There are a number of Barclaycard and CitiBank credit cards that earn American AAdvantage miles. Here we’re going to take a look at the Barclay Aviator Red and the Citi AAdvantage Platinum Select, the most popular options to earn AAdvantage miles.

In This Post

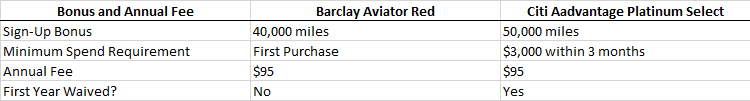

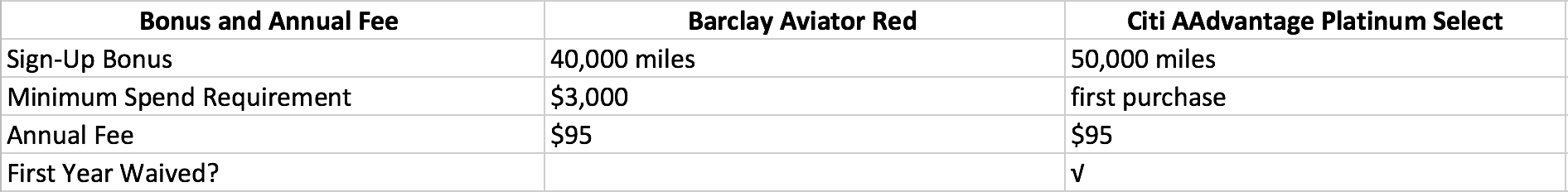

Current Sign-Up Bonus

The Barclay Aviator Red card currently offers 40,000 miles after your first purchase on the card. The Citibank AAdvantage Platinum Select offers 50,000 miles after spending $3,000 within the first 3 months of opening the card.

[Thanks to the readers that pointed out we had mixed up the two minimum spend requirements so we could correct it.]

Winner: Based on the industries valuations of miles and points, the Aviator Red’s bonus is valued at $600 while the Citi Platinum’s is about $750. If you can swing the minimum spend the Citi AAdvantage Platinum Select is for you, if not go for the Barclay Aviator Red.

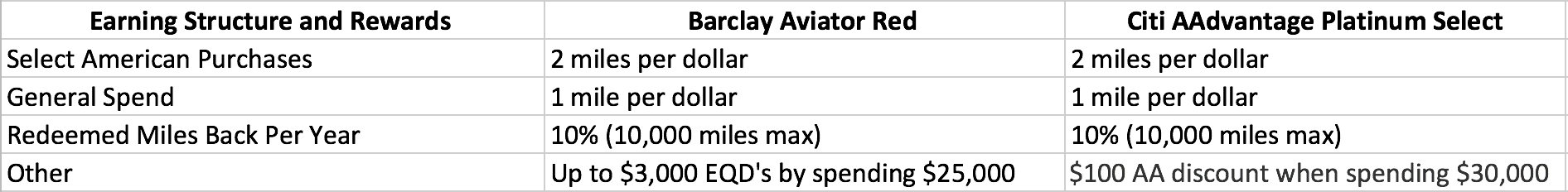

Earning Structure and Rewards

Both cards earn the same number of points for every $1 you spend with American or on everyday purchases. The difference comes with the bonuses earned for meeting specific thresholds. Barclay Aviator Red will earn you up to $3,000 EQDs (Elite Qualifying Dollars) when you spend $25,000 on the card. The Citi AAdvantage will give you a $100 discount on a future flight after spending $30,000 on the card.

I also like that American Airlines will rebate you back up to 10,000 miles each year when you have either of these cards. The 10,000 miles isn’t much, but the miles add up year after year towards another free flight!

Winner: These rewards and cards structures are almost identical, but I’d give the edge to Citi AAdvantage Platinum Select due to the ability to earn $100 off an American flight and the reduced mileage awards. Both are bad cards to consider for everyday purchases.

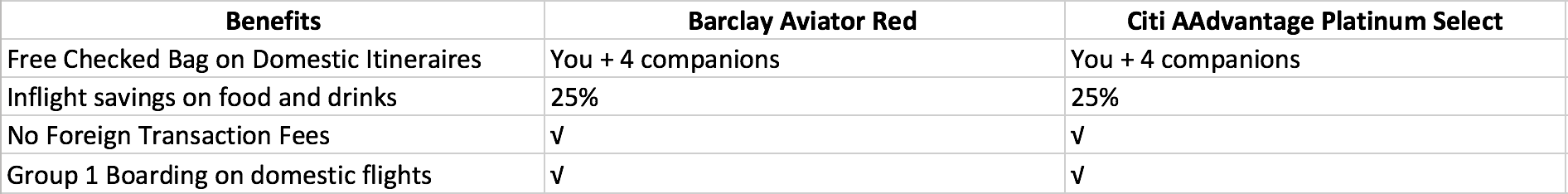

Benefits

Both cards offer some great benefits that will help you save money on travel. You get a free checked bag for you and up to 4 companions on the same itinerary, which will save $25-$35 per person each way. And if you’re going to buy food or drinks on your flight, using the card will save you 25%. When traveling internationally, both cards do not charge foreign transaction fees.

This doesn’t save you money (unless you were planning on paying for early boarding), but it will save you time and give you a head start on overhead bin space. Both cards provide Group 1 Boarding on domestic flights.

Winner: While they are very similar cards I give the edge to the Barclay Aviator because you can upgrade it to the Aviator Silver!

Aviator Silver

This is the premium Barclay American Airlines card. You can only get it by upgrading your Aviator Red, and it comes with some sweet benefits such as

- 5,000 elite-qualifying miles for every $20,000 you spend annually (up to 10,000 miles each year)

- Earn $6,000 elite-qualifying dollars when you spend $50,000 on purchases each calendar year

- Companion certificate good for up to 2 guests at $99 each, issued annually when you spend $30,000 or more in purchases

- $100 Global Entry Fee Credit

- 3 AA miles per $ spent on AA purchases

- 2 AA miles per $ spent on select hotel and car rentals

- Group one boarding for you and up to 8 companions

Spending $50,000 in a year with the Aviator Silver would net you

- 50,000+ AA miles

- A companion ticket

- 6,000 Elite Qualifying Dollars (EQD)

- 10,000 Elite Qualifying Miles (EQM)

A pretty good haul for a $195 Annual Fee, right? Just the Companion Ticket alone would be worth the increase in annual fee.

Pro’s of Each Card

Which Card is Better?

Choose the Barclay Aviator Red if you’re chasing elite status, have had the Citi AAdvantage Platinum in the last two years, don’t know if you can spend $3,000 in three months, and the Aviator Silver interests you. Choose the Citi AAdvantage Red if you’d like to avoid paying an annual fee, want better travel protection, or haven’t opened or closed the any Citibank American cards (personal or business) in the last 24 months.

If I had to choose one and could earn the sign-up bonus on both, I’d choose the Citi AAdvantage Platinum Select. The card has a better sign-up bonus, the discounted award flights and the annual fee waived the first year, every other benefit is about the same.

What are your thoughts? What card would you guys choose?

The Aviator Red also has the $100 flight discount after 30K spend and reduced mileage awards.

Rick, that is a nice perk! And Barclaycard sends me offers for spending challenges on a regular basis. I just finished another $2500 a month for 6 months challenge where I’m receiving a 30K mile bonus. Score!

I’ve had the Barclays card for over 4 years. Can I sign up for the Citi bank card and still receive the bonus points?

Hi Mina, yes you can. I have AA credit cards from both Citibank and Barclays and received bonuses each time. As always, I appreciate it when you use my links to apply.

Today is Oct 23, 2018 and the offers for each have now changed:

1. Citibank Platinum is 40,000 miles initially after $2000 spend within 3 months (+10,000 extra after $20,000 spend during first year), f$95 annual fee waived

vs

2. Barclay Aviator Red’s 60,000 miles after a single first purchase (could be a pack of gum!) and $95 fee NOT waived.

I would like an AA card simply for the checked bag credit and the preferred boarding (neither card offers boarding in group 1, which would be priority boarding, but rather both offer group 5 preferred boarding). I guess I could always cancel the Citi card (or call to see if they would waive the fee a second year) after first year..?

On the other hand, I do love those extra 20,000 miles with the Aviator card – it is just that fee kills me since I have never had a fee card in all my life.

**Do you know about the Penfed credit union Pathfinder AMEX card? No annual fee but it still offers $100 airline incidentals credit per year and $100 global entry fee credit 1/5years – and 3x (4x for military) for travel purchases, 1.5x other purchases. I love this card!

Hi Dauphine, the offers change all of the time. I’ve learned that, if you see an offer you like, you need to jump on it right away, because it may not be there even one day later.

I like the Barclays card better simply because Barclays is not as restrictive as Citibank about getting the card bonus multiple times. And, as you said, the bonus is currently bigger with Barclays.

Essentially, you are buying 20K miles for $95. With average economy domestic tickets at 30K miles, would you take a flight for $150? That’s what you’re doing by paying the $95 the first year to get the Barclays over the Citi card.

Hey man, looks like the last chart was updated correctly with the sign up bonuses, like the first one was.

It would be a great time to update this article:

Currently, Barclays offering a 70K bonus vs. Citi bonus of 50K. Annual fee not waived, but still better deal. Also free checked bag for both. Everything else seems the same.

I’m wondering if I can get BOTH? Just got the Barclay’s one.

Thanks for sharing. Yes, I do need to update this article since both cards have changed so much since the article was originally written.

Yes, you can get both cards – one from Citi and one from Barclays. Nothing in the rules prohibits you from enjoying the perks from both. Unlike Marriott, which has rules that prohibit Chase and Amex applications.

u can get both i jusst got both.. citi bank in february and barlcays in june!

I have both as well, Dee. It’s wonderful being able to double-dip AA miles like this. Congrats on getting approved for both cards!

Thank you. Good to know. I’ll try to get the Citi one later in the year. It’s great, especially since it seems they’re now upping their bonus to compete with Barclays.

It’s always nice to be able to benefit from competition among brands. Are you saving for a specific trip, or just trying to accumulate AA miles for the future?

Just trying to accumulate AA miles. I travel several short trips per year but I never manage to accumulate many miles that way. When I have enough for a free trip, I spend them right away.

Even with one big trip per year added to that, I barely accumulated enough miles to get a short trip ticket. And then the other perks like free bag and better boarding would be nice. I don’t know why they don’t give free wifi. Airlines used to be more generous to their loyal customers.

Sadly, being loyal to one airline isn’t profitable any longer.