It seems like everyone uses AwardWallet to track their miles and points balances. It’s an awesome way to easily access your accounts, keep track of reservations, and have one place to view all of your balances. I love money just as much as I love to travel, and I want the same easy-to-use dashboard for my money so I can focus on creating more memories with family and friends.

What is AwardWallet?

For the two or three people remaining who haven’t used AwardWallet, here goes. AwardWallet is a website and an app that tracks all of your miles, points, and other reward programs. It is free to use for the basic features, and if you use my link, you’ll get a free upgrade for 6 months.

To track your accounts, you enter the details of your hotel, airline, train, and rental car loyalty programs. Additionally, proprietary programs from banks, cash back websites, and restaurants can be tracked. Most programs will be updated automatically when you provide your login and password, while a few require you to manually update or have your email statements forwarded to AwardWallet.

The AwardWallet site claims that they are tracking a total of almost 87 BILLION miles and points across 661 loyalty programs. That’s HUGE!

On the dashboard, it shows you your account number, your status level, how many points you have, and when they expire. By clicking on any program, AwardWallet automatically logs you into your account so you can make a new reservation, check your transaction history, etc.

And you receive weekly updates of the changes to your miles and points balances so you can see what has posted to your account or what has been used.

If you’d like a free upgrade when starting an account, please use my link to sign up.

How to track your money like you track your miles

PersonalCapital is the financial version of AwardWallet. It works in much the same way, you enter in your username and password for your bank accounts, investments and retirement accounts, credit cards, mortgages, student loans, auto loans… you name it. And whatever isn’t able to be tracked automatically, you can manually enter those details as well, such as stock options from work or other hard to track investments or loans.

And I feel secure in providing my financial details to PersonalCapital because they use bank-level security and require dual-factor authentication (by phone call, text, or email) to access your dashboard.

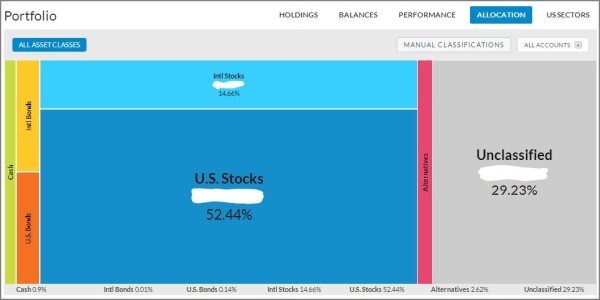

I use PersonalCapital to not only track my financial accounts, but also to track my overall asset allocation across my investments so that I do not become too concentrated in one investment category (ie: large cap stocks, international, bonds).

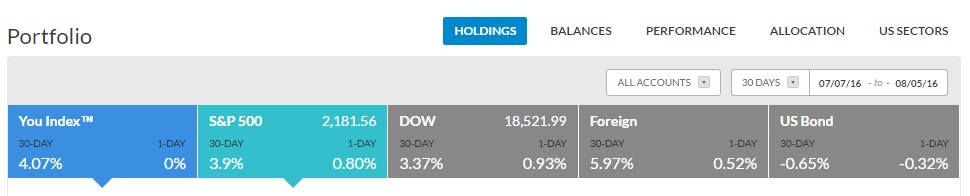

Another feature I really like is the You Index that PersonalCapital creates. Essentially, it boils down all of your financial assets into one number and shows you how you’re Net Worth is performing against other indices like the S&P 500, the Dow Jones, Foreign stocks, and US Bonds. In the example below, over the pasts 30 days, my Net Worth increased 4.07%, which was better than all other categories, except Foreign stocks. I’ll take that any day!

PersonalCapital has over 1 million customers who are tracking accounts totalling $245 billion! That’s a lot of money, and a lot of people trusting in their service.

To get started with your free account at PersonalCapital, just use my referral link and start linking all of your bank and credit card accounts, loans, investments, properties, and everything else financial related.

Free 30-minute financial consultation

When you sign up through my referral link, you are given a free 30-minute financial consultation with one of the advisors from PersonalCapital. You don’t have to schedule the call, but know that it is available for you.

During the call, they will talk about your goals, your investment strategy, and how much you are saving today towards your goals. I found it pretty useful, even though I decided against working with the advisor on an ongoing basis.

The advisor at PersonalCapital provides the following benefits:

- The personal touch of two licensed advisors

- Financial advice in your best interest – PersonalCapital abides by the fiduciary standard

- Customized investing strategies

- Risk and return optimization

- Automatic rebalancing

- Tax optimization through loss harvesting and asset location

- No hidden fees

- Advice on other investments such as your 401k, stock options, and 529 college savings

- Access to a CFP® (for portfolios over $1M)

According to the PersonalCapital website, the fee structure is defined as follows:

We charge one all-inclusive fee for investment management and advice based on a percentage of assets managed. Personal Capital has no hidden fees, no trailing fees and no trade commissions.

They charge 0.89% annually for assets over $100,000 and 0.49% to 0.79% assets over $1 million.

The Bottom Line

We’re all busy planning our next adventure, so having a simple tool to track your money allows better focus on increasing your Net Worth. Best of all, it is free and is accessible on the web, on your phone, and on your tablet, which means all of your finances are easily managed through one simple dashboard, just like all of your miles and points are tracked on AwardWallet.

Why not use Yodlee which tracks both banks and mileage programs in one place and skip the brokerage pitch?

I didn’t realize that Yodlee offers a consumer product. I always thought of Yodlee as more of a back-end, white label solution for banks and other sites to aggregate accounts, who then present the info in a portal like Mint or PersonalCapital. For a long time, I used Yodlee indirectly with Bank of America to aggregate my accounts, but it didn’t have much functionality, like easily viewing transactions across accounts, tracking investment performance, and seeing your portfolio mix of the underlying investments.

With PersonalCapital, you don’t have to take the investment advisor call. It is NOT requirement for using the dashboard and all of its functionality. However, most people could benefit from having an investment advisor help them with their finances. PersonalCapital is unique in that they’ll help you find the right investment mix for you across all of your accounts (including your work retirement account), not just the accounts in which they are the broker on record.

The reason I avoid these types of services and tools is security. I have my own view of the value of anyone’s bullet-proof security. I am very interested, but hesitant for that reason.

Ilsa, I understand the concern. Especially with Equifax’s recent hack, it seems that nobody is safe. I tend to value the convenience more than I fear the risk, but everyone’s perspective and comfort levels are different.