Acorns is a service I use to round up my credit card purchases and invest the difference. I find that it is an easy way to set aside money for my family’s future. Acorns recently released a feature that gives you “Found Money” for spending with their partners. The best part is that this is in addition to the miles & points you earn from your card and the cash back earned from shopping portals!

What is Acorns?

Acorns is a web and app-based micro-investment service that helps you save for your future by rounding up transactions from your linked bank debit and credit card accounts. For example, if you have a purchase for $4.75, then $0.25 will go towards your round-up balance. When your round-up balance reaches $5, Acorns will debit your checking account and invest in a mix of six ETF investments based on your risk tolerance.

We all use our credit cards on a regular basis to hit minimum spends for bonuses and to rack up miles and points on our everyday expenses. Acorns is a way to maximize that credit card usage by rounding up the transactions to invest on your behalf. There are no fees to buy or sell, and you can withdraw the money at any time without penalty.

I’ve been using Acorns for about 18 months and have invested about $500 through small investments of about $5 at a time.

Here are a few of the banks that they partner with to help you invest.

Get $5 from Acorns to open an account

When you open an Acorns account using my referral code, you’ll receive $5 to kickstart your savings, and I will get $5 for referring you.

How much does it cost to use Acorns?

Accounts under $5,000 pay only $1 per month. For accounts of $5,000 or more, you will pay 0.25% per year.

There is no charge to participate in the Found Money program. You just need to maintain an active Acorns account and ensure that your debit and credit cards are registered.

What am I investing in?

Acorns investment portfolios are composed of six Exchange Traded Funds (ETFs). Those funds invest in the asset classes of Large Cap stocks, Small Cap stocks, Real Estate, Bonds, and Government Bonds. The mix of those assets is dependent upon your risk tolerance.

I chose the Aggressive portfolio because I’m relatively young and am willing to take on the risk. However, you should consider your tolerance for risk when choosing where your money is invested.

Found Money with Acorns

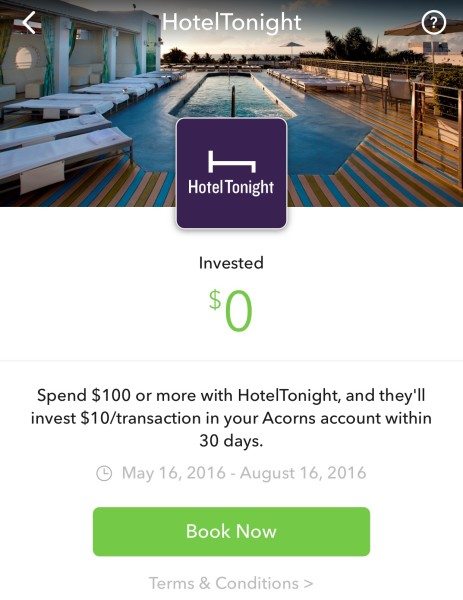

As a way to supercharge your investments and maximize your spending, Acorns is building a network of companies that they partner with to provide you with even more ways to save. And the best thing is that you don’t have to do anything to benefit from these relationships, other than to continue using the cards that you’ve already registered with Acorns.

The current partners are Dollar Shave Club, Jet, HotelTonight, and JackThreads. The Acorns / HotelTonight partnership that gives you $10 for spending $100 with HotelTonight will stack with the promotion I shared the other day where you can save up to $100 off your next hotel reservation. This promotion is good through August 16, 2016.

A couple months ago for Mother’s Day, Acorns Found Money had a limited time promotion with 1800Flowers.com where you would earn $15 when you spent $20. All you had to do was spend $20 between May 2 and May 8 using a debit or credit card linked to your Acorns account, then about 30 days later the $15 bonus would post to your Acorns account!

Promotions are changing all the time, so just watch for the latest emails from Acorns and take advantage whenever something is appealing.

The Bottom Line

I use my credit card for every purchase possible, and I’m sure you’re probably the same way. When you use an app like Acorns, the micro-saving transactions help you save for the future, even when you’re focused on today. Over time, you will blink and will have saved $100, $500, or even $1,000 or more through small transactions that you barely notice. And the Found Money promotions help accelerate those savings with special promotions with Acorns’ partners.

I’ve been using a different app that rounds up things as well for gift cards. I think this Acorns one makes a lot more sense. I’ve been using mine to refill my coffee funds. That is something that can easily be dropped as I can make coffee at home… Plus as a bonus my work even brews a Starbucks roast…

I would set mine to aggressive also. But it would be interesting to see the results of someone choosing a different risk tolerance.

Thanks John. I like the app because it allows you to invest automatically through these round-ups, but you can also invest manually whenever you have an extra few dollars in your account that you’d like to set aside for your future. Let me know what you think after you’ve used it for a little while.