The Chase Freedom doesn’t get much praise mainly due to that fact that you only earn one percent cash back or one Ultimate Rewards (UR) point per dollar on everyday purchases. Everyday purchases are not where the Chase Freedom shines, rather, the 5% cash back categories is where this card shines brightly.

Related post – 2016 Q4 Bonus Categories Are Now Live

In This Post

Why the Chase Freedom?

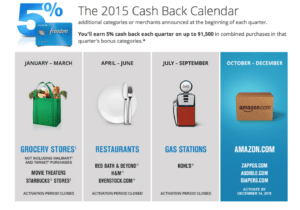

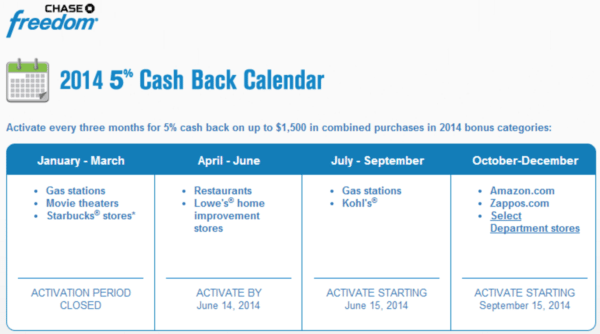

The Chase Freedom has significant quarterly 5% cash back categories and NO ANNUAL FEE. Since 2014, gas stations, restaurants, and either department or grocery stores have ALL been included. You can gather a good amount of valuable Chase Ultimate Rewards (UR) points with the Chase Freedom just with everyday spend.

How Do I Maximize the Points I Earn?

The Cash Back Route

Maxing out one category would lead to 7,500 Ultimate Rewards (UR) points. Redeeming these points for cash, at a rate of 1 cent per point, leads to $75 cash back. However, this is not the best way to get the most value out of your newly acquired Ultimate Rewards points.

Pro Tip – Did you know that you can have more than one Chase Freedom card? Many people have downgraded their Chase Sapphire Preferred cards to a Chase Freedom rather than paying the annual fee. You get to keep your Ultimate Rewards points… and now have a second (or more) card that earns up to 5x UR points! That’s a seriously cool way to maximize the number of Ultimate Rewards points you earn.

The Best Way

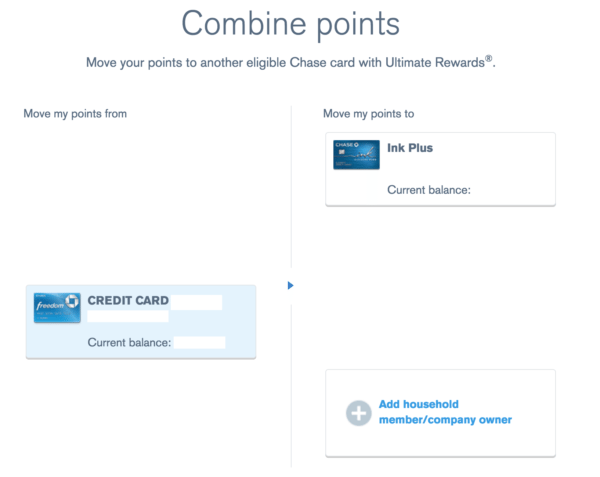

When your pair the Chase Freedom with a premium Chase card (Sapphire Preferred, Sapphire Reserve or Chase Ink), you can transfer these points to airline and hotel partners. When transferred out to partners, the value of 7,500 points is $150 or more! Spending $1500 and receiving points valued at ~$150 is 10% cash back! Just imagine the possibilities.

What If I Don’t Spend $1500 per Quarter in the Bonus Categories?

The problem is that most of us don’t spend $1500 per quarter in categories such as grocery, gas, department stores, or Amazon, but this is where gift cards come into play. Gift cards can help you maximize your categories when you buy them at stores that correspond to the 5% calendar.

Let’s say you love Olive Garden, instead of using your Chase Freedom at the restaurant, buy an Olive Garden gift card at the grocery store to earn 5% back on your purchase. Doing so gives you up to 10% cash back (when transferring to travel partners) at Olive Garden instead of 1%, not a bad reward for the money you are going to spend anyway.

Buying gift cards that are useful is the fundamental principle to apply to all of the categories during the calendar year to max out categories when “natural spend” won’t do the trick.

How Many Bonus Points Can I Earn?

If you could max out all 4 of the quarterly bonuses, you could earn 30,000 Ultimate Rewards points per year, a value of over $600. While this may not seem like much, getting $600 of value out of a card with no annual fee is excellent. As mentioned above you can downgrade a more premium Chase Ultimate Rewards credit card to a Freedom to avoid the annual fee, you will retain your Ultimate Rewards points, your average age of accounts (AAoA) and save yourself money. Also, rumor has it the 10x on Amazon that ran during the holiday season last year will be returning again this year, fingers crossed!

The Bald Thoughts

While many credit cards offer much better spending categories than the Chase Freedom, not many can match the Freedom’s potential with no annual fee.