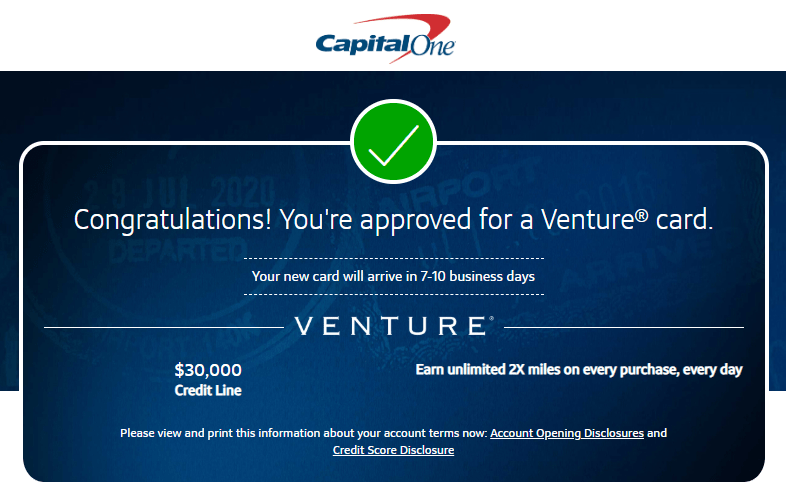

I was really excited when I was approved for the Capital One Venture Card recently. I love that it earns an unlimited two points for every dollar that you spend. And it is awesome that you can redeem the points without any blackout dates. Capital One really upped their game with the November announcement of 12 airline Capital One Venture Card transfer partners. Today, they added two more transfer partners and the airline transfer option is now live!

Who are the Capital One Venture Card transfer partners?

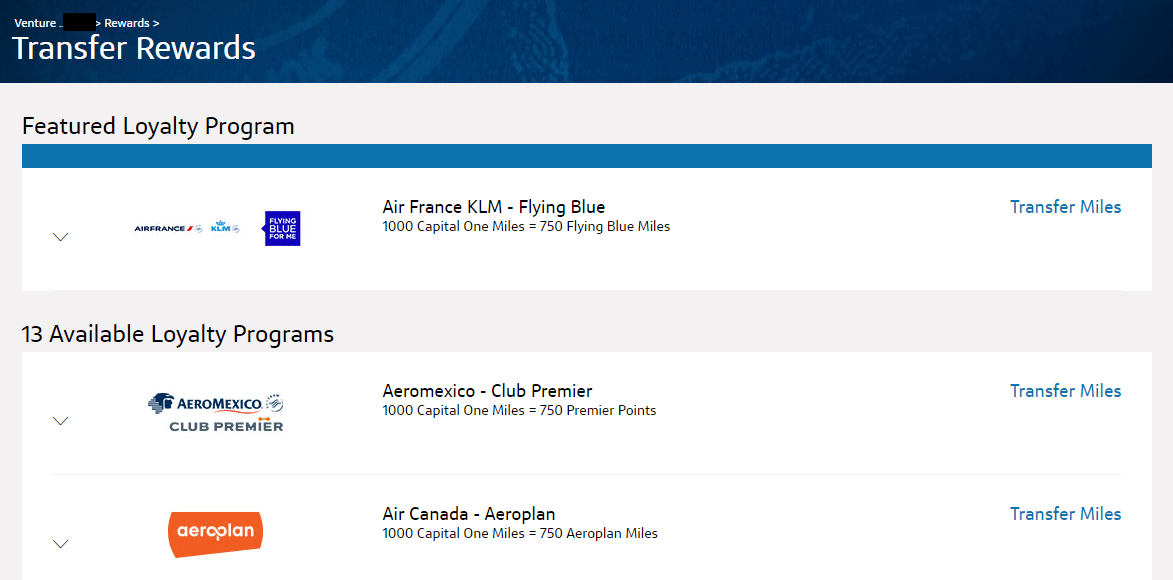

There are 14 airlines that are Capital One Venture Card transfer partners. Most of them receive 750 airline miles for every 1,000 Venture Miles that you transfer. The two newest additions, Emirates and Singapore, receive only 500 miles for every 1,000 Capital One Venture Miles.

| Transfer Partner | Venture Miles | Target Rewards Program |

|---|---|---|

| Aeromexico Club Premier | 1000 | 750 |

| Air Canada Aeroplan | 1000 | 750 |

| Alitalia MilleMiglia | 1000 | 750 |

| Avianca LifeMiles | 1000 | 750 |

| Cathay Pacific Asia Miles | 1000 | 750 |

| Emirates | 1000 | 500 |

| Etihad Guest | 1000 | 750 |

| EVA Infinity MileageLands | 1000 | 750 |

| Finnair Plus | 1000 | 750 |

| FlyingBlue (Air France & KLM) | 1000 | 750 |

| Hainan Airlines Fortune Wings Club | 1000 | 750 |

| Qantas Frequent Flyer | 1000 | 750 |

| Qatar Privilege Club | 1000 | 750 |

| Singapore Airlines | 1000 | 500 |

Here is what the transfer page looks like:

What is the minimum transfer amount?

To convert these points to miles with the Capital One Venture Card transfer partners, you will need to transfer a minimum of 1,000 points. After meeting that minimum, point transfers will need to be in 100-point increments.

For example, if you have 25,937 Capital One Venture Miles, the most that you can transfer would be 25,900.

How to earn Capital One Venture Miles?

There are several ways for you to earn Capital One Venture Miles.

Apply for the Capital One Venture Card

The Capital One Venture Card is one of the best values around. The standard sign-up bonus is 50,000 points and the $95 annual fee is waived the first year. Those 50,000 points are worth $500 in travel or up to 37,500 miles with one of the Capital One Venture Card transfer partners.

With the Purchase Eraser option, you can book travel today then have 90 days to earn the points to erase that purchase. That includes being able to earn the sign-up bonus!

After years of trying, I finally got approved for the Capital One Venture Card

Apply for other Capital One credit cards

It is awesome that Capital One didn’t limit the ability to transfer points to airline partners to just the Venture Card. This airline partner transfer benefit is also available with three other credit cards as well:

- Capital One VentureOne – the no annual fee version of the Venture Card. Earns 1.25 miles on every purchase.

- Capital One Spark Miles – this business card also earns 2 miles for every dollar that you spend. Right now, it is offering a HUGE 200,000-mile bonus!

- Capital One Spark Miles Select – this business card has no annual fee and earns 1.5 miles for every dollar you spend.

Click here to review the latest credit card offers for personal and business credit cards.

Spend on your Capital One Venture Card

Once you have one of these credit cards, put all of your spending on these cards to earn the maximum amount of miles that you can use to pay for travel or to transfer to one of the Capital One Venture Card transfer partners.

With the ability to earn up to two Venture Miles for every dollar that you spend, your next free vacation is just around the corner.

Book hotel reservations with Hotels.com

In the past, I was really focused on booking directly with the hotel brand that I am staying at. However, with the ability to earn 10x points with Hotels.com/venture, my approach is starting to change.

Not only can you earn a ton of Capital One Venture transfer partner miles this way, you will earn one free hotel night with every 10 from Hotels.com. That rivals the perks from most hotel loyalty programs.

The Bald Thoughts

The credit card world is changing dramatically. Many banks are tightening their approval process. Credit cards are increasing annual fees while simultaneously eliminating or reducing benefits. Diversifying your wallet to banks like Capital One is a smart move. I’m stoked that I was finally able to get approved for the Capital One Venture Card. And now that the Capital One Venture transfer partners offer such great value, I’m even happier.

Which Capital One Venture Card airline transfer partner is your favorite? Are you interested in applying now that there are 14 airline transfer partners? Let me know in the comments below.

Thinking of getting a new credit card?

To see the best credit card offers available, go to our credit card marketplace to find your next card.