. Take note of it for safekeeping.

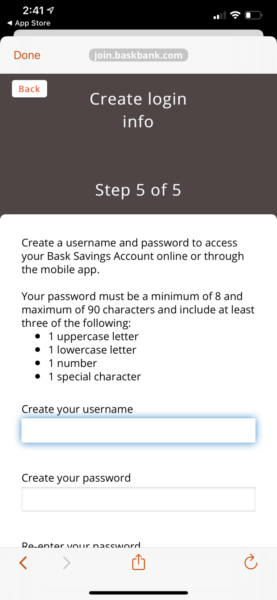

Create your login credentials

Now that your account has been opened, created a login username and password.

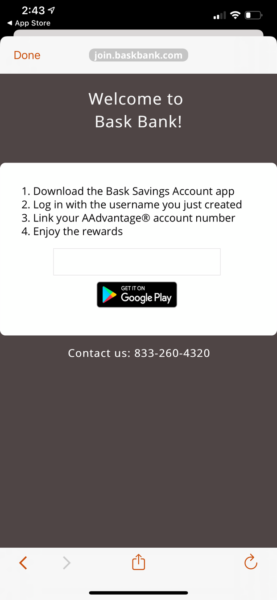

Download the Bask Bank app

You can download the Bask Bank app to keep track of your balances and activity. Versions are available for Apple and Google.

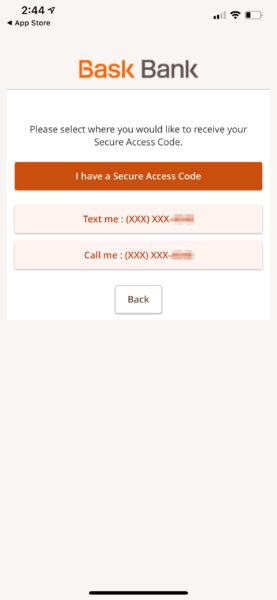

Secure access code

Bask Bank will send you a secure access code so you can view your account.

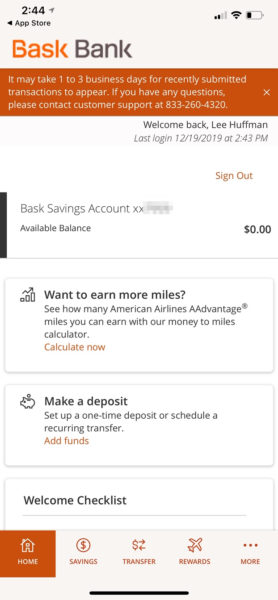

Your Bask Savings Account dashboard

Your Bask Bank account is now created and you can see the current balance. However, your American Airlines account is not yet linked. Follow the Welcome Checklist to link your loyalty account.

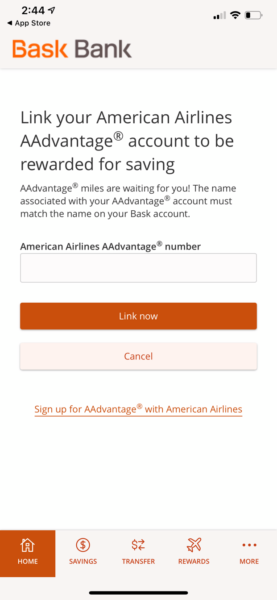

Link your American Airlines AAdvantage® account

Provide your American Airlines AAdvantage® number to link your account to your Bask Savings Account.

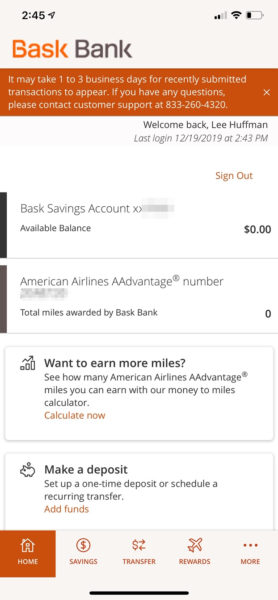

All done

Your account has been created. The first deposit is on its way. And your American Airlines AAdvantage® account has been linked. Don’t forget to complete the survey to earn your 1,000 bonus miles.

Other options to earn American Airlines AAdvantage® miles

In addition to the Bask Savings Account, these are some of my favorite ways to earn American Airlines AAdvantage® miles.

- Pay cash for flights with American Airlines and its partners

- Register your credit cards for AAdvantage® Dining and eat at participating restaurants

- Use the AAdvantage® Shopping Portal whenever shopping online

- Apply for an American Airlines co-branded credit card, like the Citi® / AAdvantage® Executive World Elite™ Mastercard®

- Rent cars using the American Airlines promo code

- Have Sprint as your cell phone provider

- Sign up for utilities with its partners

- Donate to a good cause, such as Stand Up To Cancer

- Book a hotel room with Rocketmiles (get a 1,000 bonus with first booking)

What are some of your favorite ways to earn American Airlines AAdvantage® miles? Share your tips in the comments below.

The Bald Thoughts

If you’ve been looking for a way to earn more American Airlines miles while getting a better return on your savings, you need a Bask Savings Account. I love that these miles are passive and don’t require any additional effort on your part. Simply, open your account, fund it, and start earning American Airlines miles. And, if you want more miles, add more money to your savings account. Pretty easy.

For a limited time, you can earn even more American Airlines miles with new account bonuses and completing a quick survey to provide your feedback. From my conversations with Bask Bank, they want to continue to improve the customer experience. Your input will help them make a better account for you.

Click here to learn more about the Bask Savings Account.

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Member FDIC.![]()

I don’t have a cell phone number. I use Google voice and Skype number for incoming calls. These numbers aren’t accepted to receive SMS codes from bask bank, even though they are fully capable of receiving SMS. Can you ask bask Bank to relax their cell phone checker to accept non cell phone numbers for sms verifications?

Thanks for sharing the feedback, Rowanda. I will pass it along to my contacts there.