Since the inception of Chase’s 5/24 Rule, the travel world has been turned upside down and credit card application strategies have had to change. Banks want customers to apply for a card and keep it forever. Acquisition costs for new customers are high… those miles and points bonuses are not cheap! They implement rules to minimize the opportunity for you to switch cards frequently.

- Does applying for too many credit cards hurt your score?

- 7 steps to take before your next credit application

- Track your spending or you may not get your bonus

In This Post

Chase 5/24 Rule basics

Most people have heard about the Chase 5/24 Rule, but in case you haven’t, here’s a basic primer…

- Chase has some of the most popular credit cards, like the Sapphire Preferred and Reserve, United, Hyatt, and Southwest cards.

- Because Chase’s cards are so popular, and they have so many, people will rotate between cards collecting the sign-up bonuses along the way.

- Chase is one of the biggest banks and most well run (aka profitable), so they want to minimize behaviors then result in a loss for them.

- To stop people from churning, Chase implemented a rule where you will not be approved for a new credit card if you’ve opened more than 5 new cards from any bank in the last 24 months

Other banks limit cards too

Chase is not the only bank to try to limit their losses by minimizing the amount of cards the travel hackers can get approved for.Pair Chase’s new restriction with Citi’s recent “one bonus per family of cards” and Amex’s limit of “one bonus per lifetime” and it leaves many of us with just a few good options remaining for the next credit card App Party. I’m taking a different approach, however, because I think that Chase’s policy is actually going to have the opposite

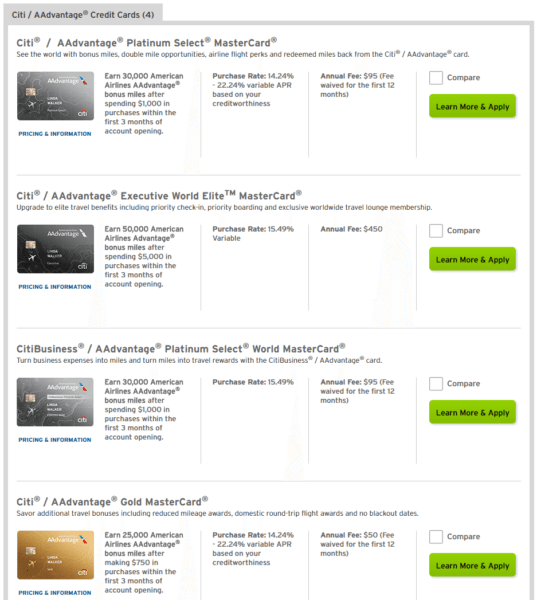

Citibank

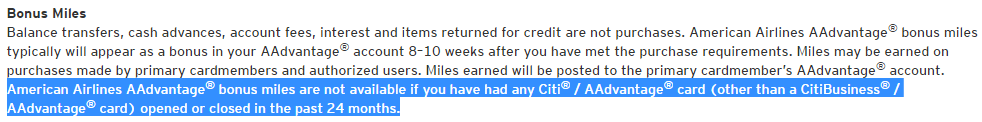

Citibank has valuable cards under the brands of Hilton, American Airlines, and their proprietary ThankYou Points program. In August 2016, Citibank revealed new rules where you can only get one bonus per “family” of cards, whether those cards are personal or business.

For instance, Citibank has several cards available under the American Airlines co-branding. There is the Platinum Select, Executive World Elite, Business Platinum, and the Gold Mastercard.

With the new rule, you cannot receive the bonus on any card in the American family (except the business version) until your account has been closed for 24 months.

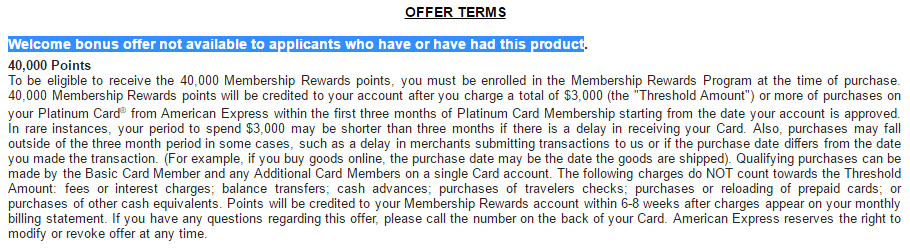

American Express once per lifetime bonus rule

At least with Chase and Citibank, the most you have to wait is 2 years until you can get a card again. With American Express, you can only receive a personal card’s bonus once in your lifetime. These rules come and go, and Amex got rid of a similar rule 10 years ago, so it should only be a matter of time before they lift this lifetime ban… but, the rule applies currently, so you have to be strategic with your applications to ensure you get the most points from your application.

This language not only applies to personal applications, it also applies to small business credit cards.

The good thing is that there is often other benefits with Amex cards, so although you may not get the bonus, you can still receive the card, unlike with Chase’s more restrictive 5/24 Rule.

What does this mean for the miles & points game?

When you pair Chase’s new restriction with Citi’s recent “one bonus per family of cards” and Amex’s limit of “one bonus per lifetime” and it leaves many of us with few good options remaining for the next credit card App Party…. hello US Bank, Barclay, and Bank of America!

I’m taking a different approach, however, because I think that Chase and Citibank’s new policies are actually increasing credit card churn.

Chase

With Chase, all new cards count towards their 5/24 Rule. However, when speaking with someone inside a branch, if you close a card that was opened in the last 24 months, it will not count towards the 5/24. If anyone has tried this yet, please reply in the comments below.

To get around the 5/24 Rule, I’m going to try closing a few cards and focusing on small business cards in my next few App Parties because most small business cards do not reflect on your personal credit report. The inquiry does, due to the personal guaranty you agree to, but the impact of the inquiry is short-lived and falls off after 2 years.

Citibank

Citibank is literally telling you to get the bonus, grab all the benefits as fast as you can, then close the account so you can start the clock on the 24 months you have to wait until you can apply again!

You’re going to have to decide whether the ongoing benefits of a card are worth keeping it in the long-run. With their American AAdvantage and Hilton cards, there’s no problem because the points transfer over to the respective brands each month.

However, with the ThankYou points, if you close your card with points remaining, you will lose them. You’ll need to cash out the points via gift cards, travel redemptions, or transferring to ThankYou Points partners before closing your account.

American Express

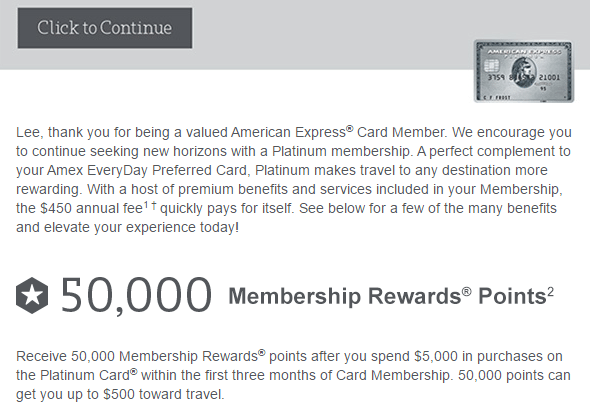

It’s hard to tell what’s going on with Amex. They lost a huge revenue earner in Costco, and they’ve lost other cards like JetBlue (now with Barclay – referral link), and it seems like they’re struggling to figure out their strategy in the hyper-competitive card world.

Amex may be conceding the lower-end of the personal card world and just focus on small business, corporate, and high-end consumers.

Their card offerings are becoming relatively limited, and I’ve already had most of their personal and small business cards. Luckily, the “once per lifetime” restriction does not apply if Amex contacts you directly with a pre-approved offer, which happened to me recently with their personal Platinum card that I applied for in August.

The Bald Thoughts

The miles and points game continues to evolve. Banks make rules, and we adapt as best we can so we can continue with amazing travel experiences. Anytime a rule is made, there are often unintended consequences that happen. I believe that’s the case with the Chase 5/24 Rule and Citibank’s “one bonus per family” rule. They want us to stop churning credit cards, but, in reality, these rules encourage people with lots of cards to squeeze as many benefits out of the cards as quickly as possible, then close them right away. I think that’s a lose-lose situation that banks will need to address.

[…] Is the Chase 5/24 Rule actually increasing card churn? I almost stopped clicking Chase posts until I saw this contrarian take. […]

The 5/24 rule absolutely applies to closed cards.

The 5/24 rule is not increasing my churning. I’m not eligible for another card until 5/24 until roughly 1 year from now. I’m holding out for the Sapphire Reserve because that is far and away the best offer on the market. I have regrets of picking up the British Airways and United cards at the last minute because of impending 5/24. The CSR would have been much more valuable.

TJ, how do you know that it applies to closed cards? When I went into a branch and spoke with one of the senior bankers while opening up a business account, he specifically said that closed accounts do not count towards 5/24. Obviously, a branch banker isn’t always 100% correct when it comes to bank credit approval policy, so he could have been steering me in the wrong direction.

I will reach out to a couple of other sources to see whether or not closed accounts (that were opened in the last 2 years) do count, then I’ll report back.

Have a good one.