Credit card companies offer bonuses for spending on their cards through promotions and when you first sign up. It is important to track your spending to ensure you receive your bonus. I would have missed out on 50,000 points if I hadn’t been keeping track. Here’s how I received my points.

Applying for the card

Last summer, I applied for the Chase British Airways Visa during my August App Party. The card offered 50,000 bonus Avios after spending $2,000 within the first 3 months. As an additional bonus, I could earn 25,000 Avios after spending $10,000 and another 25,000 Avios after spending a total of $20,000 within the first year.

You can also receive a Companion Pass on British Airways good for one flight after spending $30,000 within a calendar year, but you’ll pay big time for taxes and fuel surcharges that make this benefit not as valuable.

The current offer for the Chase British Airways card offers 50,000 bonus Avios after spending $3,000 within 3 months, but doesn’t include the spend bonuses for the extra 50,000. If you’d like to apply, please use our referral link.

Rewards Credit Cards

- Earn rewards with your everyday spend, and get a little closer to your next vacation.

- Use rewards to book hotels, air travel, gift cards, or to cover travel expenses like Uber.

- Loyalty pays off — earn double rewards when you use your card to book a trip with your favorite hotel or airline.

- Enjoy additional travel perks like travel insurance, waived foreign transaction fees, and airport lounge access.

- Terms vary by partner offer. Please see each bank’s application for terms and conditions.

Why are British Airways so valuable?

British Airways Avios points are a valuable addition to your miles and points strategy. The amount you pay for flights is based on the distance you fly, so they are awesome for domestic short-haul flights.

I have used these points for my mother-in-law to fly down from the Bay Area of California to Orange County for 4,500 points each way on American. Timmy, Uncle David, and I flew to Hawaii on American in March 2016 for 25,000 Avios round-trip each. And Uncle David and I flew to Dublin from Boston on Aer Lingus in October 2015 for 25,000 in Business Class one-way and 12,500 in Economy on the return.

Notice that none of these flights were actually on British Airways. All of these flights would have cost way more in miles and points had we redeemed directly with American or Aer Lingus.

How I keep track of my miles and points

I use AwardWallet to keep track of my miles and points. This website and phone app logs into your accounts and provides you weekly notifications of changes to your account – spending and earning.

The basic version is completely free. If you use our referral link, you will receive an upgraded account for the first six months. Then, you can pay as little as $5 every six months to maintain the upgraded status.

Bonus not received, now what?

I received the first 50,000 Avios after meeting the initial $2,000 minimum spend. And I spread out the other $20,000 in spend throughout the year and reached the total in August 2016. To ensure I met the minimum, I logged into my Chase account and added up all of my statement balances, excluding any annual fees.

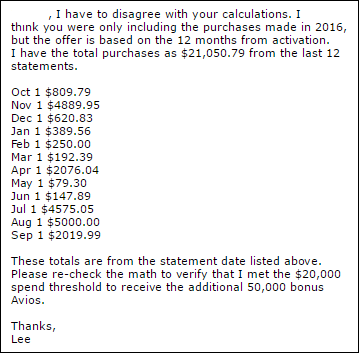

Here are the amounts I spent:

- Oct 1 $809.79

- Nov 1 $4889.95

- Dec 1 $620.83

- Jan 1 $389.56

- Feb 1 $250.00

- Mar 1 $192.39

- Apr 1 $2076.04

- May 1 $79.30

- Jun 1 $147.89

- Jul 1 $4575.05

- Aug 1 $5000.00

- Sep 1 $2019.99

This is a total of $21,050.79. Always spend a little more than necessary when hitting minimum spends in case you need to make a return or dispute, some transaction is disqualified, or any other reason. Plus, it is just good karma. Yes, we want to earn all the miles and points possible, but we also need to make our accounts a win for the bank, just as we make them a win for ourselves.

How to contact Chase’s customer service department

Contacting Chase’s customer service department is very easy. First, log into your Chase.com account. At the top of the screen, you will find a link that says Contact Us.

After clicking on Contact Us, click on Send us a message.

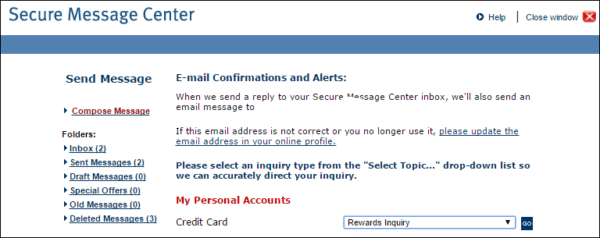

Then choose the issue that you’re contacting Chase about. In this case, my complaint is related to my personal credit card and it would fall under the category of “Rewards Inquiry“.

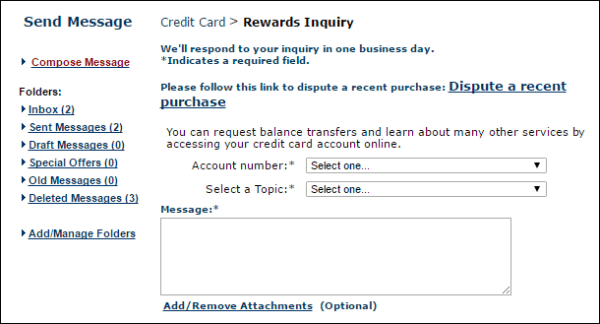

After clicking Go, a pop-up window shows up for you to write your message to Chase’s customer service. Select the specific account number that you are writing about and select a topic that helps to classify your message.

I’m writing about Chase for this issue, but most banks offer a similar online function to contact their customer service departments. I find this so much easier than waiting on the phone and having to push all the buttons through their phone tree to reach an actual human being. Plus, with this format, you can easily attach screen shots to help verify your offer and any additional information you need to support your claim.

Contacting Chase’s customer service department

The easiest way is through their customer portal. It is quick, you can type in whatever information you want to present, and you don’t have to wait on hold to speak with someone. I’ve found that Chase’s customer service responds quickly and resolves the problem with very little effort on your part.

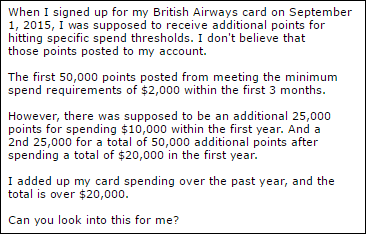

I contacted Chase’s customer service and asked them to look into the missing bonus for me.

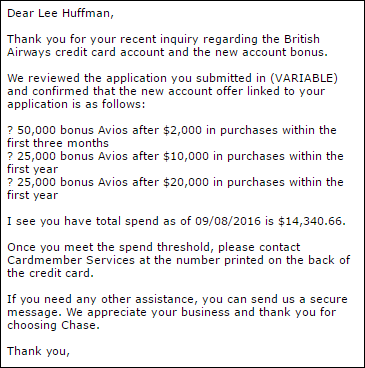

When they responded, they told me that I had only spent a little over $14,000. I knew that something was wrong with this answer.

Having a list of my spend allowed me to push back and ask them to check their numbers again. When I added up the numbers, it turns out that the agent had only added up the spend for the calendar year 2016 and not the 12 months since I applied for the card. So, I wrote back and explained why there was a difference in the numbers and stating that I had, indeed, met the requirements for the additional 50,000 Avios.

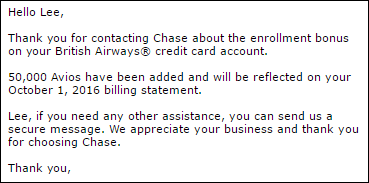

Chase’s response was quick and they realized the mistake in their initial calculation. My additional 50,000 Avios will post with the close of my next statement on October 1st.

The most important thing to remember is to keep calm and stay nice. The customer service person on the other side didn’t cause your problem. Their job is to help resolve your issue. Provide them with all the information that they need to help you, and they will do their best to keep you happy!

The Bottom Line

Nobody cares more about your miles and points than you do. Just like you keep track of your money, keep track of your miles and points to ensure that you receive everything that you rightfully deserve. If something happens, contact the bank, airline, or hotel as soon as possible to ask them to fix the problem. Have as much documentation as possible to justify your request and the customer service agents will do what they can to have you remain a loyal customer. Just remember to always be nice when speaking with them!

Firstly, you need to count your allowance on the availability

of your funds and to the amount of chance you are more comfortable with.