As you know, I travel all the time and have a family so I want to make sure that they’re taken care of if something horrible were to happen to me. It is annual benefits enrollment time at my work, and one of the options is to sign up for group life insurance. In the past, I’ve signed up for benefits like this simply because it was easy and relatively affordable. This year, instead of just signing up for my employer’s group life insurance, I decided to investigate getting term life coverage online for myself.

After walking through this process myself, I reached out to Haven Life for them to sponsor this post because I enjoyed how easy the process was and wanted to share it with our readers. Haven Life’s sponsorship does not influence my opinion of the process and I am sharing my true feelings.

Related posts:

- How to travel safely – 7 tips to keep you safe!

- How to track your money like you track your miles

- How miles & points can advance your career

Why I have life insurance

I’ve been a big believer in life insurance for many years. The most important reason is that I’m married and have two young children.

I’m healthy and work out regularly, so I don’t think anything bad will happen to me physically. However, I do travel a lot. Air travel is pretty safe, but you never know.

And I’d rather be prepared for the worst, instead of leaving my family without the right financial resources to continue on without me.

What is term life insurance?

There are two basic types of life insurance – term and permanent.

Haven Life offers a free 10-page PDF guide on term life insurance that’s a good place to start your research.

Term Life Insurance

Term life insurance is similar to car and home insurance. You pay for it and hope you don’t need it. It covers you for a specified period of time, the “policy term”, and if you pass away during the term, it pays a benefit. At the end of the term, you can choose to continue coverage without taking a medical exam, but at a higher premium.

Term life insurance comes in many flavors with various features. One big difference is whether the premiums stay level (level premium term), or change from year to year (annual renewable term). Annual renewable term life insurance offers premiums that start out a little lower, but can (and usually do) increase every year. And then there are other term life insurance policies that have a certain number of years where the premiums will not change (i.e.: 5, 10, 20, and 30 years), then they can increase after that.

Permanent life insurance

Permanent life insurance policies cover you for your lifetime and accrue cash value that builds over time. Because a portion of your premium goes towards the cash value, the premiums are often much higher than for term life insurance.

Differences between group and individual term life insurance policies

Group life insurance policies, often offered through your work or membership organizations, are usually more expensive than you can get on your own if you are healthy. Because the insurance company offers a guaranteed level of insurance without a medical exam, they have to err on the side of caution and charge more due to the risk that unhealthy people will get insured.

When you purchase individual term life insurance, your insurance rates and coverage is determined by your health and history. So, when you take good care of yourself by eating right, exercising, and avoiding risky behaviors (like smoking or skydiving), you will get much better life insurance rates.

At my company, the group life insurance is annual renewable, so every year the cost of the life insurance would increase. Total bummer, right? I have enough monthly bills that keep increasing… like my cell phone, cable, and utilities.

I like bills that stay the same each year! And I’m mostly worried about covering my family for the next 20 years, which will get my kids through college. That’s why I am looking for a 20-year term insurance policy.

Who is Haven Life?

Haven Life is backed by MassMutual, a leading insurer with over 160 years of experience. MassMutual has an A++ rating from A.M. Best* for their financial strength and claims-paying ability. And MassMutual paid out $5 billion in combined insurance and annuity benefits in 2016 (Source: MassMutual 2016 Annual and Corporate Responsibility Report). That’s a lot of coin!

And, as of November 21, 2017, Haven Life has received a 9.3 out of 10 rating on TRUSTPILOT.

I’ve shied away from online life insurance quotes in the past because they always want your name and contact information before providing you any information. This way, a salesperson can follow up with you and try to make the sale.

Come on people, I just want information. I don’t need yet another salesperson calling and bugging me while I’m trying to work or enjoy time with my family.

This is just one of the reasons that Haven Life is different. I was able to get an estimated quote without providing ANY contact information. So, if the rates are good, you can proceed and apply. If you don’t like the rates, click away from the site.

Simple as that.

How Much Life Insurance Do I Need? from Haven Life on Vimeo.

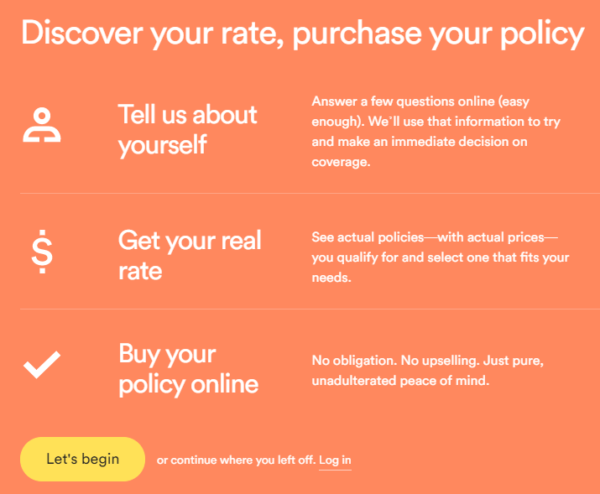

How to apply online with Haven Life

When I applied for term life insurance on Haven Life’s website, the entire process took about 15 minutes. And, best of all, it was done easily online without the need to talk to anyone!

First off, I went to HavenLife.com and answered a couple of really quick questions to receive an easy estimated rate.

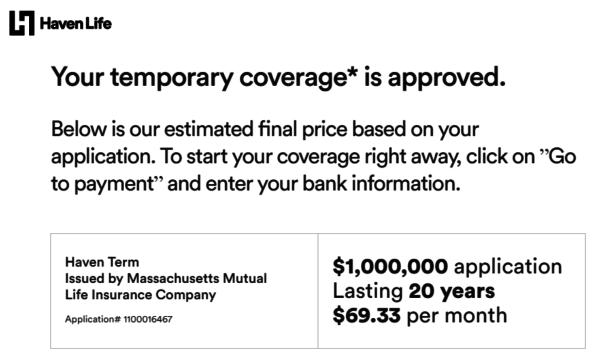

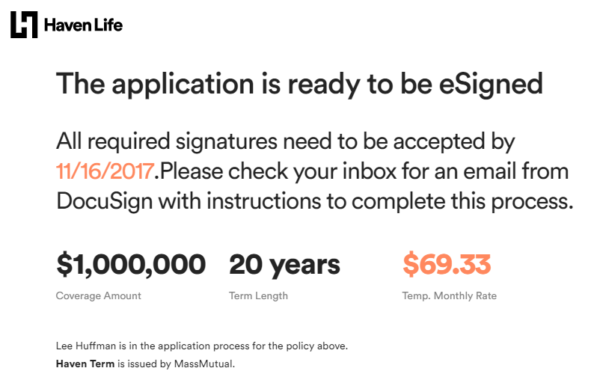

I answered that I’m a Male and gave my date of birth. I certified that I’m not a smoker and answered some basic health questions. Next, I selected the amount of term life insurance coverage I wanted (in my case, it was $1,000,000) and the time frame that I wanted (20 years works for my situation).

After answering these basic questions, which took just a couple of minutes, I received an estimated term life insurance rate from Haven Life for my 20-year $1,000,000 policy.

Of course, your numbers will vary from mine based on your age, sex, health history, amount of coverage, and the duration of your policy.

I absolutely love that I was able to get a quick estimated rate without providing my name, email address, phone number, or any of the other information required from most of the sites I’ve visited.

Since I was comfortable with the cost, so I proceeded with the application.

At this point, since this is an actual term life insurance application, I needed to provide my name and contact information and answer more personal questions about myself and my family’s health history.

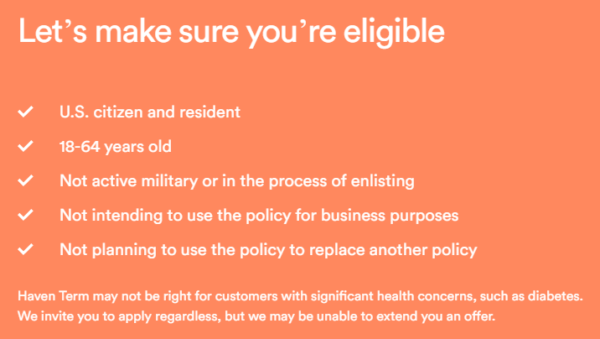

There are some basic restrictions on the term life insurance policy offered by Haven Life. For example, you must be between the ages of 18 and 64, not be in the military (or in process of signing up), and aren’t planning to use it for business purposes or to replace another policy with it. You’ll want to refer to their site for all features and limitations.

Take note… for travelers like us, Haven Life will ask which foreign countries you’ve visited in the last 2 years and the length of stay. I believe that they’re looking to find out if you’re traveling to “safe” destinations or going to more “exotic” (aka dangerous) locations.

The total time for my Haven Life term life insurance application process was about 15 minutes, which is super quick! Some people are approved automatically based on they answers they provided to health questions in the application process.

However, after answering all of the questions, my term life insurance application went pending and temporary coverage was approved pending a physical exam. Some applicants need to take a medical exam to finalize coverage. From my past experience in financial planning and life insurance sales, this probably has to do with some of the family health history answers I provided.

I checked with my friends at Haven Life and they assured me that the fact that I requested the maximum term life insurance coverage available ($1,000,000) did not affect my ability to get full approval instantly (aka Haven Life’s InstantTerm, a process that lets some qualified applicants (up to age 45) finalize coverage without the need for a medical exam, based on application answers).

Once my temporary coverage was approved, all I had to do was e-sign the application and authorize payment of the first month’s premium.

Now, I need to schedule the physical exam to finalize the process and have my coverage in place for the next 20 years… assuming I continue to make the payments. Remember, term life insurance coverage is just like your car and home insurance… if you stop paying, they stop covering you.

The Bald Thoughts

Getting more benefits for the money that I’m already spending is one of my top priorities. That’s one of the reasons I tell people to first focus on your 10 largest expenses to see how you can reduce them or get more bang for your buck. Once you’ve tackled those “big wins” then move on to other areas of your life for even more wins. Re-evaluating employer-sponsored benefits for health, dental, vision, and term life insurance is a perfect opportunity.

Even though I still need to complete a medical exam to get final approval, I’m happy that I chose Haven Life over my company’s life insurance. In my situation, I’m able to get about 25% more term life insurance coverage than I could through work for about the same price. Your situation will be different. And because I purchased a level term policy, my monthly premium stays the same for the next 20 years instead of increasing every year.

This post was sponsored by Haven Life Insurance Agency, LLC (Haven Life). All opinions are my own.

*Massachusetts Mutual Life Insurance Company (MassMutual) is rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of November 1, 2017 and is subject to change. MassMutual has also received different ratings from other rating agencies.

Haven Term is a Term Life Insurance Policy (ICC15DTC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111 and offered exclusively through Haven Life Insurance Agency, LLC.

I’ve had Term insurance for over 30 years in total. You can get policies anywhere, and as you described. Be careful with the medical portion; don’t lie or omit anything, because then they might not pay if it looks like you had pre-existing medical conditions which caused your death. Also, keep in mind if you are declined, that’s a question you have to answer later if you apply somewhere else (“have you ever been denied an insurance plan”). I’m not in the business, so just my opinions, here.

Thanks for sharing. All very valid points.