Every few months, I apply for several cards to boost my miles and points balances and receive all of the perks that the cards offer. I’ve been able to get approved for almost every card I’ve applied for either automatically on the online application or when calling the reconsideration lines. This time, however, I was only able to get approval for 4 out of the 6 cards that I applied for.

- 7 steps to prepare before your next credit application

- Don’t cancel that card before you negotiate

- 11 immediate steps when you receive a new card

Doesn’t applying for cards hurt your score?

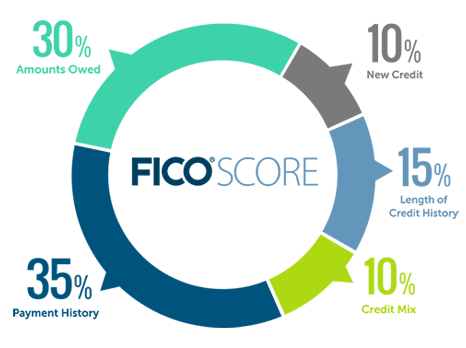

Yes and no. Every inquiry you do decreases your score 2 to 5 points, and, obviously, when you do a bunch of applications, your score will be affected by each inquiry. However, since I’m not planning on applying for other credit anytime soon because I just paid off my student loan and my car loan, I’m not concerned with a short-term drop in my credit score.

Over the next month or two, my credit score will pick back up as older inquiries fall off my report and the new credit limits post to my report, which will lower my credit utilization (aka amounts owed 30%) and increase that portion of my score.

Which 6 cards did I apply for and why

Whenever I apply for new cards, I like to spread my applications across several banks to improve my odds of success. And as much as possible, I follow the 7 steps to improve your chances of getting approved for your next card.

American Express Platinum

I had the American Express Platinum card once before, and I thought I wouldn’t be able to get it again due to Amex’s new rules on personal cards that limit bonuses to once per lifetime. However, I received an email from Amex offering 50,000 Membership Rewards points if I applied.

Pro Tip: If you are selected to apply for an exclusive offer, like I was, then the “once in a lifetime” bonus rule doesn’t apply for that offer.

I applied for this charge card (aka no pre-set spending limit) and was approved automatically online.

The Platinum card carries a hefty $450 annual fee (that is NOT waived the first year), but there are some serious perks that come with the card that offset the fee:

- 50,000 bonus points after $5,000 in spend within 3 months. These points alone are worth at least $500.

- $200 Airline Fee Credit is allowed once per calendar year, so you can redeem this twice for a total of $400 in potential benefits. You must pick one airline and incidental charges by that airline are credited to your bill. Some people have had success in buying four $50 gift cards with the credit.

- Global Entry or TSA PreCheck reimbursement is worth up to $100 if you apply for Global Entry. My Global Entry doesn’t expire for awhile and Anna, Timmy, and Scarlett already have theirs. I even used one credit to get my mother-in-law Global Entry… scored some huge MIL points with that one!

- Amex Centurion Lounge access is complimentary. Many lounges are just so-so, but the Amex lounges are consistently some of the nicest lounges available with the best perks. You can also access Delta Sky Clubs, Airspace Lounges, and enroll in Priority Pass Select for free. We stopped in the Las Vegas Centurion Lounge on the way back from Miami over Labor Day Weekend for some great food, free drinks, comfortable seating, and a designated play area for the kids.

I was approved instantly online for the Platinum card. And it is always exciting to see the approval arrive via email!

I don’t have a specific use set aside for these points at this time, but there are some great transfer bonuses right now with your Amex points where you get 50% more British Airways Avios or 25% more Virgin America Elevate points.

To apply for the American Express Platinum card, please use our referral link.

Barclay Arrival Plus

I also had the Barclay Arrival Plus card in the past. It is a good card to have with the 40,000 bonus miles (after $3,000 spend within 90 days), the 2% earning power on all purchases, and 5% rebate on redemptions. The 40,000 Arrival miles are worth $400 in travel reimbursement. The annual fee of $89 is waived the first year.

I dumped this card in the past for the following reasons:

- The rebate was reduced from 10% to 5%

- The minimum redemption was increased from $25 to $100

- Barclay Arrival eliminated the TripIt Pro complimentary membership

To me, spending $4500 just to offset the ongoing annual fee of $89 wasn’t worth it considering I have the Citibank DoubleCash card that offers 2% cash back with no annual fee… and the cash back isn’t limited to travel spending the way that the Barclay Arrival is.

I love seeing approvals online. It saves me from having to call a bank’s reconsideration line to plead my case to overturn a decline.

The Arrival is a great card for reimbursement of travel expenses for my stays at Kimpton because they don’t have their own co-branded credit card, so there aren’t many other ways to use miles and points for my stays there. The $400 from Barclay Arrival will pay for at least two nights of my upcoming stays at Kimpton, so this card is totally worth it in the short run to me.

We’ll see how this card does to justify paying the annual fee next year. Before I close any card, I always call to see what type of retention offers are available.

If you’d like to apply for the Barclay Arrival, there’s now a 50,000 offer, which is 25% better than the normal offer! Please use our links to support the site if you do apply.

Chase Sapphire Reserve

This card has been the hottest card since it’s release in August 2016. The 100,000 bonus point offer is worth $1,500 in travel, plus you get $300 in annual credits towards travel and $100 reimbursed towards Global Entry or TSA PreCheck application fees, for a combined value of $2,200 against an annual fee of $450 that isn’t waived. Overall, a pretty awesome deal…

And that’s before you factor in that the Sapphire Reserve card earns 3x points on travel and dining and includes a complimentary Priority Pass Select membership and special benefits when booking rooms with The Luxury Hotel & Resort Collection.

Unfortunately, I was declined for this card because I had 8 new personal cards in the prior 24 months. I’m analyzing my cards now to figure out which can be jettisoned over the next few months so I can get back under the 5/24 Rule.

Citibank AAdvantage Platinum Select Mastercard

Thankfully, Citibank had not yet implemented their new rules limiting bonuses to “one per family of cards” every 24 months when I had applied. The new rules seek to limit churning by stopping people from getting every card in a particular “family” (ie: Hilton, American, ThankYou) over and over again.

For this Citi AA card, I earned 30,000 AAdvantage bonus miles after spending $1,000 within the first 3 months. The card also provides the first checked bag free for you and four companions traveling on the same reservation, Group 1 Priority Boarding, and a 25% savings on in-flight purchases. A unique feature of the AAdvantage program is that if you hold any of their AAdvantage co-branded cards, you will receive a 10% rebate on miles redeemed up to 10,000 miles back each year.

The annual fee is $95 a year, but is waived the first year.

American Airlines is my favorite airline for international travel, so I love getting these AAdvantage cards to boost my mileage balances. You can often find 50,000 AAdvantage mile offers, but there were none available when I applied, so I had to pull the trigger on a lower offer to get my application in before the bonus rules changed.

I was initially declined with my online application, but then I called the reconsideration line and was approved on the condition that I closed one of my accounts. When speaking with the rep, I was told that I had reached my maximum credit limit with Citibank… which doesn’t sound right since I recently closed a couple of Citi cards that had $40,000 in limits between the two of them. Not wanting to push my luck, I chose to close my Citi ThankYou Premier card that had an annual fee coming due and transferred the line of credit over so I could receive my approval.

In the package I received from Citibank with my new AAdvantage card, my credit score from Transunion was included, and it was 792, which is a very nice score.

If you’d like to apply for one of the Citi cards, please use our links to apply and support the blog.

Sun Country Airlines Visa Signature

Now that the big banks are enforcing stricter limits, you’re going to see more cards like the Sun Country Airlines card showing up in people’s wallets. It is offered by a small bank in the mid-west that most people have never heard of, First National Bank of Omaha.

The offer is for 30,000 Sun Country UFly Reward points when you spend $1,000 within the first 3 billing cycles. And you can receive an additional 10,000 UFly points when you spend $10,000 each year.

The annual fee is waived the first year, but is $69 a year afterward.

Besides the desire to spread my applications across more banks, this card actually does offer some great value. I have friends that live in the Minneapolis area, so the points would be a great way to visit them and save my more valuable miles and points for other adventures. And, after I spent some time in Minneapolis at the Mall of America and Radisson Blu Mall of America during the May 2016 TBEX conference, I realized that it would be a fun place to return with the family.

This card was my second decline of the August 2016 app party… based on their letter, I had “excessive inquiries” so it seems that they may not be friendly to card hackers, even though their letter shows that my credit score is 792 from Experian!

I called their reconsideration department a couple of times, but each time was told that I needed to wait for the decline letter to arrive. It was dated 9/1/2016, but didn’t arrive for almost 3 weeks at my home. Now that the letter has arrived, I will give it one more shot and see if I can work some reconsideration approval magic!

If you’d like to apply for the Sun Country Visa, go to the Sun Country Airlines website and click on the banner to apply.

US Bank FlexPerks Travel Rewards Visa

I also have had the US Bank FlexPerks Travel Rewards Visa in the past. I canceled it a couple years ago after I was approved for the Amex version. Both cards were fantastic for earning points at my local grocery stores that were worth up to 4% on every dollar spent! Once the local grocery stores stopped accepting credit cards for gift card purchases, the value of my FlexPerks cards in my wallet dropped pretty considerably.

With the 2016 Rio Olympics, there was a special offer where this card offered an additional bonus on the number of medals that the US Olympic team won. With the US Olympic team dominating the medal stand, this card offered an additional 14,800 points on top of the normal 20,000 points, for an extra $300 in value given that 1 FlexPoint is worth up to $0.02 when redeeming for travel their the FlexPerks booking portal.

The minimum spend to earn the bonus is $2,000 within the first 4 months. The annual fee is waived the first year, then it is $49 a year afterward.

Besides the value of the FlexPoints, this card also has two other great benefits:

- For every flight you redeem points on, you get a credit of up to $25 on incidentals. I used mine for drinks on the flights to St Maarten for my 40th birthday.

- 12 times a year you get free GoGo Wireless internet on your flights.

I was declined online for this card as well, even though I have a strong banking and lending relationship with US Bank. A few days later, I started my reconsideration calls and found out that the holdup was based on the need to verify my identity more than the need to reconsider the underwriting.

After verifying my identity, my application was sent to the underwriters for decisioning, and I was approved for my card within 48 hours!

What is weird is that US Bank’s letter noted that my Experian credit score was only 718, which is far lower than the Experian score that Sun Country noted was 792. I was approved from the bank that showed I have a lower score, but declined by the bank with the higher score. It just goes to show you that credit score is not the only factor a bank makes in make a credit decision.

I still have some points from my FlexPerks Amex card, so these new points will combine into one account at US Bank. The best use is for tickets that are just under $400, or any increment of $200 above that, to get the maximum value out of the FlexPerks program.

Just like the other bank points programs, (Citibank ThankYou, Chase Ultimate Rewards, American Express Membership Rewards) when you book tickets with FlexPoints, you will earn miles and points with that airline just as if that ticket was paid for in cash. You have more than 150 airlines to choose from when redeeming FlexPoints!

To apply for the US Bank FlexPerks Visa, go to the US Bank referral website. If you use my link and my FlexPoints number (400006173712), I will get 5,000 points for referring you.

If you do apply, note that the Amex version has a 30,000 point bonus, while the Visa bonus is back to 20,000 points. In other words, the Amex FlexPerks card has a bonus that is worth $200 more than the Visa version.

The Bottom Line

I was able to go a respectable 4 for 6 on my credit apps in late August. The results are even better when you factor in that my Chase Sapphire Reserve application was thrown in as a “just in case” since I knew that I was over Chase’s 5/24 Rule. When the bonus is that lucrative, sometimes you just have to apply even when you think you’re going to get declined.

Overall, I am poised to earn 154,800 miles and points from these 4 cards which will contribute to some very nice vacations in 2017 and beyond. And, I’ll be sure to register each new card for the awesome programs that will help me earn even more miles and points on top of my spending.