The Platinum Card® from American Express offers tremendous benefits like airport lounge access and $400 annually in Uber and flight credits. But there are many other benefits that you should know about to get full value out of the premium annual fee that you are paying. We take a look at 17 American Express Platinum hidden benefits to help you decide if it is worthy of a space in your wallet.

In This Post

The Platinum Card® from American Express sign-up bonus

As with any credit card, the sign-up bonus is one of the immediate benefits of getting a new credit card. With The Platinum Card® from American Express, the current welcome bonus is 100,000 points after spending $6,000 within the first six months.

American Express Platinum annual fee

Keep in mind that the first-year annual fee of The Platinum Card® from American Express is not waived. However, the value of the sign-up bonus and the $400 in annual credits more than makes up for the first year’s annual fee.

Cardholders can add up to 3 additional cardholders to extend these benefits for $175 per year. Each additional cardholder beyond that is $175 per year for each person.

Popular benefits of the Amex Platinum

The sign-up bonus is nice, but you’ll also receive it once. American Express has a “once per lifetime” bonus rule, so make sure the bonus is high enough to make the application worth your effort.

What convinces cardholders to renew year in and year out are the benefits that you receive each year. Here are the common benefits that most American Express Platinum cardholders use on a regular basis:

- $200 annual airline credit

- $200 in Uber credits

- Centurion Lounge Access

- Priority Pass Select membership

- Up to $100 Global Entry or TSA PreCheck reimbursement

$200 Airline Credit

Cardholders receive $200 in airline credits each calendar year from the American Express Platinum card. These credits can be used for baggage fees, seat assignments, change fees, and phone reservation fees, to name a few. Airplane tickets are not eligible for these airline credits. Gift cards are also excluded. However, some people report success in receiving credit for purchasing them.

In order to use the airline credits, you’ll need to designate your preferred airline from among the list of:

- Alaska Airlines

- American Airlines

- Delta Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

Once you make your selection for the year, you cannot change it. However, you are free to stay the course or choose another airline once January 1st rolls around.

$200 Uber credits

Unfortunately, the $200 Uber credits aren’t provided all at once. Instead, cardholders receive $15 in Uber credits each month with an extra $20 in December. If you’re like most people and don’t use Uber every month, these credits also count towards Uber Eats orders.

With the Amex Platinum, you’ll also receive an upgrade to Uber VIP status without meeting minimum ride requirements. This assures that you’ll be matched up with top-rated drivers whenever possible.

Centurion Lounge Access

American Express has a lounge network that is exclusive to American Express Platinum and Centurion cardholders. There are nine Centurion Lounge locations:

- Dallas (DFW)

- Hong Kong (HKG)

- Houston (IAH)

- Las Vegas (LAS)

- Miami (MIA)

- New York LaGuardia (LGA)

- Philadelphia (PHL)

- San Francisco (SFO)

- Seattle (SEA)

There have been reports of the Centurion Lounge restricting access during busy times of the day or year. And American Express recently limited admission to the cardholder plus two guests.

This admission restriction rule totally sucks for families like mine that travel with Mom, Dad, and two kids. Basically, it forces us to pay for a day pass (if available that day) or to pay $175 for the second parent to be a cardholder as well.

Priority Pass Select airport lounge membership

Remember that registration is required with Priority Pass before you can access one of their lounges. When you call to activate The Platinum Card® from American Express, speak with a customer service representative to enroll in Priority Pass and learn about all of the latest benefits they offer.

When you visit a Priority Pass lounge, cardholders can bring in two guests at no additional charge.

If you have additional authorized users on your account, they will also be able to access any of these lounges whether they are traveling with the primary cardholder or not.

For people without Priority Pass as a benefit on their credit card, click here for the latest Priority Pass offers.

Global Entry or TSA PreCheck Reimbursement

Frequent travelers know that waiting in line is not the best use of their time. That’s why Global Entry or TSA PreCheck is crucial to getting through airport security and customs at domestic airports.

With the Amex Platinum, you’ll receive up to $100 reimbursement every 4 years to enroll in either Global Entry of TSA PreCheck. Other border security programs, such as NEXUS, SENTRI, and FAST, are not included. Additional cardholders also have access to this reimbursement benefit.

17 Hidden Benefits of The Platinum Card® from American Express

Although these popular benefits are pretty great, there are plenty of hidden benefits of the American Express Platinum card that cardholders either don’t know about or forget to use. If you’re considering canceling the card when the next annual fee comes due, these 17 hidden benefits may convince you to keep the card another year.

Additional lounge access

With the American Express Platinum card, the Centurion Lounge and Priority Pass are not the only lounge networks you can access. There are over 1100 airport lounges across 120 countries that Amex Platinum cardholders can enter.

Here are the 7 lounge programs included in the Global Lounge Collection benefit:

- The Centurion Lounge (exclusive to American Express)

- The International American Express lounges

- Delta Sky Club (when flying Delta Airlines)

- Priority Pass Select lounges

- Airspace Lounges

- Escape Lounges

- Plaza Premium

When I lived in California, one of my favorite lounges to visit wasn’t even in an airport. It was actually located inside a mall. The Access Suite lounge at South Coast Plaza in Costa Mesa is relatively small, but they offer free drinks and snacks. I would hit the golf course with friends in the morning, then treat them to a little luxury afterward.

And I randomly found an Escape Lounge at the Reno Airport on the way back from snowboarding with my son. They had great food, free drinks, and a comfortable place for us to rest before our flight.

Authorized Users Get Global Entry Reimbursement

With many other premium credit cards, the Globel Entry or TSA PreCheck reimbursement is reserved for the primary cardholder only. That’s not the case with the American Express Platinum card.

With the Amex Platinum Card, each authorized cardholder also receives up to $100 in reimbursement for Global Entry or TSA PreCheck. This benefit can be used once every 4 years. Simply pay the application fee on the authorized user credit card and the reimbursement is automatic.

Fine Hotels & Resorts

This is one of the underused benefits of the American Express Platinum. But savvy travelers know that the Fine Hotels & Resorts Collection offers tremendous benefits at over 1,000 hotels and resorts around the world.

American Express estimates that these benefits are worth $550 on average every time you use them. The benefits include:

- Room upgrade upon arrival, when available

- Daily breakfast for two people

- Guaranteed 4 pm late checkout

- Noon check-in, when available

- Complimentary hotel WiFi

- Unique amenity valued at $100

The amenity will often be a food & beverage or spa credit. When comparing hotel prices for your upcoming vacation, don’t forget to take a look to see what Fine Hotels & Resorts is offering. Even if you pay a little more per night, the value of free breakfast and $100 amenity will often tilt the decision towards Fine Hotels & Resorts.

Honestly, I haven’t used this benefit as much as I should have over the years. But most of my hotel stays are booked using hotel points instead of cash.

5x Membership Rewards Points on Flights

When you book airfare directly with the airlines or through American Express Travel, you will receive 5x Membership Rewards points. All other purchases earn 1 Membership Rewards point per $1 spent.

5x Membership Rewards Points on Pre-paid Hotels

You can also earn 5x points on prepaid hotel reservations on AmexTravel.com. This includes reservations made through Fine Hotels & Resorts and The Hotel Collection.

If you book directly with a hotel, you will not earn 5x points. Those reservations only earn 1x points, so you’re better off using the hotel’s co-branded credit card.

International Airline Program

Speaking of booking flights with American Express Travel, they offer another way to save. You can save money on international first, business, and premium economy tickets with over 20 participating airlines when you book with Amex Travel.

The discount is good for purchases of one to eight tickets on both refundable and non-refundable fares. And you’ll still earn the 5x Amex Membership Rewards points on these purchases. Win-win.

When booking with Amex Travel, if you use Membership Rewards points for all or part of your ticket purchase, you will still earn miles from the airline. To learn more and receive the latest list of participating airlines, contact Amex Travel at 800-525-3355.

Premium Roadside Assistance

Whether you are driving on vacation or just around town, Amex Platinum cardholders have access to Premium Roadside Assistance service 24 hours a day, 7 days a week. Some of the included services are towing up to 10 miles, changing a flat tire, or jumpstarting a dead battery. You can use this service up to 4 times per year at no additional charge.

Premium Global Assist Hotline

When traveling more than 100 miles from home rest easy knowing that the Amex Platinum offers a Premium Global Assist Hotline. Although many of the services provided are not complimentary, it is assuring that you can be easily connected with an English-speaking medical or legal professional for medical, legal, financial, and select other emergency and coordination services. Some examples of these services include replacing a lost or stolen passport, prescription replacements, missing luggage, and cash wires.

Extended Warranty Protection

When you pay for your purchases with the American Express Platinum Card the manufacturer’s warranty term is doubled, up to a maximum of two additional years. This applies to warranties that are 5 years or less. The coverage is limited to a maximum of $10,000 per occurrence and $50,000 per calendar year. Click here for more information.

Purchase Protection

Purchase protection provides protection in case your item is stolen, accidentally damaged, or lost for up to 120 days from purchase. The coverage is limited to a maximum of $10,000 per occurrence and $50,000 per calendar year. Click here for more information.

Return Protection

Sometimes we aren’t sure if we’re getting the best deal. With Return Protection, American Express will reimburse you up to $300 per item and $1,000 per calendar year if you try to return an eligible item that the retailer will not take back. Click here for details.

Hertz Car Rental Discount and Benefits

American Express Platinum cardholders receive extra benefits when renting a car with Hertz and using CDP# 211762. Receive a 10% bonus on Hertz Gold Plus Rewards points, a complimentary one-car-class upgrade, and a 4-hour grace period on returns in the U.S.

$100 per year Saks Fifth Avenue

Amex Platinum cardholders can get up to $50 in statement credits twice a year. Up to $50 from January through June and another $50 from July through December. Purchases made at Saks Fifth Avenue locations in the US, US territories, and at saks.com are eligible for the credits. No minimum purchase is required to start earning credits. Credits will post on your statement a few days after the purchase.

This benefit is for the entire account, not $100 per authorized user. Call customer service to activate this benefit.

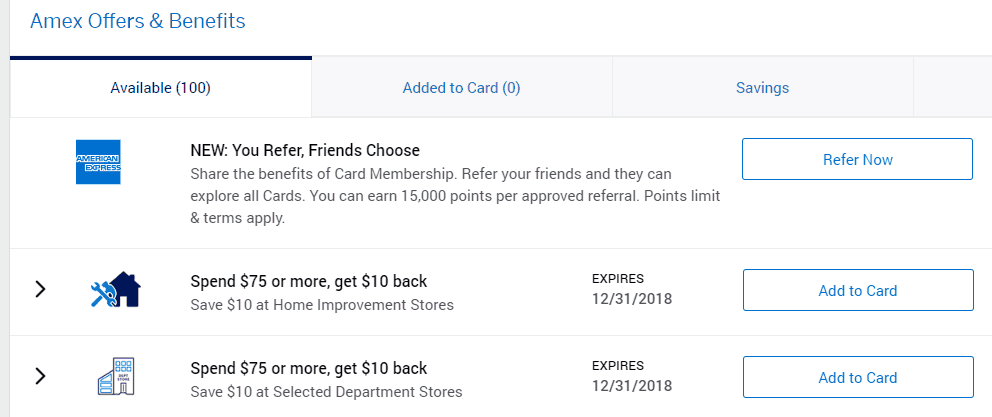

Amex Offers

All American Express credit cards have special offers where you can receive discounts or bonus point opportunities for spending at specific retailers. The offers are often targeted, which means that the offers will vary. Offers are usually based on which card you are using and which retailers and restaurants you spend money at. You need to add the offers to your card.

Hilton Honors Gold status

Enjoy complimentary Hilton Honors Gold status without any stay requirements. To earn Hilton Honors Gold status travelers need to have 20 stays, 40 nights, or 75,000 Hilton Honors base points earned in a calendar year. You need to call in to request this benefit.

Hilton Honors Gold members receive an 80% bonus on base points earned, get the 5th-night free benefit on award stays, and receive many other benefits.

Marriott Gold status

Marriott Gold status is another benefit of the American Express Platinum card. Marriott Rewards members usually need to spend 25 nights with a Marriott or SPG property. With the Amex Platinum, you receive this status automatically. Just call in to request the benefit.

Marriott Rewards Gold members receive an enhanced room upgrade, earn 25% bonus points on stays, and enjoy a 2 pm late checkout in addition to other benefits.

Cruise Privileges Program

I’m not a big cruise person, but many readers are. This benefit could be huge for you! When you book a sailing of five nights or more with your American Express Platinum Card, you will receive the following benefits:

- $100 to $300 in stateroom shipboard credits.

- Additional exclusive amenities vary by the cruise line.

- An extra Membership Rewards point for every dollar you spend with Amex Travel.

There are 15 different cruise lines available, so I’m sure you’ll find one that works with your travel plans.

- AmaWaterways

- Azamara Club Cruises

- Celebrity Cruises

- Crystal Cruises

- Cunard

- Holland America Line

- Norwegian Cruise Line

- Oceania Cruises

- Princess Cruises

- Regent Seven Seas Cruises

- Royal Caribbean International

- Seabourn

- Silversea

- Uniworld Boutique River Cruise Collection

- Windstar Cruises

As always, some exclusions do apply, so speak with your Amex Travel phone agent for details based on the cruise line you want to book.

Does the Amex Platinum belong in your wallet?

As you can see, the American Express Platinum offers tremendous value that outweighs the premium annual fee. If you are a frequent traveler, the Amex Platinum is a must-have. For one annual fee, you’ll gain entrance to over 1100 airport lounges, receive $400 in annual airline and Uber credits, and have unlimited WiFi at over 1 million Boingo hotspots.

Do you use any of these hidden benefits of the American Express Platinum Card? Which hidden benefits are your favorite? Do these hidden benefits increase your desire to apply for or renew the American Express Platinum? Let us know in the comments below.

Thinking of getting a new credit card?

To see the best credit card offers available, go to our credit card marketplace to find your next card.

How many guests are allowed with the Priority Pass benefit?

You can bring two guests with you in Priority Pass lounges. I’ve updated the article to include these details.

Sorry to keep bothering you on this topic, but do you just flash the platinum card for entry, or do you need to request an account?

No bother at all. For Priority Pass, you do need to register ahead of time. For all of the other lounge networks, just show your Amex Platinum Card and boarding pass.

[…] reminders point out you’ve been slacking off on maximizing credit card benefits, head over to Lee’s article at Baldthoughts. When someone else does an excellent job of reviewing credit card benefits, I’m more than happy to […]

You didn’t mention the cruise lines benefits. With most of the leading cruise lines, if you pay with your AMEX card, you get differing benefits. It’s actually the whole reason I got my Platinum card. Holland America now gives you up to $300 shipboard credit and a plate of chocolate covered strawberries for paying with your card with your card.

Stephanie, thank you for bringing this up. I’m not much of a “cruise person” so I glossed over that. I will add it to the list of hidden benefits.

I got a notice in my October statement that Roadside Assistance and travel insurance would be discontinued in 2020, and a reduction in the Purchase Protection Benefits. Starting to lose some of the perks I like( but luckily have not had to ever use yet).

Hey Geoff, thanks for sharing. Unfortunately, many banks are now reducing the benefits of credit cards. These benefits cost the bank money each month whether we are using them or not. It is a calculated move to eliminate benefits that aren’t being used enough to save the monthly cost of providing them for a select few cardholders.

I agree that many of these benefits are ones that I hope to never use (like roadside assistance or lost baggage protection), but love that they are there in case something does happen. As these benefits are eliminated, it just makes it harder to justify the premium annual fees that they charge.