We bought our home in 2010, and like any good homeowner, we immediately went to work on fixing it up to our liking. And like most homeowners, most of our cash went into the down payment and closing costs of our home purchase. So, how did we manage to fix up our home? 0% offers from Home Depot and Lowe’s!

What we bought

Off the top of my head, I’m not sure exactly what we bought at Lowe’s vs. Home Depot, but we’ve done a TON of upgrades to improve the value of our home and increase the livability and enjoyment of our home.

A small portion of the upgrades/repairs:

- replaced toilets – water conservation and flushing power

- paver stones in place of concrete and creating outdoor dining and firepit areas

- cabinet storage and workbench areas in garage

- hardware to upgrade/repair electrical outlets throughout house

- some necessary (aka awesome!) power tools and other project-related tools

And I even used a 0% offer to re-carpet one of my rentals after my parents moved out.

My tricks for 0% on all purchases

Shady method

There were many times where I would only need to buy $100 or $200 worth of materials, but you need to purchase at least $299 worth to get 12-months 0% financing. So, I would find an expensive power tool to add to my purchase, then return it a week or so later.

Voila! 0% on a small purchase.

Multiple project method

Since I knew that there were many projects coming down the pike, I would bunch purchases together and keep upcoming project materials in the garage. This way, whenever I had time to work on a project, the materials were already there and I wouldn’t have to spend time going to pick up materials before I started.

Earning points on Lowe’s and Home Depot

I love to travel, which I why I started BaldThoughts.com to share my travel tips and experiences. So, I often buy Lowe’s and Home Depot gift cards from Staples and Office Depot using my Chase Ink credit card to earn 5x miles on the purchase in the form of Chase Ultimate Rewards!

There are two versions of the Chase Ink — Bold, which is a charge card, and Plus, which is a normal credit card. Both are business cards that provide 5x points on office and telecom purchases.

These points can be used to purchase travel directly, or you can transfer the points to many partners like:

- Hyatt

- Southwest Airlines

- United Airlines

- Amtrak

- British Airways

- Marriott

- Ritz Carlton

- Korean Air

- Virgin Atlantic

- IHG Rewards Club

In January, I flew First Class to Germany and back from Paris using points I transferred from Chase Ultimate Rewards to United Airlines.

0% offers are now Paid Off!

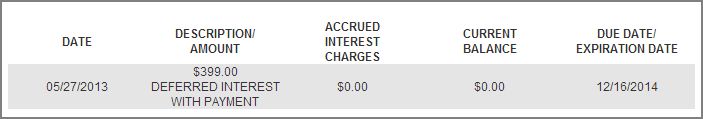

I made my last payment to Lowe’s for my 0% offers earlier this month, so the promotions are all showing $0 due.

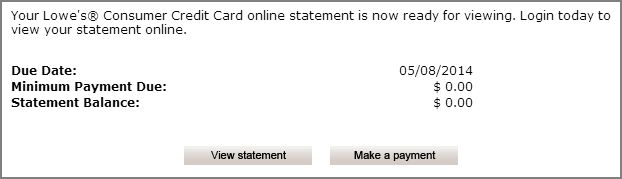

And I received this email from Lowe’s showing my new statement balance of $0.

Our lives have been more comfortable and our home is more valuable with all of our purchases, but we’re definitely happy to know that one phase of paying off our home improvements is now done.

Next up is finishing paying off Home Depot!

How I pay off 0% offers

I tend to pay the minimum on 0% offers to conserve monthly cash. But, I take things a step further. I take a look at what is owed and the dates the 0% offers come due, then calculate that into equal payments.

For example, if I buy $1,800 worth of materials/tools/etc. from Lowe’s and I get 12 months of 0% financing, I calculate that it will take $150 per month to pay off the balance before the promotional financing will expire.

The minimum payment may be around $40, so I “pay” the remaining $110 to my CapitalOne360 online savings account designated for 0% offers each month so that I will have the money available to pay before the promotional offer expires. This allows me to satisfy the credit card’s minimum payment while earning interest on the money I put into savings.

Right now, the savings account interest rate is less than 1%, but money is money. If someone offered to hand you $10, you wouldn’t turn them down, would you?

Conclusion

I am always wary of taking on debt and make sure that I have the ability to pay it off… especially if it is a 0% offer and failure to pay in full results in backdating of interest! I also consider where the purchase will improve my lifestyle, increase the value of something I already own, or will increase in value itself.

Never take on debt lightly. The debt payments you make tomorrow for purchases today results in a trade-off… you may not be able to purchase something in the future because you are still paying off purchases from the past.

Do what’s best for your situation. And remember, the end game is to “keep it in your pocket!”