Today’s the day that Michael J Fox time traveled to in Back to the Future… and it’s quite a bit different than we imagined. Some innovations have come true, but most have not. The world changes in ways that you can never imagine. The big question is “Do you want to look back at yourself 30 years from now and wish you had done things differently today?”

Back to the Future

We’ve all see the movie where Marty McFly uses a time-traveling Delorean to go back and forth through time to change the lives of his family and community. The first movie was fun and a cult classic, while the sequels (as usual) didn’t live up to the original.

The basic premise is that Marty (Michael J Fox) used a time machine to change the future by helping his father win the heart of his mother.

Unfortunately, time machines don’t exist, so we can’t go back to save ourselves from the bad decisions we make.

Imagine yourself in 30 years

Movies are a fun escape from reality, but we also need to focus on ourselves and our future.

What will your future look like in 30 years? I recently turned 40 and reaching 70 years old seems so far away. Yet, small steps today will have a ripple effect with HUGE positive results for our future.

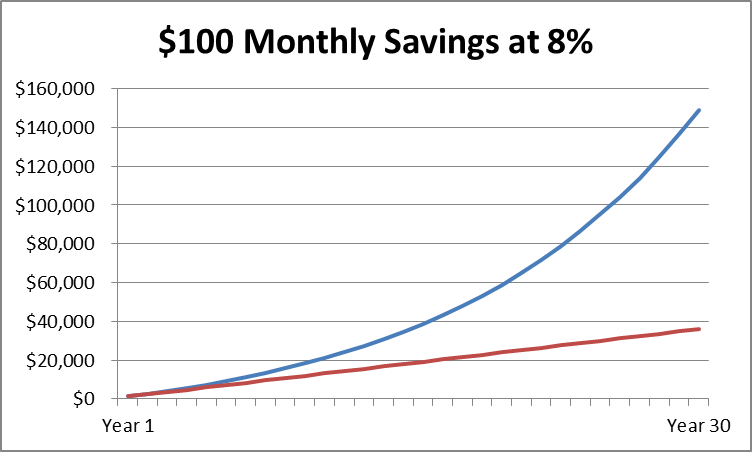

Saving just $100 a month at 8% interest for 30 years, will turn your $36,000 investment into roughly $150,000, a total return of 314%.

If you are able to save this $100 into a 401(k) with a 50% employer match, it would be almost $224,000, which is a 521% return on your $36k!

Saving for the Future

I know that my retirement goals will require far more than $224k, and I’m sure your goals do as well. However, saving an extra $100 a month equals a significant boost to your future.

Over the past year, I have been saving $100 a month into 4 investments to show my readers how various options will perform over time. The results will be posted soon, but here is the start of the $1000 investment challenge series from October 2014.

Sometimes, it is hard to “find” $100 a month… but many people are able to start saving after taking a close look at where you’re spending and what you’re earning. Carefully review the money you spend to determine if there are things you are buying that you do not need, or if you can scale back. For example, many people are cutting cable and subscribing, instead, to HULU and Netflix.

Also consider opportunities to earn more money. Do you have a skill that you can turn into cash by selling your services on sites like Fiverr.com or have you considered being a driver for Uber for extra cash in your spare time?

What steps are you taking today to create a better future for yourself? What can you do between now and the end of the year to make progress on your goals?