We all tend to approach miles and points differently. One thing is clear, the quickest way to earn a lot of rewards is through efficient use of your credit cards. But, have you ever considered how many miles and points are you missing? Here is my Birch Finance review and the findings of how many miles and points I’ve been missing out on.

Birch Finance sponsored this post, but all opinions are mine. I’m personally using Birch Finance to help optimize my credit card spend so I can go on even more vacations for free using miles and points.

How many miles and points are you missing?

I absolutely know that I’m missing out on all of the miles and points I could be earning. However, I use my credit cards and avoid using cash or checks/ACH/EFTs whenever possible so I earn some miles and points for just about every dollar I spend.

But, because I don’t always have the “right” card with me or I’m working towards a specific award redemption, I don’t always get as many miles and points as I could.

Birch Finance review of my spending

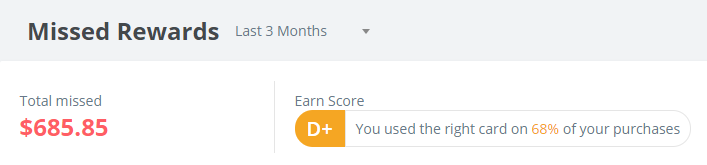

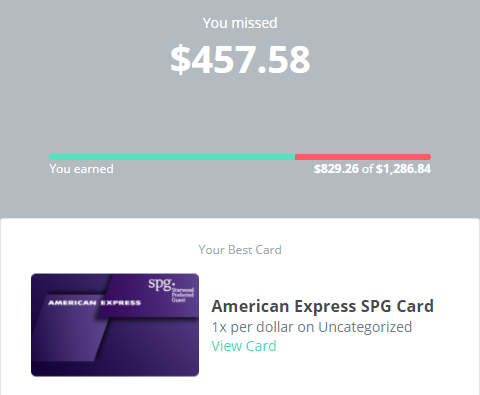

According to the Birch Finance review, my card selection when spending would be considered a “D+” because I’ve missed out on $685.85 worth of rewards the last 3 months. Ouch!

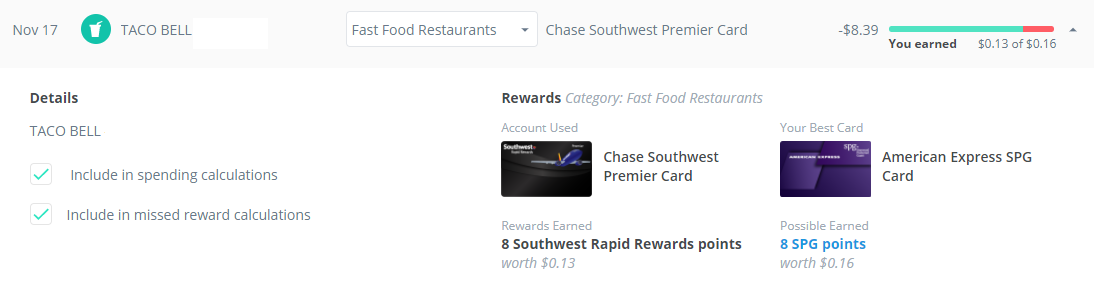

The Birch Finance review took a look at all of the cards in my wallet and determined that the best card for uncategorized spend is the American Express SPG card. It’s a great card, and one that we feel is pretty great… and a better card to earn Marriott points than using the actual Marriott card thanks to 3:1 transfer of points from SPG!

However, because I have the Southwest Companion Pass, I value Southwest points higher than SPG points. It’s a personal opinion and the system doesn’t take into account the double value of Southwest Rapid Rewards points when you hold the Companion Pass.

My recommendation is that Birch Finance should allow you to modify the values based on your own valuations of the miles and points and indicate which rewards are most valuable to you.

How do I know which card to use?

This is where the Birch Finance review of your spending comes into the equation. They have a dashboard that will help you figure out how many points you’re missing out on because you used a different card.

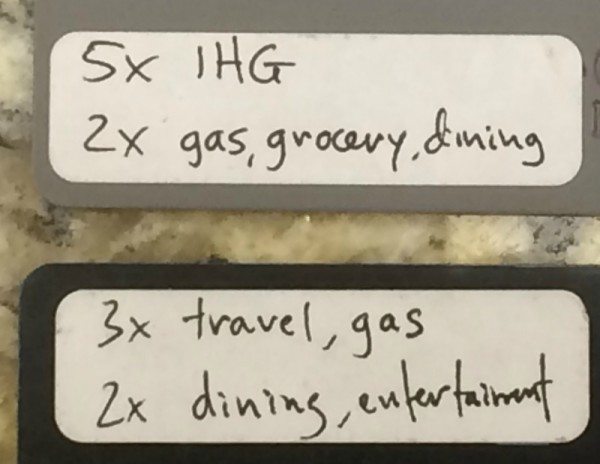

My usual method of knowing which card to use it to place a little sticker on the back of each card. This is one of the steps I recommend when getting a new credit card.

But, most of the time, I’m not as focused on maximizing the points I earn from each transaction as I should be. That’s because I am usually trying to hit the minimum spend on a new card, working to hit spend bonuses (like free nights from US Bank Club Carlson, Hilton Diamond status, or the Southwest Companion Pass), or earning travel rewards for a specific trip I want to book.

I need to do better though. I just know that there are tons of miles and points that I’m missing out on because I’m not using the best card for that category of spend (ie: gas, travel, dining).

This is where the Birch Finance review comes in.

It’s so easy to sign up for Birch Finance

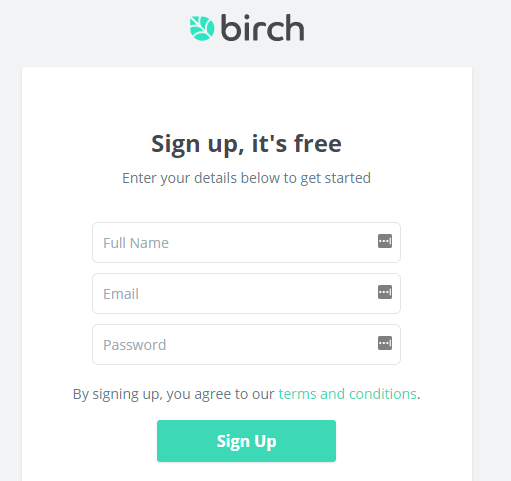

Signing up for Birch Finance is really simple and easy to do. When signing up, I’d really appreciate if you used my referral link so they know I sent you.

Sign up for Birch Finance

Simply enter your name, email address, and preferred password to sign up.

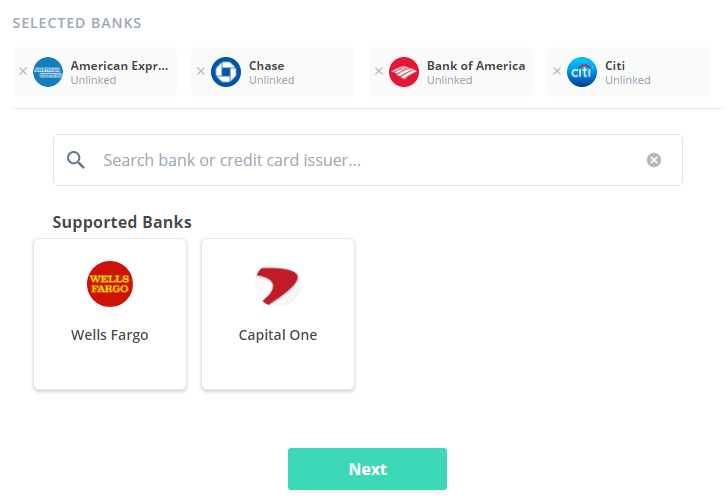

Link your bank accounts

Then start linking your bank accounts. Birch Finance uses SSL and the same 256-bit AES encryption that is standard for banks.

I found that Birch Finance offers all of the major banks that we get our miles and points earning credit cards from. If you have a bank that isn’t on the list, send Birch Finance a message and let them know so they can work to include it.

When you connect your bank accounts, some banks take longer than others. I had a problem linking a couple of bank accounts, but I’m not sure if it was the bank, Birch Finance, or the fact that I haven’t restarted my laptop in a week and have about 30 browser tabs open.

Once you’ve linked an account, it can take up to 24 hours for all of your transactions to be imported and analyzed. Your patience will be rewarded with all of the data and insights that will be available to you.

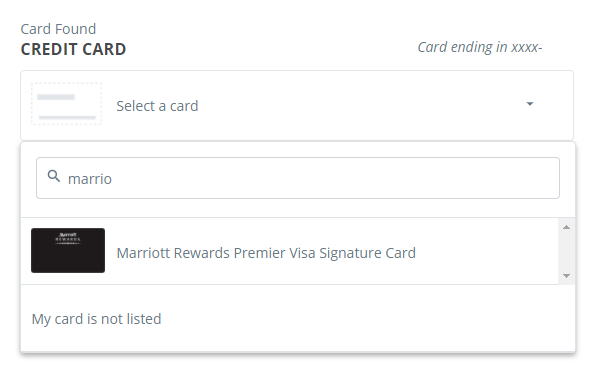

Assign credit cards to their specific type

Birch Finance automatically detected most of my credit cards by their co-branded partner. However, it did have trouble determining some of my business cards and many of the cards from Chase.

Either way, there is a simple process to assign each card to their specific card type so the Birch Finance app could work its magic.

Evaluate the results

Once you finish linking your accounts, Birch Finance takes it from their and starts analyzing your spending against the cards you have in your wallet. It will make recommendations on which card to use for every day spend and let you know how many rewards you’ve been missing out on.

Birch Finance Review and Recommendations

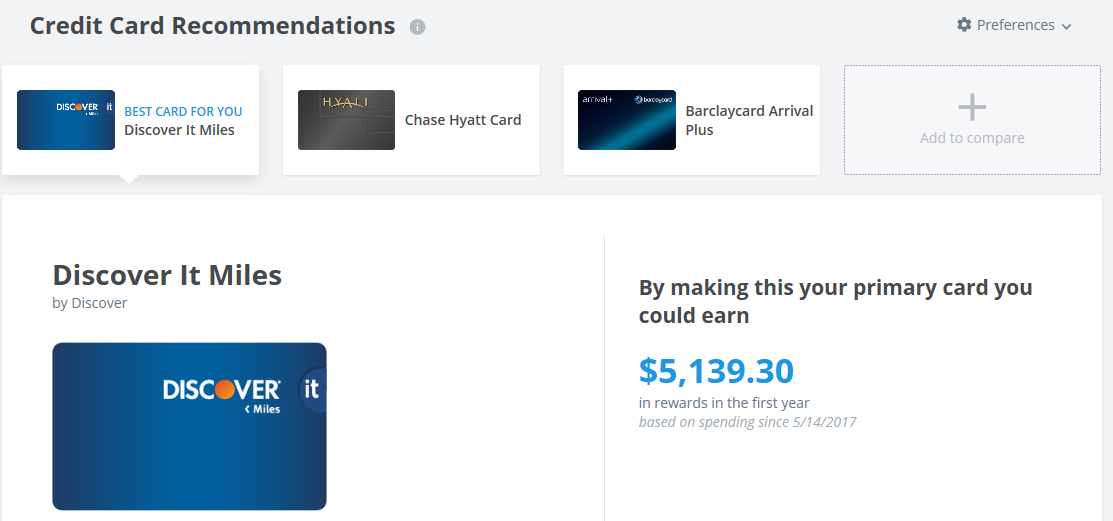

Based on the Birch Finance review and assignment of point values, they recommend that I should be using my American Express SPG card for all spending that isn’t bonus spend (ie: dining, gas, travel). As I mentioned above, I prefer my Southwest card because of the added value that comes from having the Companion Pass.

And then Birch Finance also offers a recommendation for a card that best fits your spending patterns and lets you know how many more rewards you could have earned had you been using this proposed card.

In my case, Birch Finance recommended I sign up for the Discover It Miles card based on the rewards earned. This factors in the double value of all earnings with Discover in the first year thanks to Discover matching all of your earnings.

Since that 2x bonus is only for the first year, I would need to re-evaluate my spending in 12 months. Some people may shy away from that, but you should be constantly re-evaluating the cards in your wallet. Programs and benefits change. Reward redemptions change. Your preferences change.

Do not pay an annual fee until you’ve reviewed the card to make sure that the benefits outweigh the annual fee and that you can’t get the benefits from another card at a more attractive price!

Other Birch Finance benefits

Aside from evaluating your spending for maximizing points, Birch Finance’s dashboard also offers up a lot of other benefits.

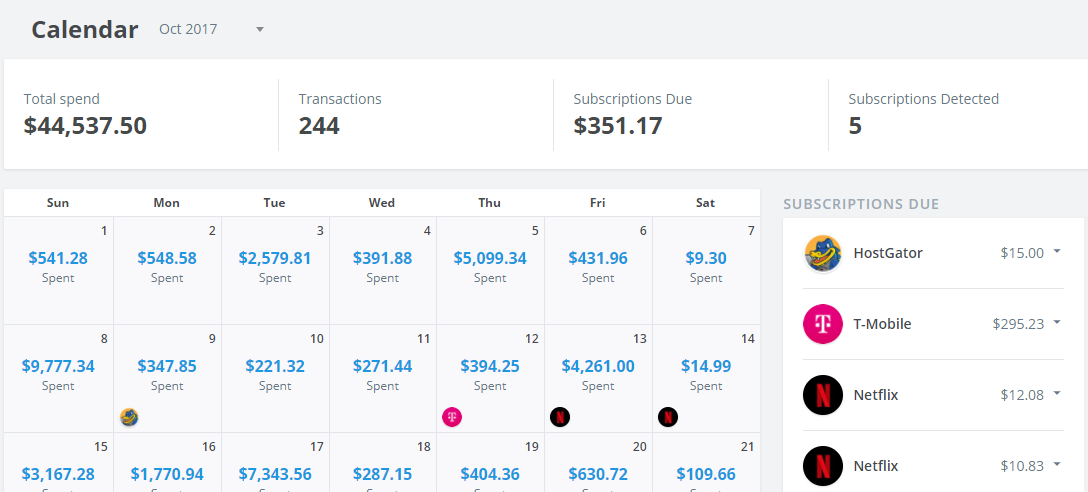

Monthly Spend at a Glance & Subscriptions

You can easily map out your spending by day and see what subscription services you have hitting your cards. I really like that Birch Finance highlights subscriptions because it is so easy to sign up for something, forget about it, then continue paying for something that you’re not using.

Review individual transactions

I usually use products like Mint, Personal Capital (use our referral link), and Penny to track my spending and net worth, but Birch Finance also breaks down your individual credit card transactions to provide more insight into what categories they are, what card you used, and their recommended card instead.

Birch Finance mobile app

Although I find it easier to set everything up using the Birch Finance website, they also offer a mobile app in the iOS store for Apple phones and tablets.

My friends at Birch Finance tell me that the Android version will be available by the end of February 2018.

The Bald Thoughts

Although I didn’t agree with everything that Birch Finance recommended for my personal situation, I really liked their dashboard and insights into my credit card spend. I could easily see which days I spend the most money (hello manufactured spend) and keep tabs on which categories of spending I use most. This information is of great help when I’m picking out new cards to consider adding to my wallet or to replace cards I already have.

Click here if you’re ready to try Birch Finance using our referral link.

I am 100% convinced that I would be a D-… I use my card for other things like spend promos and “I want more of this point” program…

I agree. In future iterations, they should allow you to set goals for minimum spend bonuses or adjust the point valuation based on what points you value most.

Hi Jon, it’s on our roadmap after we push a few product changes over the next month.

Thanks!