Amazon Prime Day comes around once a year, offering amazing deals on countless products. While many of these deals offer incredible savings, some “deals” are just a discount on an inflated price. No matter what you’re buying during Prime Day, it’s a great opportunity to maximize rewards and save money. Here are my tips to help you find the best deals on Amazon Prime Day 2024.

Maximize Rewards, Save Money & Avoid Scams During Amazon Prime Day

Amazon Prime Day this year is held on Tuesday, July 16th and Wednesday, July 17th. To help you find the best deals during Amazon Prime Day, I’m breaking these tips into three sections – maximizing rewards, saving money and avoiding scams.

How to maximize rewards on Prime Day

For those of us who love to earn and redeem rewards, getting the biggest bang for your buck is key. This is how I maximize rewards when shopping online, whether it’s at Amazon or any other website.

Paying with a rewards credit card that offers bonus points.

Using a rewards credit card is a great way to maximize the cash back, miles and points you can earn on your everyday purchases. While many credit cards earn rewards, most will not offer extra points on Amazon purchases. Instead, you need to use the right card that offers bonus points at Amazon. Here are a few of the best credit cards for Amazon purchases.

- Best for Amazon purchases: Amazon Prime Visa. Using Amazon’s own credit card is a smart choice because it earns unlimited 5% rewards when you have an Amazon Prime membership (get Amazon Prime).

- Best for cash back rewards: Bank of America® Customized Cash Rewards credit card. Get 3% cash back in your chosen category (including online shopping) on the first $2,500 combined spending in your chosen category and at grocery stores and wholesale clubs. People with large deposit and investment accounts may qualify for up to 75% more cash back with Preferred Rewards. That would boost your rewards up to 5.25%!

- Best for intro APR offer: Wells Fargo Active Cash® Card. If you want to save money on Prime Day but need extra time to pay off your balance, the Active Cash Card offers 15 months of interest-free financing on purchases and balance transfers without an annual fee. Plus, you’ll get an unlimited 2% cash back on your purchases.

- Best for the highest cash back rate: U.S. Bank Shopper Cash Rewards® Visa Signature® Card. While the Amazon Prime Card offers 5% rewards, this card offers 6% cash back on the first $1,500 you spend each quarter at the two retailers you choose. Select Amazon as one of your choices and you’ll be raking in the dough during Prime Day.

Learn more about the best credit cards to see their latest offers.

Earn a welcome bonus on a new credit card.

Getting a new credit card is the quickest way to earn a lot of points in a hurry. Many rewards credit card offers a one-time bonus when you meet the card’s minimum spending requirement before the deadline. Amazon Prime Day spending is a great way to meet those minimum spends on top of the rewards you’ll earn on every purchase.

Learn more about the best welcome bonus offers on your favorite credit cards. Some credit cards offer instant access to your card number so you can start using them online and through mobile app payments right away.

Buy gift cards using your bonus categories.

If you don’t have a credit card that offers bonus rewards on Amazon purchases, maybe you can take advantage of other bonus categories. Many credit cards offer bonus cash back, miles and points at grocery stores, office supply stores, gas stations and others. These stores often have gift card racks featuring Amazon gift cards.

Buy Amazon gift cards at stores where you’ll earn bonus points, then use those gift cards to pay for your Amazon purchases. Pay attention to any monthly, quarterly or annual spending limits that may apply to bonus categories to avoid missing out on extra rewards.

Examples of credit cards that offer bonus points without charging an annual fee include:

- Best for grocery stores: Capital One SavorOne. A card for foodies that earns an unlimited 3% cash back on grocery store purchases.

- Best for office supplies: Ink Business Cash Credit Card. Get 5% cash back on the first $25,000 spent in combined purchases each year at office supply stores and on internet, cable and phone services.

- Best for gas stations: Citi Custom Cash Credit Card. Earn 5% cash back on the first $500 you spend each billing cycle on your top eligible spend category (including gas stations, grocery stores and drugstores).

- Best for drug stores: Chase Freedom Unlimited Credit Card. The Freedom Unlimited earns an unlimited 3% cash back on drugstore purchases.

Use a shopping portal to earn extra rewards

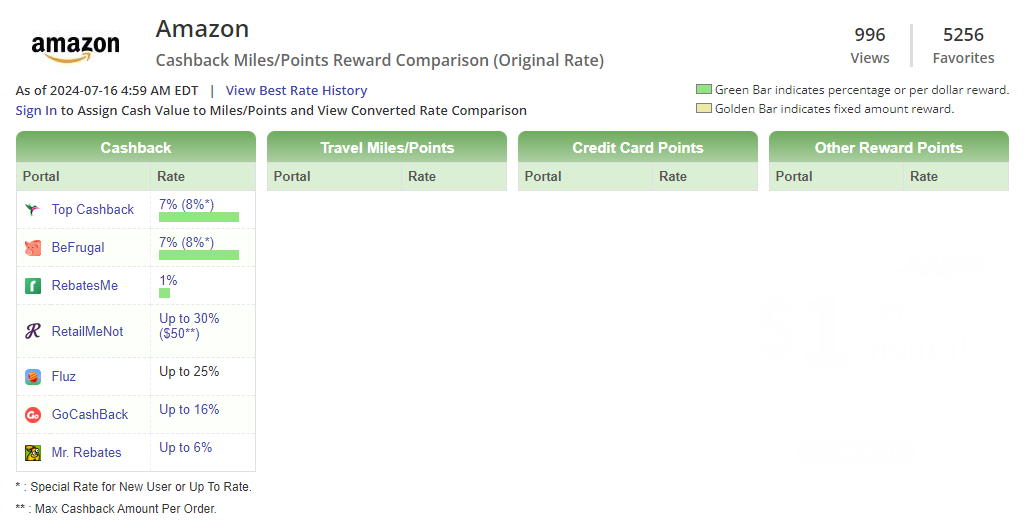

Before shopping on Amazon Prime Day, visit a shopping portal first for bonus cash back. Many sites offer cash back, while airline shopping portals earn miles and some bank portals earn flexible points. It can be challenging to know which shopping portal offers the best cash back, miles or points.

That’s why I always start my search at CashBackMonitor.com. It not only tells me which sites offer the best rewards, but you can also view the site’s history to know if rewards are higher or lower than normal.

Please use my referral links to TopCashback or Mr. Rebates if you sign up for one of their accounts.

How to save money on Amazon Prime Day

Earning rewards is great, but saving money can be even better. With the best deals on Amazon Prime Day, it is important to follow these tips to score the biggest savings.

Choose “No Rush” shipping on Prime Day.

Prime membership provides numerous benefits, but one that you may not know about is the ability to save money by picking the right shipping option. We all love to shop at Amazon because items can be delivered so quickly. But if you aren’t in a rush and don’t need the items for a few days, you can save 2% (actually earning rewards) when you select no-rush shipping and pay with your Amazon Prime card at checkout.

The savings automatically apply to products shipping by Amazon. And while your items may get there a little later than the standard two-day shipping you normally get, I’ve found that the difference may be as little as one day.

Get up to 50% off when redeeming Amex points.

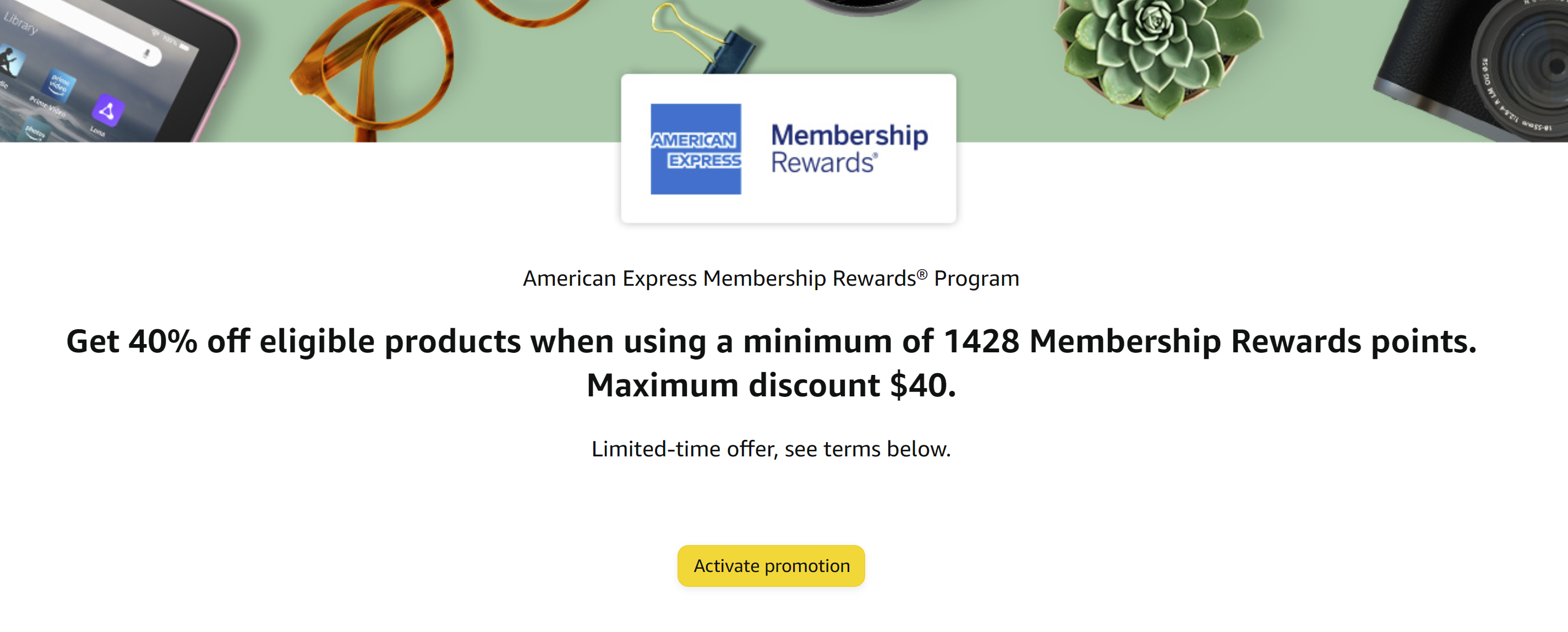

American Express, Chase and Citi often hold special promos that encourage Amazon shopping to redeem points to cover their purchases. While these redemptions are typically a bad value, you can beat the system by redeeming just a minimum number of points.

Through this Amex promotion, you can get up to 50% off your purchase. The discount offer varies by user, so your bonus may be higher or lower than mine. When I clicked the link, I was offered a 40% discount (up to $40 off) if I redeemed a minimum of 1,428 Membership Rewards points toward eligible products of at least $100.

Amex points are worth up to 2 cents each, so 1,428 points are equivalent to $28.56.

How to avoid Amazon Prime Day scams and bad choices

Unfortunately, companies and scammers try to take advantage of us on a regular basis. They assume that we’re so focused on “getting a deal” that we’re not paying attention and won’t notice their tricks. Follow these tips to avoid getting into financial trouble when shopping at Amazon (and other sites).

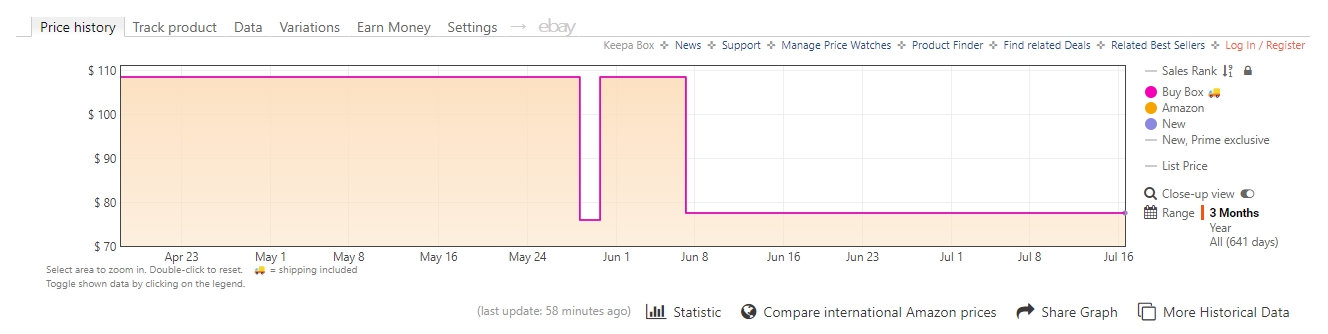

Use a browser plug-in to view price history.

When we visit Amazon on Prime Day, we’re looking for huge discounts. But what if the deal really isn’t a “deal” after all? Use a browser plug-in like Keepa or Honey to view an item’s history before you buy it.

Some sellers may temporarily inflate the price ahead of Prime Day so they can slash the price and lure in unsuspecting buyers. In reality, the price may be the same, at a small discount or even a higher price than before the sale.

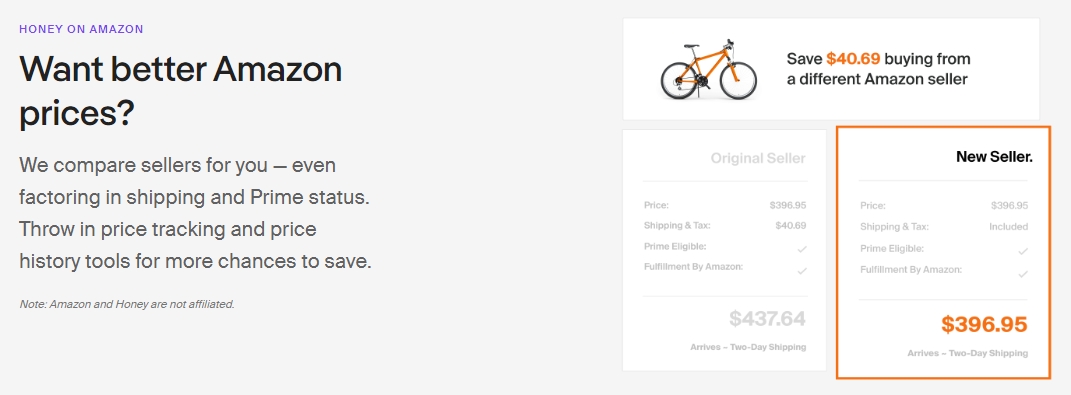

Honey automatically applies discount codes when shopping online. Plus, it compares sellers for you on Amazon to help you find the best deal by comparing shipping costs vs. Prime status for the best “all-in” price on the items you want to buy.

Avoid overspending on Amazon Prime Day

Getting a great deal is awesome, except when it takes you months (or even years) to pay off the purchase. Credit card interest rates are the highest they’ve been in more than 20 years, and banks are making record profits off credit card interest charges. Don’t fall for their trap by overspending just because something seems like a deal.

If you need extra time to pay off your purchases or you’re carrying credit card debt, check out the latest intro APR offers. You may qualify for up to 21 months of interest-free financing, which would give you almost two years to pay off your balance without facing interest charges on your debt.

Protect your personal data

If you’re shopping the Prime Day deals while away from home, be careful with your personal information. Accessing Amazon and other online retailers while using public WiFi is a risky situation that could expose your financial information.

Always use a VPN service when using public WiFi to keep hackers and scammers out of your personal info. I typically use Express VPN (referral link) when I travel, but there are several free VPN services that are almost as good.

The Bald Thoughts about Amazon Prime Day

In July 2024, Amazon Prime Day is a two-day event on July 16th and 17th. You’ll find some amazing deals over these 48 hours, but there are ways to maximize your rewards and save even more money. As always, you also need to be vigilant to avoid scams and other ways that criminals target your personal info. Plus, banks make a LOT of money when you get into debt, so stay within your budget when shopping to minimize interest charges that a bank may charge if you carry a balance.