I’m preparing to travel to Europe a couple of times for separate solo trips with my son and daughter this fall. Europe is very similar to the US in many ways, but it can also be quite different. One of the differences is in how they process credit card transactions. In the US, we are used to Chip and Signature, but that’s not how they always do it in Europe. To reduce fraud, many vendors and machines require a Chip and Pin. Here’s why it is important and how to set up your chip and pin with Barclays.

In This Post

What is Chip and Pin?

Chip and Pin technology is the international standard for credit card transaction security. Instead of swiping your credit card or inserting the chip, then signing a receipt to verify that you are the owner of the card, you then type in your four-digit pin code.

This technology has been around since 1984 when French banks starting testing its security. In 1996, major credit card companies collaborated to standardize the Chip and Pin technology into a secure payment system known as EMV. EMV stands for Europay, Mastercard, and Visa, which are the three companies that developed the technology.

How is Chip & Pin different than Chip & Signature?

Chip & Pin and Chip & Signature both use the EMV standard to verify your credit card. However, the big difference is using a pin versus a signature to finalize the transaction. With a signature, it is up to the vendor’s employee to look at your identification to determine if your signature is a match. Criminals can easily create fake IDs, so this approach is less secure.

With Chip & Pin, the employee is removed from the verification process. If your pin does not work, the transaction will not go through. And, unless a criminal has access to your pin, they will not be able to perform that in-person transaction either.

How to set up Barclays Chip and Pin

There are three ways to set up your Barclays’ Chip and Pin code for your credit cards.

Create your pin online

The easiest way to create your Barclays chip and pin four-digit password in seven easy steps that will take about two minutes to complete.

- Log into your account.

- Select which Barclays credit card you want to create a pin for.

- Click on “Services”.

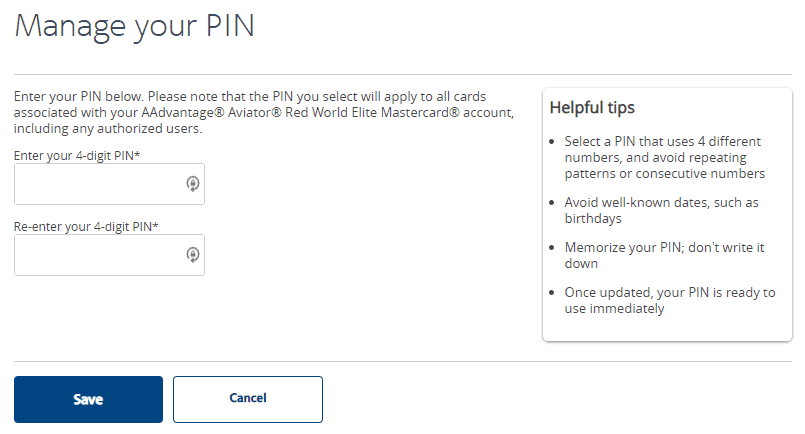

- Click on “Manage your PIN”.

- Click on “Change your PIN”.

- Enter PIN and save.

- Answer verification question.

Automated via the phone

When calling Barclays’ customer service, request to change your pin code. The phone agent will transfer you to the automated service that will allow you to create (or reset) a pin.

This process is handy if you’re already on the phone with someone at Barclays. However, I still prefer to create my pin online because the overall process is faster.

Request a pin be mailed to you

As a last resort, your pin can be created for you. The new pin code in about 7 to 10 days. I generally avoid this option because of the time it will take to arrive and because the pin will be assigned to you.

You will want to create your own pin to make it easier to remember and to secure your account. You never know who had access to your pin code before it was mailed to you.

Why choose Barclays?

Don’t get me wrong, your credit cards will work on most transactions while traveling to Europe. However, that isn’t always the case! Barclays is a UK-based bank, so they understand European banking rules better than our American banks. Because of this, every one of their credit cards is enabled with Chip and Pin technology.

When my buddy David and I flew to Europe we got stuck in a parking garage. We traveled to Germany to pick up a Mercedes S550 for his dealership, then cruised through Amsterdam and Brussels on the way to drop off the car in Paris. As we attempted to leave the parking garage in Amsterdam, we got stuck in a parking garage for about two hours one morning because we didn’t have Chip and Pin on our credit cards.

After that humiliating and frustrating experience, I always make sure to bring a Barclays credit card with me while traveling.

The Bald Thoughts

When traveling internationally, you notice how things are different versus how we do them in the United States. A simple credit card transaction could be easy with chip and signature, but many require that you have a pin code. Be sure to set up your chip and pin code before you travel so that you are not embarrassed (like I was) when you transactions are declined.

Have you ever had a transaction declined while traveling? Was it due to a fraud alert or because your credit cards didn’t have chip and pin technology? Let us know about your experience in the comment section below.

I will never forget running up and down the train platform in Rome trying to find a machine that would work without a PIN card. I finally just boarded and paid cash on board. It was the last train to FCO that night. I understand many of the unattended kiosks have now been updated to recognize a chip card with no PIN assigned, but I won’t travel without my Barclays card for backup.

I feel your pain, Marshall. Being stuck in the parking garage for two hours was frustrating. And it wasted so much time that would have been better spent exploring Brussels on our way to Paris. I always keep one Barclays card on me just to be safe!

The challenge is the Barclay cards from the U.S. will always default to Chip+Signature for “attended” transactions — such as in stores, restaurants, etc. The only value of having the PIN in Europe is for kiosk-like transactions.

I’m not sure if there’s a way to change the default to have the Chip and Pin be the primary option. I don’t think a lot of US retailers are ready for that. I know that my hide has been saved numerous times with Chip and Pin at kiosks in Europe. I’m getting ready to travel to Europe a couple of times this Fall, so my Barclays Aviator Red card will be in my wallet.

No way I have found to change the default, unfortunately, but I love encountering a long line at an attended museum ticket counter and being able to be in and out of the kiosk in mere seconds, tickets in hand.

Absolutely! Anything to skip waiting in long lines.

Not true. I have used my Barclay’s card during several European trips, in stores and restaurants. When it asks for a pin, I type my code and I’m done. Have never had a problem since i got my first chip card

After setting up your pin for your credit card, don’t you have to initially use the card + pin with a transaction involving an attendant before you can use the card + pin at an unattended kiosk?

That might be a requirement from your credit card company. Call and ask them. I don’t recall having to do that and it worked fine. (but it’s been several years since i created the pin and started using it.) If they say it is required, ask them to identify a nearby merchant where you can do that to ensure it’s working before you leave the US.