One of my favorite things to do is save money. Besides the awesome feeling of “winning,” I love being able to take the cash I’ve saved and pay off debt, save for my future, or splurge on something cool. I’ve been using Dosh for several months and really enjoy savings 7-10% when I dine at a participating restaurant. They recently announced the Dosh Cash Back Multiplier which boosts cash back by up to 10x your savings!!!

Disclaimer: Dosh has sponsored this post. They compensate this blog for our honest feedback and opinions of their service. I use Dosh in my personal life and would use the service even if they weren’t a sponsor.

What is Dosh?

Dosh is an app that provides cash back opportunities on dining, shopping, and travel when you use linked credit cards at participating merchants.

So far, I’ve been focused on getting cash back at restaurants that I already eat at normally locally and using it when I travel to pick out which restaurants I’ll try when I travel. Most of the places I’ve ate at have given between 7% and 10% cash back on my meals, whether they are fast food, fast casual, or sit down dining locations.

If you’d like to try Dosh, use my referral link for a little bonus (and I’ll get a little bonus for referring you). Currently, they are giving new customers $5 after their first purchase, plus another $1 each for two credit cards that they link.

What is the Dosh Cash Back Multiplier?

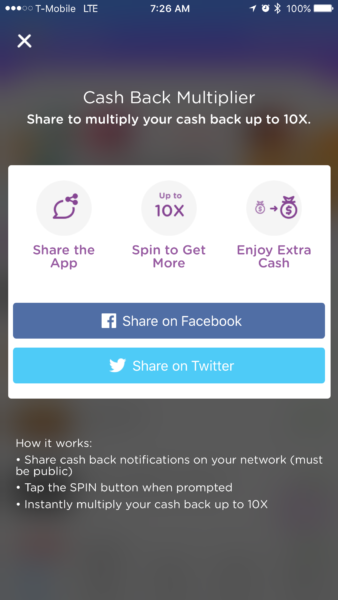

Dosh recently launched a new benefit where you can receive a multiplier of up to 10x your cash back when you share your earnings via social media.

It only takes a few seconds to share and the process is super simple. And, as an added bonus, you get $5 extra when someone signs up using your link and after they’ve made their first purchase!

My experience with the Dosh Cash Back Multiplier

I was in Dallas having dinner at a place called The Press Box Grill. It was late on a Saturday night and the place came highly recommended and was just a short walk from my hotel, the Hilton Garden Inn Dallas Downtown.

I highly recommend the Shiner Bock brisket sandwich or the burger (which is a mixture of brisket and beef). Both were very delicious! And order the tater tots to go with them… it’s an extra charge, but well worth it.

Shortly after I paid with my Dosh linked credit card, I received a notification that I received Dosh cash back. I didn’t see it until the morning, but super awesome!!! I didn’t even realize that The Press Box Grill participated in their program.

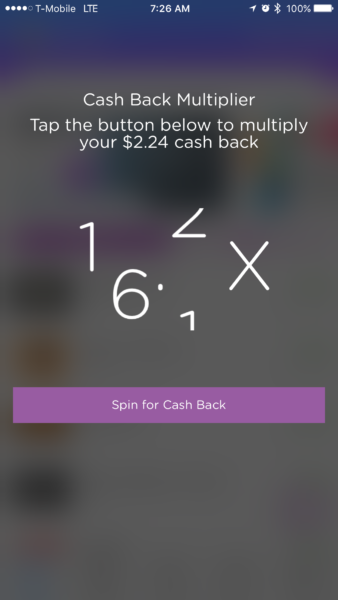

So, I clicked on the iPhone notification and it brought me to this screen. I chose to share via Twitter.

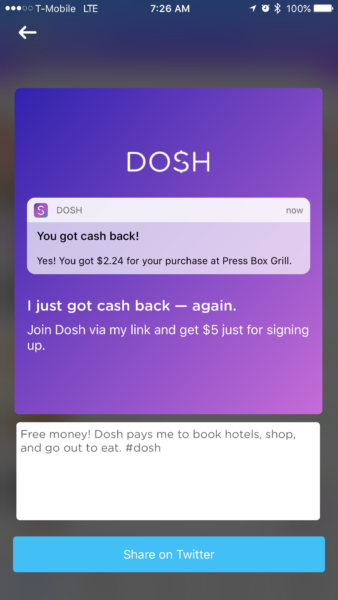

When I clicked to share on Twitter, the image pre-populated and I could type my own message.

This is what I wrote…

Free money! Dosh pays me to book hotels, shop, and go out to eat. #dosh https://t.co/dPLKV12EMc pic.twitter.com/GVqKhCC0PC

— Bald Thoughts (@BaldThoughts) October 29, 2017

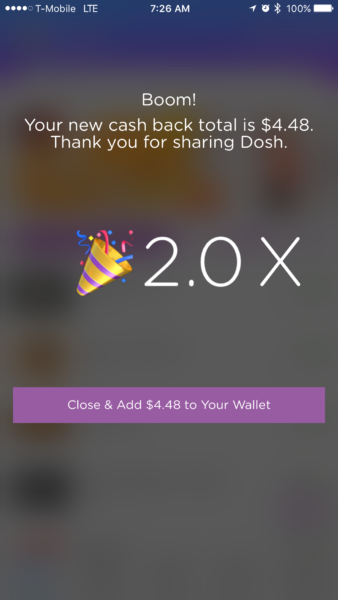

And then I clicked to spin the wheel to see how much I could increase my $2.24 cash back with the Dosh Cash Back Multiplier. When the spinning wheel stopped, I had doubled my cash back to $4.48. Not bad, right?

When the spinning wheel stopped, I had doubled my cash back to $4.48. Not bad, right?

The Bald Thoughts

I recommend signing up for Dosh to earn cash back when you eat out, not because this is a sponsored post, but because I love saving cash for doing nothing! And with the Dosh Cash Back Multiplier, you can save up to 10x more for simply sharing your savings via Facebook or Twitter.

Here’s the link again if you’d like to sign up for Dosh and get a $5 bonus after your first purchase.

Have you tried Dosh? What are some of the ways you save money when eating out?

DoC mentions some reservations about their security. While I know that it’s impossible to be truly impartial while asking people to use your link, I’d like to know your thoughts on the matter.

Christian, I haven’t checked into their security, so I can’t speak to it.

I work for a bank as my day job, so I know about the rules for credit card liability. I’m not concerned about issues with credit card fraud, other than the potential for a PITA when you have to re-establish auto payments.

As for debit cards, there’s always huge liability with them causing ripple effects if there’s fraud. For that reason, I never use debit cards except for ATM withdrawals.

If a hacker drains your account, checks and EFT/ACH payments may bounce and you’ll seem like the bad guy. Same can be true for authorizations at hotels, gas stations, and car rentals potentially causing overdrafts.

Bottom line, I take certain steps to limit liability but don’t live in fear as long as I’ve taken precautions. In the case of Dosh (or any other app), I’m fine with linking credit cards but would NEVER link a debit card.