Since I became married, tax planning has almost been impossible. Between joining finances, having two kids, buying a home and two tax credit-eligible vehicles, our tax situation has changed every year. When you add in buying and selling rental properties and flips, tax planning gets even crazier. So, this year we owe money to the IRS. It sucks, but let’s earn some points to minimize the damage. We’re going to pay taxes with credit card, but which card is best?

Pay Taxes With Credit Card

Many people pay their taxes with a check, money order/cashier’s check, or wire transfer/EFT/ACH. Why would you do that when you can earn miles and points?

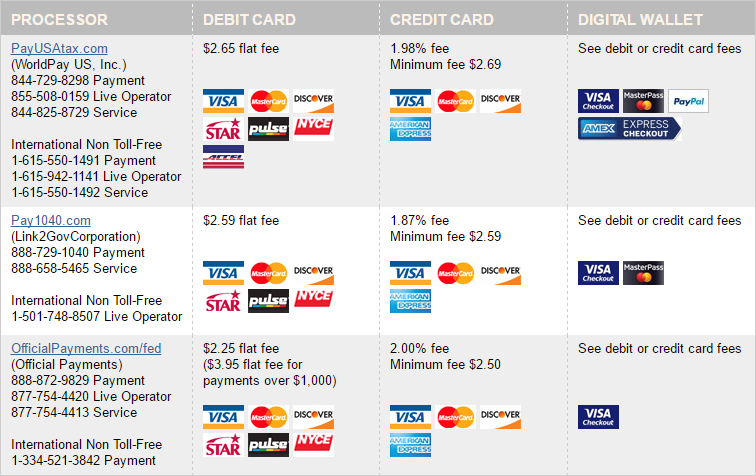

The IRS offers 3 options on their website if you want to pay taxes with credit card.

When you review the options, it makes sense to use Pay1040.com versus the others considering that their fees as a percentage are lower than all of the rest.

Which Card To Use When You Pay Taxes With Credit Card?

The good thing is that all 3 options accept the 4 major card types – Visa, MasterCard, Discover, and American Express.

Now you just have to figure out which card is most advantageous to your miles and points (or cash back?) strategy when you pay taxes with credit card.

Pay Taxes With Credit Card to Hit Minimum Spend

If you are trying to meet a minimum spend to collect a bonus, that should be your first choice to pay taxes with credit card. Hitting minimum spends is one of the biggest challenges with getting a new credit card. If you have a large enough tax bill, you might be able to hit the minimum spend on multiple cards!

Pay Taxes With Credit Card to Meet Category Bonuses

Some credit cards offer additional Elite Qualifying Miles (or whatever their specific term is) or other Loyalty Program upgrades when you meet certain spend amounts. For instance, the American Express Hilton Surpass and Citibank Hilton Reserve cards both provide Hilton Honors Diamond status after $40,000 in spend.

Pay Taxes With Credit Card for Profitable Redemption

Everyone values miles and points a little differently, so focus on the programs that will offer you the ability to redeem the earnings for flights, hotels, etc. that will be worth more than the fees. If you’re about to book a business class ticket and need just a few more miles, determine if you can buy them cheaper than the 1.87% you get hit with when you pay taxes with credit card. Then go with the cheaper option.

The option I like best is using my Barclay Arrival card. I get 2% in credits when I spend, plus a 5% bonus on points redeemed, for an all-in rebate of a little more than 2.1%. Best of all, I have 90 days from the time I spend on the card to earn enough points to offset the charge! I’m just now paying off my hotel stays from when Timmy and I flew to Mammoth to teach him how to snowboard in January.

An a fallback, the Citibank Double Cash card is also a good option. It provides 1% cash back on purchases, plus another 1% cash back when you make payments, for a total of 2% cash back on all spend. Some people prefer the flexibility of cash vs. points. In some cases, I don’t blame you.

How Often Can I Pay Taxes With Credit Card?

Be aware that there is a limit to the number of times you can pay taxes with credit card. Most of the limits are 2 per year, but some tax types allow 2 per quarter (or even 2 per month in select cases).

Can I Deduct The Fees When I Pay Taxes With Credit Card?

According to the IRS, “the convenience fee paid to your provider will be listed as “Tax Payment Convenience Fee” or something similar.”

For individuals, “the fee is deductible for personal tax types as a miscellaneous itemized deduction. However, only those miscellaneous expenses that exceed 2 percent of the adjusted gross income can be deducted.”

For businesses, “the fee is a deductible business expense.”

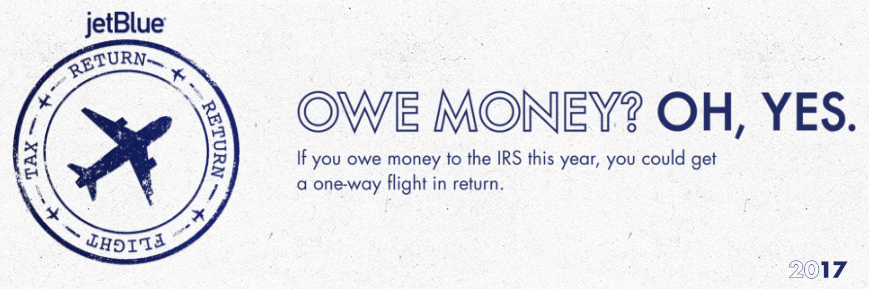

JetBlue Contest If You Owe Taxes

If you owe taxes this year, JetBlue is holding a contest that my friend Angelina shared with me. She wrote that JetBlue is giving away 1,000 free flights to people that owe taxes. I love the idea, but I love the idea of a refund so much better!

Unfortunately, this year I’m one of the people that owes taxes. I’ll be entering this contest. Here’s the link to the contest if you want to enter.

The Bald Thoughts

If you have a large bill coming up, that’s the time to get a new credit card so you can easily hit the minimum spend. In some cases, you can even hit the minimum spend on multiple cards to supersize the rewards you will earn. When you pay taxes with credit card, you can earn a lot of miles and points if you use the right cards.

Have you ever paid your taxes with a credit card? Which card did you use and why? Would you do it again?

I just paid my taxes using the Pay1040.com. I found it pretty easy to use and the fee was reasonable. Fortunately, the points earned make up for having to pay the processing fee.

It also helps that the fee is tax deductible for many people.

I may do this if I owe next year. While I do owe for this year, I just paid off my credit card debt last month. I don’t want to have a balance on a card anytime soon.

Jason, strategies like this work best if you can pay off the balances without owing interest, so you’re smart to wait.